The pandemic continues to disrupt some IoT markets, but some sectors present opportunities for operators

The total number of wireless IoT connections worldwide will increase at a CAGR of 15% from 1.8 billion at the end of 2020 to 6.2 billion in 2030, according to Analysys Mason’s latest IoT forecast. IoT connectivity revenue will grow more slowly than the number of connections, at a CAGR of 11% between 2020 and 2030, because the competitive pressure in the connectivity market continues to erode connectivity ARPC. The increased use of IoT during the pandemic and the introduction of 5G will provide opportunities for operators to increase their number of IoT connections, but they may have to take more risks if they are to translate this into meaningful revenue growth.

Knock-on effects from the COVID-19 pandemic will slow down growth in the IoT market until at least 2023

The growth rates for the number of IoT connections fell in most countries between 2019 and 2020; for instance, the growth rate for the number of IoT connections in France fell from 20% in 2019 to just 8% in 2020, based on data from the French regulator. This decline in growth rates was greater than we had previously forecast for some countries.

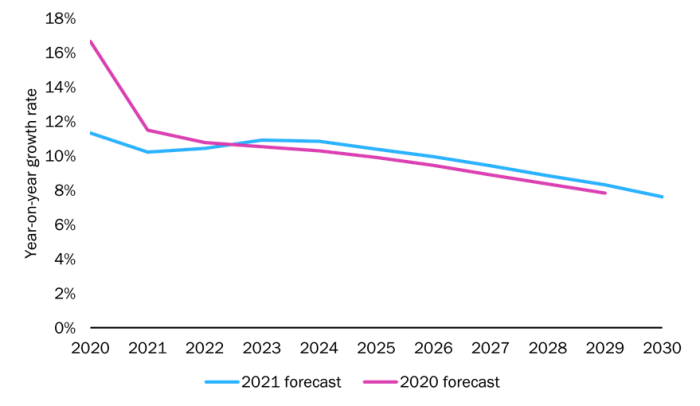

IoT connectivity revenue and the number of IoT connections will grow more slowly in 2021 than anticipated prior to the pandemic due to the lack of new contracts signed in 2020 and the ongoing chipset shortages. We forecast that the growth rate for the number of connections and connectivity revenue will return to the previous trend by 2023 as the effects of the pandemic subside (Figure 1).

Figure 1: 2020 and 2021 forecasts for the year-on-year growth in IoT connectivity service revenue, worldwide, 2020–2030

Source: Analysys Mason, 2021

The automotive sector was particularly disrupted in 2020: OICA reported that the sales of automotive vehicles fell by 12% worldwide in 2020, with significant regional variation.1 Vehicle sales fell by over 20% in the EU and almost 30% in North America, but declined by just 6% in China and grew by 8% in South Korea. Vehicle sales started to pick up in 2H 2020 and early 2021, but the ongoing global chipset shortage has slowed the recovery. Vehicle sales in the EU were lower in 3Q 2021 than in the same months in 2020.2

Not all sectors have been adversely affected by the pandemic and there are emerging opportunities for operators

Revenue growth opportunities exist for operators in the automotive market, despite the disruptions due to chipset shortages. The electric vehicle market, in which a high proportion of cars are connected, is growing rapidly, even though the wider automotive market is struggling. Hybrid electric vehicles and electrically chargeable vehicles accounted for over 22% of all passenger car sales in the EU in 2020, up from 9% in 2019.3 5G will enable operators to offer higher-value in-car services, such as in-car entertainment and over-the-air software updates.

The COVID-19 pandemic has also accelerated the digitisation of other sectors, thereby providing further IoT opportunities for operators.

- Healthcare. The extra pressure on hospitals and healthcare clinics and the need for social distancing has forced the healthcare sector to adopt virtual solutions such as telehealth, remote patient monitoring and remote clinical trials. Healthcare has long been a challenging market for operators due to its strict regulations and fragmented nature, but operators’ activity in healthcare space has increased since the onset of the pandemic. Vodafone has connected over 20 million healthcare devices and partnered with Deloitte in October 2021 to accelerate the adoption of connected healthcare solutions. KORE has also been highly active in the US healthcare market after acquiring Integron, a healthcare specialist, in December 2019, and aims to generate USD300 million in healthcare revenue by 2025.

- Retail. The shift to contactless payments during the pandemic helped to increase the number of connected point-of-sale (PoS) terminals. PoS terminal use was also boosted by the relaxation of payment regulations and the increase in the contactless spending limit in several countries.

- Utilities. The utilities sector will benefit from stimulus funds such as the EU Recovery Fund and the US Infrastructure Bill, which will provide funds for sustainability-related projects. These include smart water and gas meters, as well as smart grid applications such as electric charging points.

The automotive sector will drive the take-up of 5G IoT solutions

The number of 5G IoT connections worldwide will reach 470 million in 2030.4 The automotive sector will account for 70% of these connections, followed by the smart cities sector (13%). Both sectors include high-bandwidth, low-latency applications that will benefit from 5G, such as in-car entertainment and CCTV cameras. OEMs in these sectors will be more willing to pay the additional hardware costs associated with 5G than OEMs of other IoT devices. The take-up of 5G in other sectors will be slow because the extra module cost of 5G will be prohibitive for most applications.

Few commercial 5G IoT contracts (for devices on public networks) have been announced. Indeed, the majority of 5G IoT activity is taking place in the private networks space. One public network 5G contract is GM’s connected car deal with AT&T, which was announced in August 2021. GM will use AT&T’s 5G network to provide entertainment and over-the-air software upgrades. Most other 5G activity on public networks is still in the trial phase. For example, China Telecom has trialled a smart city project in Hangzhou and Vodafone UK and Telefónica Spain are trialling 5G connected trams and C-V2X, respectively.

Operators must assess their appetite for risk when chasing IoT revenue growth

The competitive pressure in the IoT connectivity market is unlikely to ease. The connectivity disruptors that are competing with operators tend to be less risk-averse and more willing to innovate with new technologies (such as cloud-native virtual core networks). Operators’ attempts to move beyond connectivity and provide vertical-specific solutions have yielded mixed results so far. Operators must choose between accepting that IoT will be a relatively small, low-growth (but high-margin) connectivity play, or making a bigger push into the faster growing market for vertical solutions. Some will also choose to push more into adjacent opportunities such as private networks and edge, which have greater revenue growth prospects, but require investment and attention.

1 OICA is an international automotive trade association consisting of 39 members of national automotive trade associations. Data is from OICA, Global sales statistics 2019–2020. Available at: https://www.oica.net/category/sales-statistics/.

2 ACEA (2021), Commercial vehicle registrations: +19.1% nine months into 2021; -12.3% in September. Available at: https://www.acea.auto/cv-registrations/commercial-vehicle-registrations-19-1-nine-months-into-2021-12-3-in-september/.

3 ACEA (2021), Fuel types of new cars: electric 10.5%, hybrid 11.9%, petrol 47.5% market share full-year 2020. Available at: https://www.acea.auto/fuel-pc/fuel-types-of-new-cars-electric-10-5-hybrid-11-9-petrol-47-5-market-share-full-year-2020/.

4 This forecast focuses on IoT connections using public and wide-area networks, and does not include private network connections.

Article (PDF)

DownloadAuthors

Ibraheem Kasujee

Senior AnalystRelated items

Tracker

IoT/M2M revenue and connections tracker 2H 2024

Article

KDDI’s results demonstrate the challenges of entering new markets such as energy and finance

Article

Wireless Logic’s purchase of Arqia is a further sign of the threat that IoT disruptors pose to MNOs