IoT market growth will slow down due to the COVID-19 pandemic and the limited take-up of LPWA solutions

01 February 2021 | Research

Ibraheem Kasujee | Hugues-Antoine Lacour

Article | PDF (3 pages) | IoT Services

The total number of wireless IoT connections worldwide will increase from 1.5 billion at the end of 2019 to 5.8 billion in 2029. The growth rates for the number of connections and connectivity revenue in our latest forecast update are lower than those in our previous forecast.1 This is partly due to the negative impact of the COVID-19 pandemic, but also due to other factors such as the slower-than-expected take-up of LPWA solutions.

These factors have increased the pressure on IoT operators, who already face a squeeze on connectivity revenue. Operators’ efforts to generate more revenue from elements beyond connectivity have also had mixed results.

The IoT market has suffered from the effects of the COVID-19 pandemic, and the effects will be seen into the future

Growth in the number of IoT connections has slowed down during the pandemic due to both demand-side and supply-side factors.

- Some IoT contracts have been cancelled or postponed due to firms going out of business or having to scale back their spending.

- The demand for some IoT applications has fallen during the pandemic. For example, the demand for connected vehicles fell due to reduced usage and deferred spending on new cars. The ACEA reported that the demand for cars in the EU fell by 28.8% in the first 9 months of 2020.2

- IoT supply chains were disrupted, particularly during the early part of 2020. Firms that are reliant on imports were affected by strict lockdowns in the exporting countries, and there were disruptions caused by workers that were unable to work during lockdown periods. There were also chip shortages, which made it difficult for IoT device manufacturers to obtain chips at reasonable prices.

The pandemic has affected some sectors more than others. The automotive and retail sectors have been the most severely affected, while others such as the agriculture sector have been far less disrupted. Demand for a few IoT applications, such as remote patient monitoring solutions, has increased during the pandemic; these solutions allow patients to be monitored from home rather than in over-burdened hospitals and healthcare clinics.

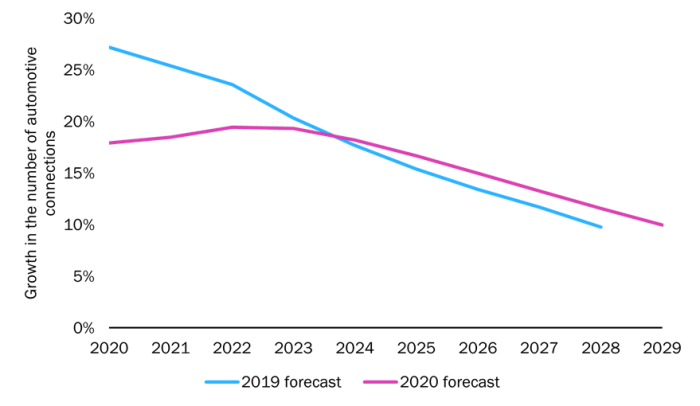

Some of the negative effects of the pandemic may not be realised until further into the future. Indeed, there is often a lag between signing an IoT contract and the first devices being switched on, so the true impact of the pandemic in 2020 will not be felt until 2021/2022. This is demonstrated in Figure 1, which shows the growth rate for the number of automotive connections in our latest IoT forecast compared to that in the previous forecast. We estimate that the growth in the number of automotive connections was almost 10 percentage points lower in 2020 than we had expected in 2019 (17.9% versus 27.2%), and will still be four percentage points lower in 2022 than we had expected in 2019 (19.4% versus 23.6%).

Figure 1: 2019 and 2020 forecasts for growth in the number of automotive connections, worldwide, 2020–2029

Source: Analysys Mason, 2021

Over half of all IoT connections will use LPWA connectivity by 2029, but the number of LPWA connections will grow at a slower pace than previously expected

The total number of LPWA connections will increase from 134 million in 2019 to 3 billion in 2029. However, the take-up of some LPWA applications has been slower than previously expected. As such, we have slowed down the growth in the number of connections for several LPWA applications during the forecast period.

Growth in the number of LPWA connections has been hampered by slow network deployments, a lack of awareness and relatively high hardware prices. Target LPWA sectors such as agriculture, smart buildings and smart cities all face significant challenges regarding channel strategy, funding and the adoption of new technologies.

Some firms in the utilities sector have chosen unlicensed LPWA solutions for their smart meter roll-outs in the absence of a viable operator-led LPWA solution. For example, the French utility GRDF is using Wize technology to connect 11 million gas meters, and Japanese utility TEPCO is using the WI-SUN standard to connect 27 million electricity meters.

Connectivity ARPC will continue to decline over the forecast period due to heavy competition

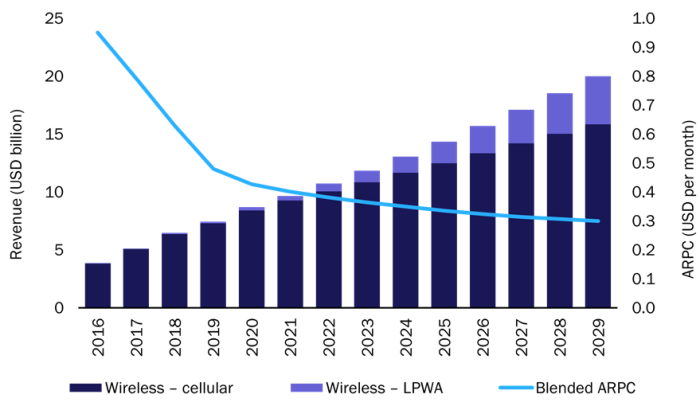

The total IoT connectivity revenue worldwide will grow from USD7.4 billion in 2019 to USD19.9 billion in 2029 (CAGR of 12%; Figure 2). The worldwide blended connectivity ARPC will decline from USD0.48 in 2019 to USD0.31 in 2029 due to competition and a lack of differentiated connectivity offers. Many connectivity disruptors are providing global connectivity, including entrants from different areas of the IoT value chain (such as Arm and Telit). Some disruptors, such as 1NCE, are competing strongly on price in RFPs for connectivity contracts.

Figure 2: Cellular and LPWA connectivity revenue and blended connectivity ARPC, worldwide, 2016–20293

Source: Analysys Mason, 2021

The pandemic will disrupt the IoT market in the short term, but there will be new opportunities for operators nonetheless

The pandemic will slow down the growth in the number of IoT connections and operators are likely to be concerned about the outlook for connectivity revenue. Nevertheless, the growth in the number of IoT connections will remain in the double digits throughout the forecast period. The pandemic has demonstrated the value of being able to manage systems remotely, which may spur further investment into IoT. Some regulations have also been eased, such as those in the healthcare sector, and this will make it easier for IoT players to provide IoT solutions. COVID-19 stimulus funds set aside for infrastructure- and sustainability-focused projects may even provide a boost to some IoT sectors, such as smart cities and utilities.

1 For more information, see Analysys Mason’s IoT forecast: connections, revenue and technology trends.

2 ACEA (2020), Passenger car registrations. Available here.

3 We recognise that NB-IoT and LTE-M are cellular technologies, but we include them in our LPWA category to analyse the impact of these emerging technologies on the traditional M2M market.

Article (PDF)

DownloadAuthors

Ibraheem Kasujee

Senior Analyst