Growth in the number of IoT connections continues, but IoT revenue growth has slowed since 2022

Mobile operators’ IoT revenue grew steadily by a weighted average1 of 24% in 2022, up from 16% in 2021 (see Analysys Mason’s IoT/M2M revenue and connections tracker).

During the same period, the number of IoT connections grew by a weighted average of 26% in 2022, from 23% in 2021. Growth in the number of connections is higher than revenue growth, which indicates that the average revenue per connection (ARPC) is starting to fall. This can be attributed to strong price competition in the IoT connectivity market. However, there are signs that ARPC in China is beginning to plateau, possibly due to the emergence of 5G IoT applications in China.

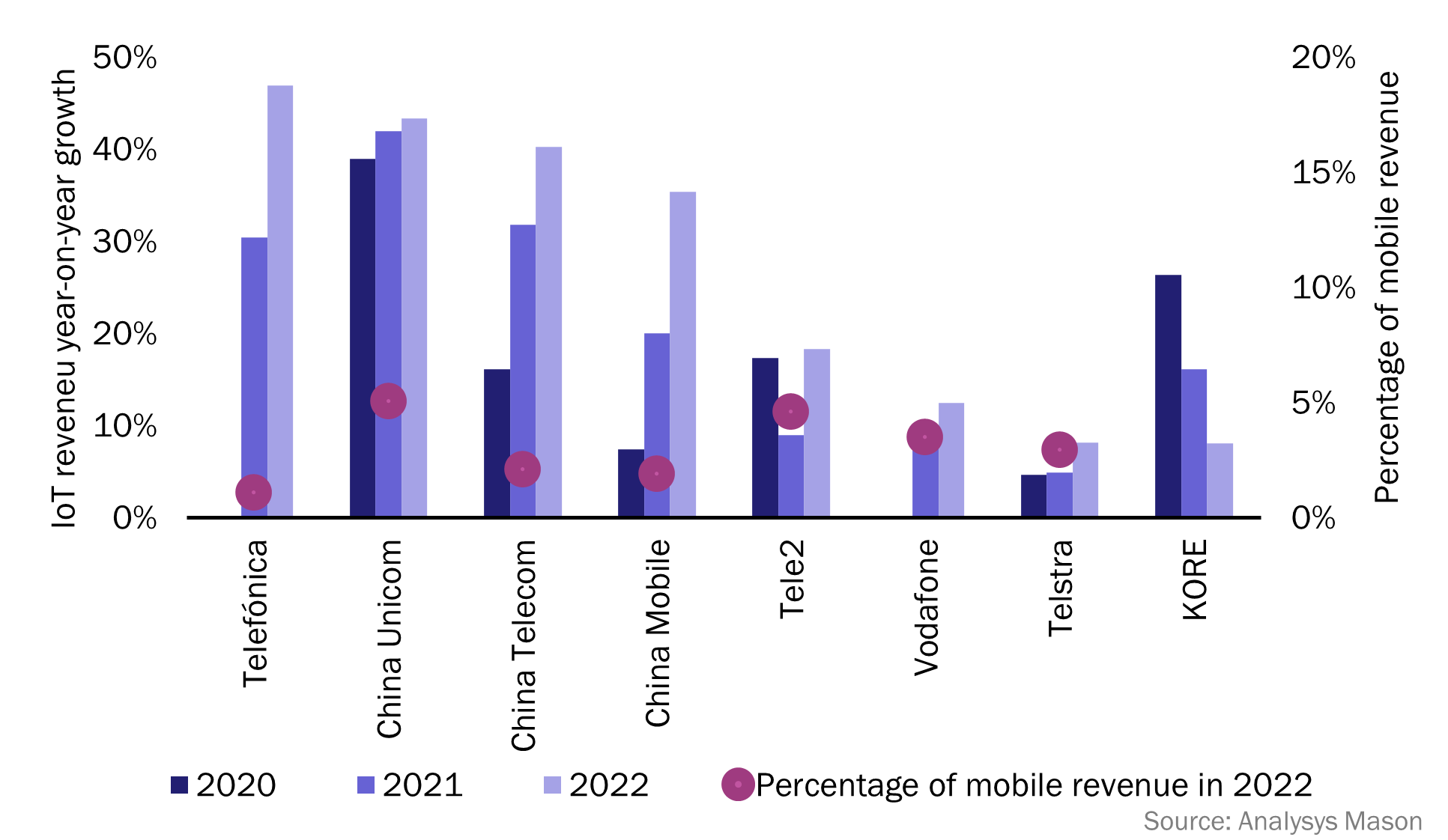

Growth in IoT revenue was higher in 2022 than 2021, but IoT continues to account for only a small share of total mobile revenue

IoT revenue worldwide, excluding China, increased by a weighted average of 12% in 2021 and 16% in 2022. China is atypical: IoT revenue increased here by a weighted average of 28% in 2021 and 39% in 2022.

