IoT connectivity prices will come under more pressure, but the decline will be offset by rising data usage

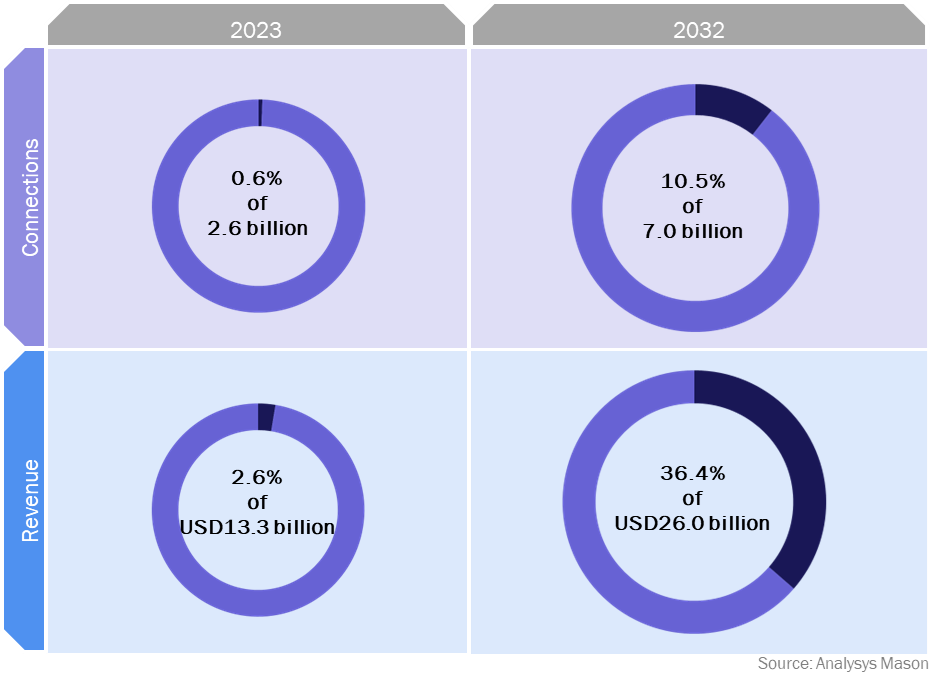

Analysys Mason forecasts that the total number of wireless IoT connections worldwide will increase from 2.6 billion at the end of 2022 to 7.0 billion in 2032 at a CAGR of 10% (IoT forecast: connections, revenue and technology trends 2023–2032). Excluding China, the number of connections will increase from 0.9 billion to 3.4 billion, a CAGR of 14%.

IoT connectivity revenue is expected to increase more moderately, at a CAGR of 8.0% worldwide (excluding China, where it will increase at a CAGR of 8.4%). This slower growth can be attributed to the competitive pricing pressure within the connectivity market, which continues to erode the average revenue per connection (ARPC). However, there is some positive news for connectivity providers. We expect the pricing pressure to ease towards the end of this decade and for it to be mitigated somewhat by rising data usage in applications such as connected cars and point-of-sale terminals.

Connectivity revenue per megabyte will decline

The blended ARPC for IoT connectivity will decline from USD0.35 per month worldwide in 2023 to USD0.30 per month in 2032. This decline is driven by competition; many connectivity disruptors now offer connectivity. The average price per megabyte is even lower for large-volume deals, particularly in the automotive sector – which accounted for 41% of connectivity revenue worldwide in 2023 – where tenders are extremely competitive and automotive original equipment manufacturers (OEMs) have strong buying power. The average price per megabyte for publicly listed 1GB tariffs was just USD0.03 in 2023.

However, we expect the decline in ARPC to slow down towards the end of the forecast period. The average data usage per device will increase for applications that require continuous connectivity, such as point-of-sale terminals and remote patient monitoring devices. Connected cars will also consume more data on average as electric vehicles (EVs) and 5G connected cars will gradually account for a larger proportion of the installed base. EVs use cellular connectivity more heavily than internal combustion engine vehicles because some (but not all) EVs use cellular connectivity to deliver over-the-air updates, and mapping and information services. EVs can consume many gigabytes of data per hour compared to the hundreds of megabytes consumed by non-EVs.

