What is the IoT value chain and why is it important?

Companies with ambitions to succeed in the provision of IoT need to identify the roles that they can play in the IoT value chain and the types of partnerships that they should forge to deliver solutions. They also need to understand who they are competing with.

What is the IoT value chain?

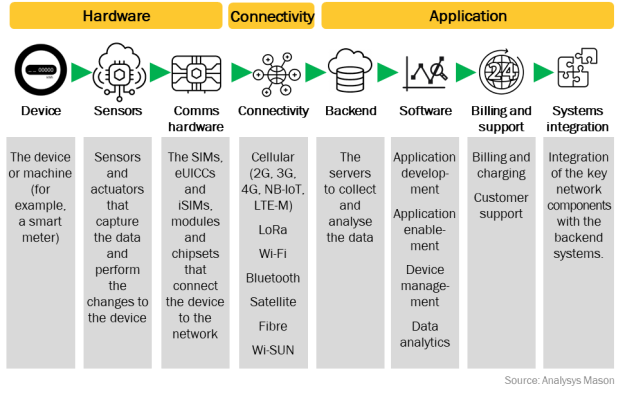

An IoT solution is formed of several building blocks or components, and each of these building blocks forms part of the IoT value chain.1 The IoT value chain illustrates how the different components, in combination with one another or separately, add value to the overall IoT solution and, in turn, for the end user. Furthermore, each component is developed by a range of companies, some of which play several roles in the IoT value chain. The following components form part of the IoT value chain.

- Devices. This category includes existing devices such as smart meters or vehicles in which the connectivity component has been integrated into the product design. This could also include new devices that would not have existed without IoT, such as pet trackers. Such a device must have a sensor and an actuator, as well as communications hardware (described in more detail below), but it will also have other elements (for example, a power source such as a battery or mains electricity). In addition, depending on the type of device, it may have a screen and other ways for the user to interact with it directly (such as buttons or a keyboard).

- Sensor and actuators are connected to the device. Sensors are able to capture data from the environment (for example, temperature). Actuators respond to instructions and make changes in the device (for example, adjusting the temperature on a thermostat). The instructions for an actuator can come from sensors on the same device, or from other sources (for example, a thermostat can be activated by mobile phone while the homeowner is on their way home). A device can have sensors, actuators, or both.

- Communications hardware enables the device to connect to the network to send the data from the sensors to the backend systems. This can include hardware for connecting wirelessly via Bluetooth, Wi-Fi, ZigBee, LoRa, cellular (for example GSM, 5G, NB-IoT, LTE-M) or a number of proprietary technologies, or over a fixed network. Some devices will have hardware to connect to multiple types of network.

- The connectivity network, which can be cellular, fixed or satellite, delivers the data from the sensors over the internet or a private network connection to the user’s backend systems.

In addition, many different software components, which can be loosely grouped as applications, deliver additional value to the end user.

- Backend systems include the servers to collect and analyse the data coming from the sensors and from other sources (for example, weather forecast data). These backend systems can be found in the public or private cloud, or on on-premises hardware. For very simple systems, the backend can be a standard PC.

- Software platforms such as device management, security and data analytics ensure that IoT devices are functioning correctly and have not been compromised. Such platforms also include data analytics software to make sense of the data and improve business processes, as well as data bases to store the data.

- This area also includes services such as billing and customer support.

Other parts of the value chain for IoT can include the systems integrators (SIs) or developers that design, build and manage IoT services. The physical IoT device will often need to be installed and maintained. Depending on the service, this installation process can account for a high share of the overall value (for example, in smart metering projects, where the installation process may cost more than the device).

Figure 1: Components of the IoT value chain

What type of connectivity is best for IoT?