IoT revenue remains no higher than 5.1% of total mobile revenue for reporting operators in 2022 (Figure 1). Limitations on IoT revenue growth including strong price competition for connectivity and increased adoption of LPWA applications (which generate less traffic) have contributed to a fall in ARPC. Operators have so far struggled to tap into the higher-value hardware and applications segments, meaning that connectivity accounts for most IoT revenue. This revenue is generated largely from enterprise services.

Figure 1: Year-on-year IoT revenue growth (2020–2022) and revenue as a percentage of total mobile revenue (2022)2,3

The performance of several operators’ revenue stands out.

- China Mobile had the highest IoT revenue in 2022 (USD2.4 billion) with consistently high growth rates for IoT revenue (39% in 2021 and 43% in 2022). The company has made considerable investments in IoT, including a new operating system and chipsets. It invested RMB21.7 billion (USD3.4 billion) in the research and development of in-house products across the company during 2022, up by 17% year-on-year. China Mobile stated that it exceeded 300 000 ecosystem partners in December 2022.

- Telstra has relatively low IoT growth (8.2% in 2022) despite trying to generate revenue beyond connectivity but holds the highest ARPC in our data set (USD2.92 per connection per month). Its reported IoT revenue includes revenue from application and platform services, areas where Telstra has had more success than most operators. The company made several acquisitions during 2022 to boost its performance including Alliance Automation (a provider of industrial automation solutions and control systems) and Aqura Technologies (a provider of infrastructure solutions, including industrial wireless and industrial IoT).

- KORE’s revenue growth is slowing: IoT revenue growth fell from 16% in 2021 to 8.1% in 2022. KORE is aiming to increase its proportion of revenue from IoT solutions and has had some success. The solutions segment accounted for 34% of its total revenue in 2022, increasing from 26% in 2020. It has aligned itself with vendors such as Google Cloud and Ericsson to provide value-added features and to broaden its customer base.

