Intelsat and SES, bound to reach an understanding?

Conversations around a possible combination between Intelsat and SES have ceased after months in deal talks. While the Satcom industry will grow at 12.5% in the next 10 years (NSR SCSD20 report), increasing pressure from new entrants like Starlink, OneWeb and Kuiper may force both companies back to the negotiating table. Do Intelsat and SES have other options, or will they eventually be forced to merge? These have been a few eventful weeks at Intelsat (announcement of RFP for 18 MEO satellites) and SES (Steve Collar stepping down as SES’ CEO). These events can’t be seen in isolation of the unsuccessful merger talks. But the rumors of an Intelsat-SES merger have been back and forth for years. It is more than probable that this is just a pause to re-assess strategic priorities and re-evaluate the capacity to capture growth in a rapidly changing industry, rather than the end of the story.

Does it still make sense?

Nothing has fundamentally changed in the industry to explain an exit to the combination discussions. Quite the contrary with pressure increasing as Starlink continues to attract funding, launch supply and penetrate new segments, ViaSat completes Inmarsat acquisition, or Eutelsat and OneWeb (finally with global coverage) merger on track to close this summer.

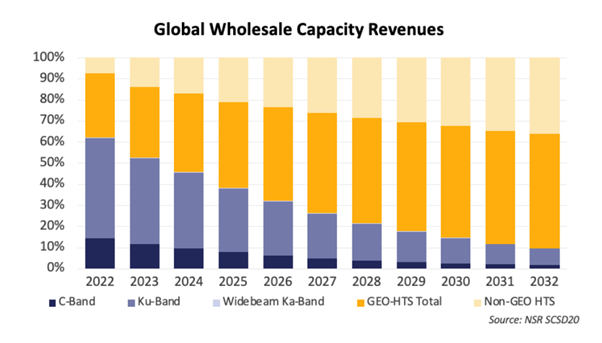

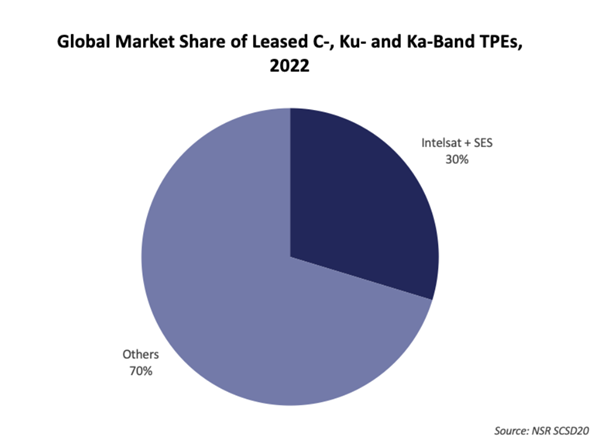

Synergies between Intelsat and SES would be abundant. For example, they both still have a large exposure to legacy C-Band and Ku-Band revenues. These are essentially video cash cows that, albeit declining, still have large cumulative revenues to offer. Supply optimization in video would yield synergies, although these won’t be short-term wins given the long cycles involved. Satcom has always been a CAPEX-intense business, but with the advent of LEOs this has scaled to a much larger level. A combined Intelsat-SES would have more leverage to participate in the LEO game.

Are the differences insurmountable?

It’s clear that the termination of the discussions occurred because “parties would not agree to certain business fundamentals”. It was never an easy combination with major barriers such as regulatory or national interest. The industry is changing at an extraordinary pace, and the balance of market share and industry influence could change in a matter of months. It’s still unclear to what extent Starlink will be able to disrupt enterprise-grade segments like Backhaul or Mobility. SES will roll-out mPower and continue pushing for an influential role in IRIS2 while Intelsat deploys multi-orbit services with OneWeb and releases the RFP for its MEO constellation. In parallel, both actors will continue their GEO supply optimization, deployment of Software-Defined Satellites (SES-26, Astra 1Q, Intelsat 41 to 44) and transition to closer relations with end-customers organically and consolidating recent acquisitions (SES-DRS, Intelsat-Gogo). Additionally, a resolution of the on-going dispute on C-Band proceeds would make merger talks easier. Finally, the fact that SES stock price is at historically low levels also discourages investors’ willingness to engage in a merger.

The bottom line

There would be positive synergies from an Intelsat-SES combination, but both companies have sufficient scale to optimize their legacy fleets and, at the same time, continue investing in space assets and services. An independent LEO play might be too risky, but both are working on alternatives such as wholesale deals (Intelsat-OneWeb) or consortiums (SES-IRIS2), while measuring the actual depth of the Starlink threat. The coming months will be decisive in many aspects of the industry and could unblock the current stalemate.

Article (PDF)

DownloadAuthor