IoT connectivity will account for nearly 20% of operators’ mobile services revenue from enterprises by 2027

18 July 2023 | Research

Article | PDF (3 pages) | IoT Services| Enterprise Services

Listen to or download the associated podcast

Revenue growth from IoT connectivity services has slowed in recent years due to pandemic-related disruption and reduced economic growth worldwide. Across the mobile market as a whole, IoT is now expected to account for a small share of operators’ mobile revenue (less than 2% in 2027).

However, its role in the enterprise market is very significant, with IoT connectivity expected to account for more than half of operators’ incremental revenue from enterprise public network mobile services over the next 5 years.

Operators need to maintain steady investment in IoT divisions to reap the rewards of their efforts to date. Other sources of enterprise revenue growth for mobile operators – including fixed-wireless access (FWA), private networks, mobile device and content management – are either much smaller opportunities or will take longer to deliver on their promise.

This article draws on figures from our recent report Operator business services for large enterprises: worldwide forecast 2022–2027, which assesses operator revenue from businesses with at least 250 employees.

Growth in the number of enterprise mobile handset connections has been boosted by support for remote and hybrid workers, but ARPU is flat

Today, a large majority of operators’ enterprise mobile revenue comes from handset services, but growth rates are low. It is IoT services that will drive the most incremental revenue growth over the next 5 years.

Multiple operators, including BT, Deutsche Telekom, TDC and Verizon, have reported an increase in business mobile handset subscriptions in recent years, especially since the start of the COVID-19 pandemic in 2020. In many countries, demand from enterprises for mobile handsets has increased to support remote and hybrid workers, and public sector organisations have also increased the number of mobile devices provided to their employees.1

However, despite increased availability of 5G networks (which might be expected to support an increase in ARPU) and inflationary pressures, operators’ basic handset ARPU from enterprise customers is typically flat or declining.

For example, Verizon’s business mobile connections increased by 4.8% in 2022 but its service revenue from these connections increased by just 3.9%, which implies a decline in ARPU. Many of the new mobile connections that are being added are for lower-usage workers than the existing base. In addition, the demand for scale discounts has also led to significant pressure on prices for large contracts. We expect this trend of flat ARPU for mobile-handset voice and data services to continue in the period to 2027.

The number of mobile IoT connections worldwide also grew rapidly in 2022. We estimate that large enterprises had deployed more than 1.5 billion IoT connections by the end of 2022 (up from 1.3 billion at the end of 2021). This number is expected to almost double by the end of 2027.

IoT connectivity will deliver more than half the growth in operators’ enterprise mobile services revenue over the next 5 years