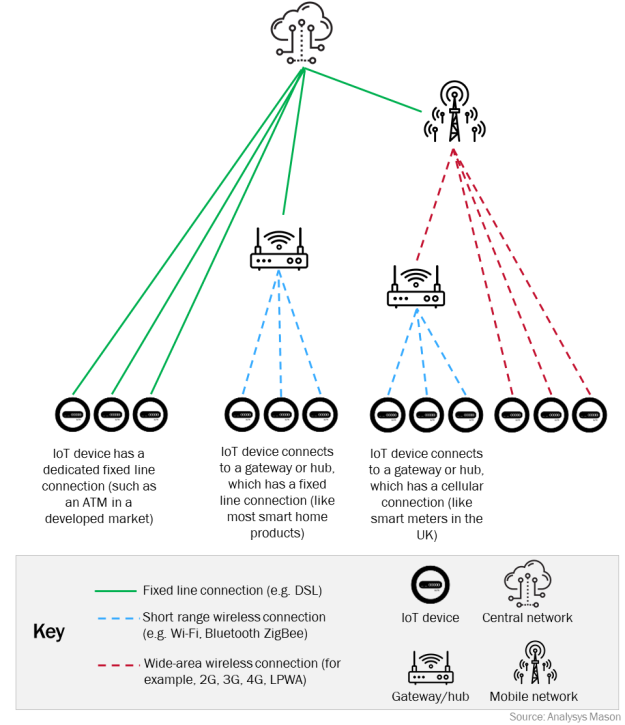

Enterprises can choose from a range of IoT connectivity options to support their IoT deployment. Their choice will depend on use case requirements and will also be governed by factors such as cost, ecosystem support and coverage requirements (local, national or global). Some examples include:

- mobile assets, which can be supported by Wi-Fi or cellular in a building (for example, a factory). If they require wide area coverage, they will use cellular networks, or possibly even satellite in remote places

- static assets, which can be supported by fixed connectivity, short-range technologies such as Wi-Fi or Bluetooth, or cellular. For example, connected intruder alarms in a residential building may use a fixed line connection (such as PSTN), a broadband/Wi-Fi connection or a cellular connection. However, static assets that are geographically dispersed (such as smart meters) may use the cellular network or alternative technologies such as Wi-SUN.

Static assets can be connected directly to a fixed or cellular network or they may use a local area network such as Wi-Fi to connect to a gateway, which then connects to the macro network.

Figure 2: IoT connectivity options

Mobile assets such as cars and trucks can move between countries or static assets such as vending machines can be shipped abroad and used in a single country. Cellular technology is often used to support the connectivity requirements of these assets, especially mobile assets.

What is the size of the IoT value chain revenue opportunity?

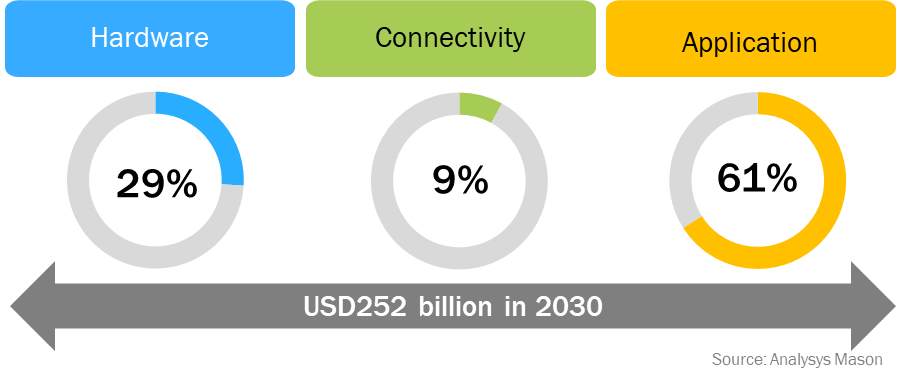

Analysys Mason produces forecasts for cellular and low-power, wide-area (LPWA) connections and the associated IoT value chain revenue. These forecasts focus on three key areas: hardware, connectivity and applications revenue (see Figure 3). We do not include fixed network, satellite or short-range technologies. Analysys Mason’s IoT value chain revenue forecast encompasses a broad range of services that we group under the ’application’ category, which includes application development, software platforms for managing devices and open APIs for developers, as well as backend systems. The hardware component includes the device, the communications hardware and the hardware installation.