5G will have a small positive effect on IoT revenue in the long term but not the short term. Adoption on 5G public networks has been limited by supply-side issues. Some IoT applications have mobility requirements that rely on extensive network coverage, and 5G coverage, especially of 5G standalone, is not yet ubiquitous. Demand has also been hampered by the limitations in 5G hardware availability and the higher prices relative to LTE.

The 5G reduced capability (RedCap) connectivity standard will start to come to market; vendors and module makers are slowly starting to release commercial RedCap products. RedCap provides a middle ground between the high-performance characteristics of LTE/standard 5G, and the low-power, long battery life associated with LPWA connectivity. We expect RedCap adoption to be gradual due to its overlap with NB-IoT/LTE-M and the need for the RedCap ecosystem (chipsets, modules and devices) to develop. Operators will be aware of the latter issue; it took several years for NB-IoT/LTE-M module costs to fall to a price point that was competitive compared to 2G/3G and LoRaWAN.

Figure 1: 5G share of wireless IoT connections and revenue, 2023 and 2032

NB-IoT, LTE-M and LoRaWAN will account for almost half of all connections by 2032

NB-IoT accounts for hundreds of millions of connections in China. NB-IoT and LTE-M account for a smaller share of connections in the rest of the world, but the share will increase over time. This will in part be driven by these technologies replacing 2G and 3G connections as operators shut down these networks.

Government smart metering initiatives will also drive the growth in NB-IoT, LTE-M and other LPWA connections. Spain and Germany are using funds from the EU Recovery and Resilience Facility following the COVID-19 pandemic to accelerate smart meter adoption. India plans to connect 250 million smart meters nationwide, some of which will use NB-IoT connectivity. IoT providers have also won smart metering contracts in countries such as Mexico, Oman and Saudi Arabia. Other examples are shown in Figure 2 with winners using various technologies including LoRaWAN and Sigfox.

Figure 2: Selected smart metering contacts awarded in 2023

|

Number of connections |

Connectivity provider (country) |

Technology |

Customer (meter type) |

Date |

|

1.3 million |

Airtel (India) |

NB-IoT |

Secure Meters (electric) |

April 2023 |

|

1 million |

WND Mexico (Mexico) |

Sigfox |

WaterMeter Corp (water) |

August 2023 |

|

1 million |

Spark (New Zealand) |

LTE-M |

Bluecurrent |

December 2023 |

|

1 million |

Vodafone (Spain) |

NB-IoT |

Aqualia (water) |

July 2023 |

|

715 000 |

Ooredoo (Oman) |

NB-IoT (replacement of 3G meters) |

Nama Holding (electric and water) |

September 2023 |

|

360 000, potentially rising to 1.2 million |

Netmore, Connexin (UK) |

LoRaWAN |

Yorkshire Water (water) |

January 2023 |

|

300 000 |

Telefónica (Spain) |

NB-IoT |

EMASESA (water) |

October 2023 |

Source: Analysys Mason

Price pressure should ease as the use of applications with high data consumption rates becomes more prevalent

High levels of competition will limit connectivity revenue growth, but IoT providers have plenty of positives ahead.

We expect price pressure to eventually subside and for data usage to rise. The number of IoT connections will continue to grow in double digits year on year throughout the forecast period (2022–2032), particularly in sectors such as utilities, and tracking and logistics. Churn in the IoT market is low, progress is being made in areas such as eSIMs and satellite IoT, which will open up new opportunities, and IoT providers (particularly smaller disruptors) are continuing to innovate by providing resilient connectivity, localised solutions and value-added services (for more information see IoT connectivity disruptors: case studies and analysis (Volume VII)). Although expectations have been reset in the last couple of years, and some providers have left the market, opportunities remain for those that are still active in IoT.

Article (PDF)

DownloadAuthor