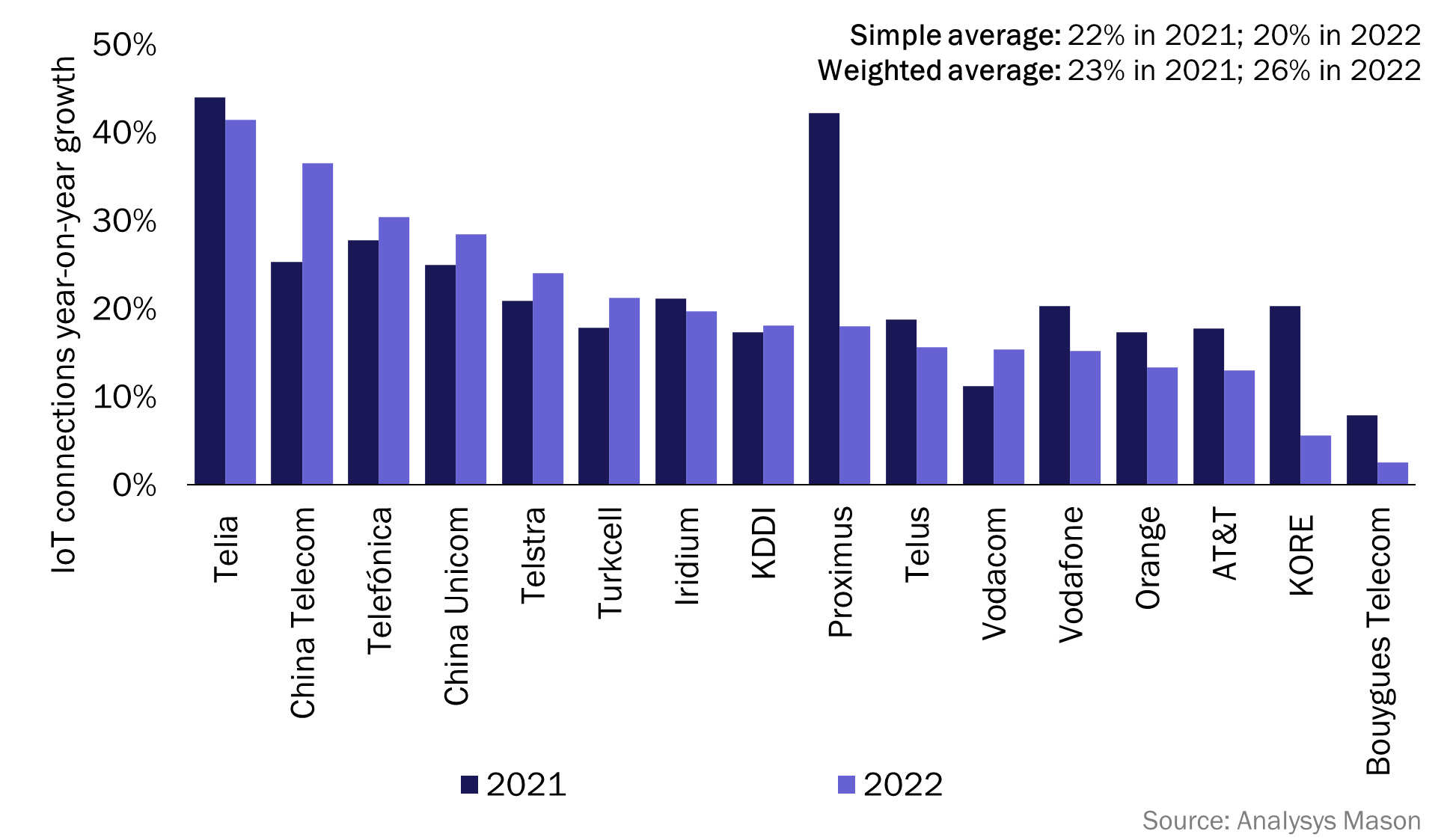

Growth in the number of IoT connections is outpacing IoT revenue growth worldwide

The number of IoT connections increased by a simple average of 22% in 2021 and 20% in 2022 (see Figure 2). Some operators experienced a significant drop in growth. For instance, the rate of growth for Proximus’s connections fell from 42% in 2021 to 18% in 2022. This decline follows the entrance in Belgium of Citymesh which acquired new spectrum in 2022 and has intensified competition according to Proximus.

Figure 2: Percentage of year-on-year growth in IoT connections, selected operators, 2021–2022

Operators experiencing the highest rates of IoT revenue growth are investing in value-added services and are seeing demand from particular industries such as the utility and automotive sectors. Telia experienced 41% growth in the number of connections during 2022, partially because of its expansion beyond Sweden. It attributes its success to a simple deployment model that allows customers to scale their businesses. KDDI also had strong rates of revenue growth (30% in 2022), reaching 30 million IoT connections in December 2022. In Japan, the greatest demand was for applications, including connected cars and smart metering.

The continued decline in the average revenue per connection has implications for operators worldwide

Growth in the number of IoT connections is steady (at least 15% year-on-year for most operators worldwide). However, revenue growth is slower, meaning that ARPC is falling for most operators. Operators have a few options to address this issue.

- Reduce the cost of selling connectivity to boost connectivity margins, by selling online for example. This strategy’s success has been limited but operators may need to reexplore this option.

- Target hardware or application revenue, although this poses challenges because it requires investment in acquisitions or in developing new in-house capabilities.

- Reduce their focus on IoT or exit the market entirely. For instance, Twilio sold its IoT division to KORE in March 2023.

The decline of ARPC in China may be starting to reverse, or at least plateau, perhaps indicating a positive trend. China Unicom’s ARPC increased from USD0.26 in 2020 to USD0.37 in 2022. This could be due to the decline in price-per-GB finally bottoming out, or the growing trend towards increasing data volume consumed per device. The 5G market in China is more advanced than in other regions, which could show that 5G has a positive impact on increasing data volume. This could help operators worldwide to ease some of the ARPC decline in the future once demand for 5G increases.

1 The weighted average considers an operator’s market share, whereas the simple average does not.

2 Telefónica does not report the split of mobile and fixed revenue for all opcos so mobile revenue is assumed to be 60% of total revenue based on reported opcos. It did not report IoT revenue for 1H 2022 so 2H data is taken for Telefónica each year.

3 Vodafone did not report IoT revenue for 2019 so the growth rate for 2020 cannot be calculated.

Article (PDF)

DownloadAuthor

Mary Saunders

AnalystRelated items

Tracker

IoT/M2M revenue and connections tracker 2H 2024

Article

KDDI’s results demonstrate the challenges of entering new markets such as energy and finance

Article

Wireless Logic’s purchase of Arqia is a further sign of the threat that IoT disruptors pose to MNOs