The revenue in the IoT value chain generated from cellular IoT connections will reach USD252 billion by 2030; of this, connectivity revenue will account for only 9% (USD24 billion). Application revenue is expected to reach USD155 billion by 2030 to account for the largest share (62%) of the IoT value chain revenue, and revenue from hardware will be USD74 billion (29% of the IoT value chain). The application component often attracts players from other areas of the value chain – connectivity and hardware providers – that have ambitions to capture a larger share of the IoT value chain revenue.

Figure 3: IoT value chain revenue by value chain component

Who are the key players in the IoT value chain?

The IoT value chain is both crowded and fragmented. IoT attracts traditional hardware, connectivity and application players as well as new entrants and start-ups.

The hardware domain includes players that design the chipsets (for example, Kigen) and sell chipsets (such as Sony Semiconductor and Qualcomm), and providers of SIMs and modules (such as G+D, Sierra Wireless and Telit). It also includes original equipment manufacturers (OEMs) that build the devices such as smart meters (for example, Diehl Metering and Itron) and are building connectivity enablers into their devices.

The role of connectivity provision in the IoT value chain is occupied by network operators such as Orange, Tele2 and Verizon, as well as mobile virtual network operators (MVNOs)2 or IoT connectivity specialists, such as 1NCE, Cubic Telecom and KORE. Operators and MVNOs provide cellular network connectivity such as LTE, NB-IoT and LTE-M, and a few (such as Orange) complement their offer with LoRa. These companies compete with network providers that offer IoT connectivity based on technologies such as Sigfox and LoRa. For example, Sigfox network operators such as Thinxtra and WND have deployed networks across multiple geographies. Amazon and Helium have partnered with LoRa to extend Amazon Sidewalk and Helium networks beyond the home and neighbourhood to provide regional or national coverage. Other connectivity options focus on a specific sector. For example, Silver Spring Networks developed the foundation technology that is now known as Wi-SUN to support smart meter deployments. The technology is now supported by an ecosystem of players through the Wi-SUN Alliance.

Companies such as AWS and Microsoft offer IoT stacks for the backend component of IoT deployment. They have become an integral part of the IoT value chain because companies increasingly require that their data is delivered to the cloud.

The application landscape is highly fragmented and includes generalists and specialists of device management solutions, application developers and data analytics companies. Telit, for example, provides an industrial IoT device management solution. Software AG and PTC deliver application enablement solutions. The hyperscalers3 are also building a strong presence in the IoT application domain (for example, Microsoft has developed its Azure IoT Hub and accompanying suite of services).

Systems integrators also play an important role in the IoT value chain. They integrate all of the components to ensure that they communicate and deliver the data to the business systems. Large companies such as Accenture and EY, as well as smaller specialists such as Mugler AG, deliver these services.

Some companies that are already active in one area of the value chain are building roles in new areas of the value chain to enhance their core business. For example, hardware providers of cellular modules are now offering connectivity that is integrated into their hardware products to capture a larger share of the value.

The IoT value chain is complex; it involves diverse roles and many different types of companies to deliver end-to-end IoT solutions. Few companies are able to capture value from multiple areas of the IoT value chain but some are building or acquiring new competencies to extend their role across the value chain.

More from Analysys Mason on this topic

- IoT connections and revenue: trends and analysis 2022

- IoT forecast: connections, revenue and technology trends 2022–2031

- IoT connectivity will account for nearly 20% of operators’ mobile services revenue from enterprises by 2027

- IoT connections and revenue will grow at a steady pace despite supply chain disruptions and economic worries

- The GSMA’s new IoT eSIM specification is a step forward in realising the full potential of eSIMs in IoT

1 For more information, see Analysys Mason’s IoT forecast: connections, revenue and technology trends 2022–2031.

2 For more information, see Analysys Mason’s IoT connectivity disruptors: case studies and analysis (Volume VI).

3 Companies such as AWS, Google and Microsoft that deliver scalable computing infrastructure to support cloud computing and big data.

Webinar – Private LTE/5G networks: an IoT growth opportunity for operators

Listen nowAuthors

Ibraheem Kasujee

Senior Analyst