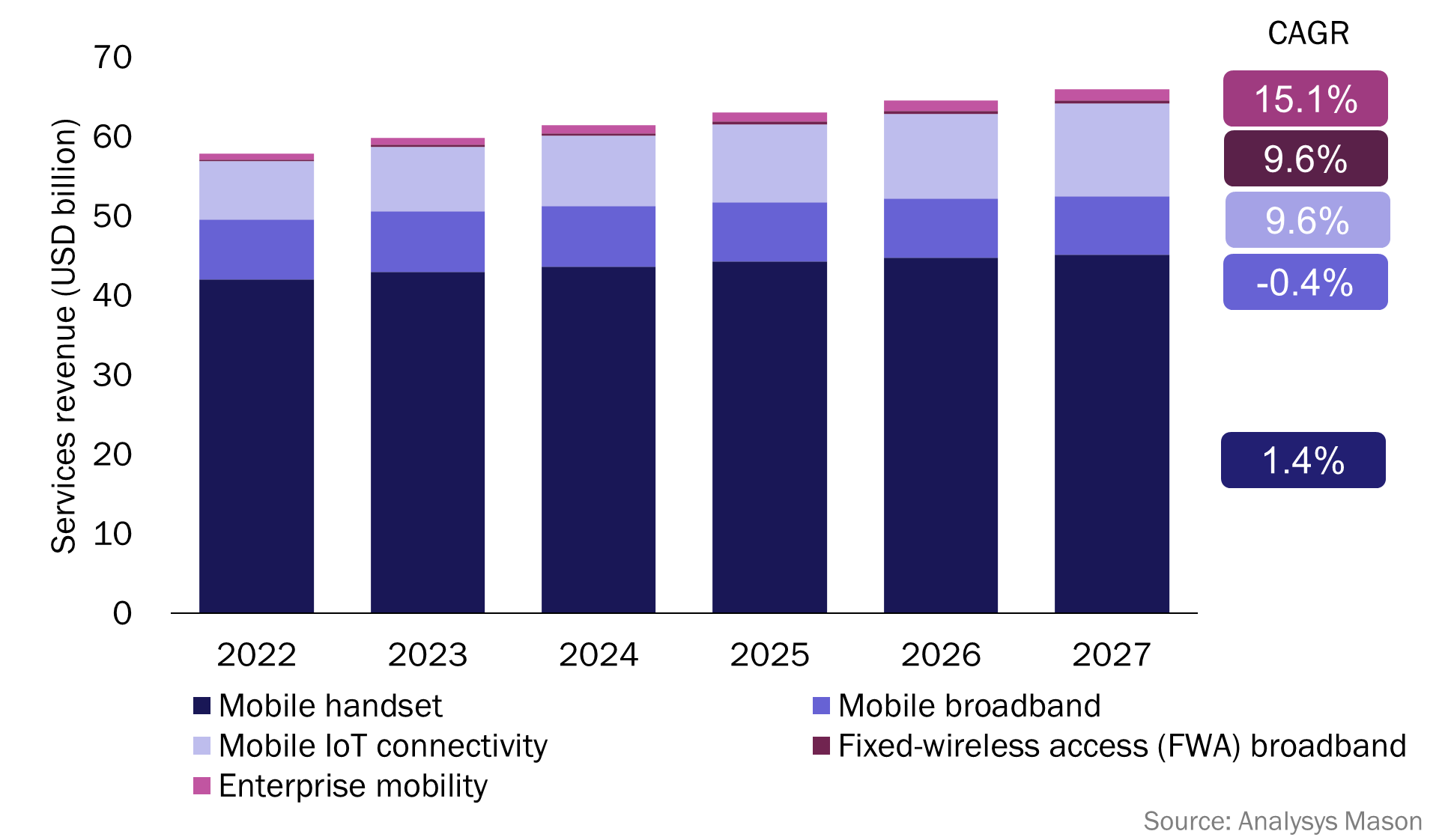

In absolute terms, IoT connectivity services for enterprises will account for USD4.3 billion in revenue growth for operators between 2022 and 2027, more than half of the total increase of USD8.1 billion in operators’ public network mobile services revenue from enterprises (excluding private networks) (see Figure 1).

Mobile handset services will contribute a further USD3.1 billion in revenue growth, though some of this will be substitutionary revenue from mobile broadband services (which will decline in response to the increasing use of handset data and mobile tethering).

Figure 1: Operators’ public network mobile services revenue from enterprises (250+ employees), worldwide, 2022–2027

Operator revenue from enterprise mobility (including mobile device management and mobile content management) will grow at a faster rate than IoT connectivity revenue but from a small base; it will contribute only USD700 million worldwide in incremental revenue in the period to 2027.

Revenue from broadband FWA services will also grow rapidly between 2022 and 2027 but will account for less than 1% of enterprise mobile services revenue by 2027 and contribute less than USD200 million in incremental revenue. Small and medium-sized enterprises (SMEs) will be the main adopters of these services.

In addition, enterprise spend on private networks (including network opex, applications and edge computing but excluding network capex and spectrum costs) is expected to increase to USD7.0 billion by 2027, but less than USD1.4 billion of this is expected to accrue to operators.

Large enterprises account for most IoT deployments in some low-value, high-volume sectors such as utilities, smart buildings and tracking. However, they also account for a majority share of deployments in higher-value sectors including health, retail and automotive. The importance of IoT connectivity to operator’s public-network mobile services revenue from enterprises is especially high in Central and Eastern Europe (CEE) and in the parts of Asia–Pacific with strong automotive industries.

IoT has not lived up to previously inflated expectations but enterprise-focused operators should continue to invest

IoT services have previously been the subject of inflated expectations and attracted a rash of investment, which has faded over time. Ericsson, Google and IBM each withdrew from or reduced their investment in the IoT market in 2022.

However, for enterprise-focused mobile operators, IoT is a crucial service, perhaps the crucial service for achieving revenue growth over the next 5 years. Despite pressure on unit prices, the rapid growth in the volume of deployments is expected to support a strong, sustainable business. For those operators with established propositions, IoT is also likely to deliver higher margins than most other growth services in the enterprise market.

It is important for operators to seek opportunities to sell more value-added services such as mobile device and content management, and to develop their private networks propositions. However, continued investment in IoT is likely to attract bigger rewards in the short- and medium-term.

1 The figures presented in this article include revenue from private enterprises and public sector organisations.

Article (PDF)

Download

Contact us to find out more about the custom and 'off-the-shelf' data, reports and surveys that we can provide to our clients on this topic

Author

Catherine Hammond

Research DirectorRelated items

Article

KDDI’s results demonstrate the challenges of entering new markets such as energy and finance

Strategy report

Strategies for telecoms operators to evolve their network-as-a-service (NaaS) propositions

Tracker

Cloud service providers' revenue tracker 2024