Kaseya’s acquisition of Datto will make it a market leader, but will also create opportunities for others

Kaseya announced, on 11 April 2022, plans to acquire Datto for USD6.2 billion. Kaseya aims to use the acquisition to bolster its market position and grow its solution set. Once the deal is complete, the company will employ more than 3700 people and will be the largest managed service provider (MSP)-focused software vendor in the world. It will be better-positioned to compete with ConnectWise and N-able and will gain access to a wide range of solutions to deliver via the MSP channel, including to Datto’s 18 500 MSP partners.

The acquisition will improve Kaseya’s cyber-security capabilities

Datto’s ransomware and managed security capabilities will fill some of the critical gaps in Kaseya’s existing portfolio. A ransomware attack exploited vulnerabilities in Kaseya’s VSA tool in 2021 and compromised some of its customer data. The attack, which made headlines, affected more than 50 MSPs and 1500 businesses.

Datto’s cyber-security solutions provide robust, multi-layered protection against new ransomware attacks. Its business continuity and disaster recovery solutions enable MSPs to manage servers, files, PCs and SaaS solutions. Datto itself acquired Infocyte, a managed detection and response services firm, in March 2022 to strengthen its cyber-security portfolio. Kaseya will integrate these cyber-security capabilities in the coming years.

Datto’s shareholders are set to benefit from the company’s acquisition by Kaseya

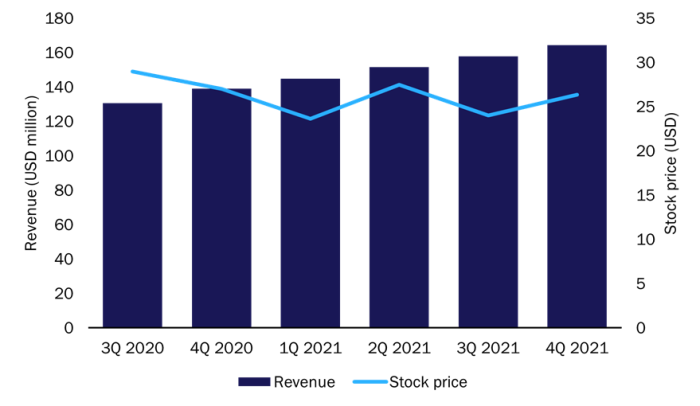

Datto’s revenue has grown by 20% each year since 2018 and small and medium-sized businesses (SMBs) continue to grow their investments in MSPs, but Datto’s stock price has remained largely flat over the last 2 years (Figure 1). Fierce competition, as well consolidation, means that MSP-focused software vendors need to make ever-larger technology investments and pursue ongoing M&A activities to remain relevant. Indeed, both Datto and Kaseya have acquired numerous companies: Datto has acquired 6 firms and Kaseya has acquired 14. Once the deal with Kaseya is complete, Datto’s shareholders will receive a pay-out that is equivalent to 52% of the company’s stock price on 16 March 2022.

Figure 1: Revenue and stock price, Datto, 3Q 2020–4Q 2021

Source: Analysys Mason, 2022

The Kaseya–Datto merger will help MSPs to meet SMBs’ needs in a post-pandemic world

The results of Analysys Mason’s SMB technology survey show that SMBs are looking for MSPs’ support to enable a hybrid working model. Indeed, SMBs’ main technology priorities in 2022 are to support employees who are working remotely and to ensure that all IT can be remotely managed from the cloud. In turn, MSPs are looking to vendor partners for assistance in managing a broader range of services and solutions.

By integrating Datto, Kaseya will be well-positioned to offer a full suite of solutions including professional services automation (PSA), remote monitoring and management (RMM) and cyber security. Many MSPs will value working with a single vendor to manage and secure the range of solutions that SMBs require in the era of hybrid working.

Kaseya’s competitors may view this acquisition as an opportunity to poach customers and partners in the short term

Competitors will hope to take advantage of the uncertainty created by the Kaseya–Datto merger. Indeed, Syncro’s CEO, Emily Glass, stated in a recent interview that the merger will provide an opportunity to attract smaller and emerging MSPs, including some of Datto’s partners.1 Kaseya’s management may also be distracted by issues related to the merger, so competitors may act to take advantage of any lack of attention to customers.

Smaller competitors will continue to target MSPs with flexibility in pricing and contracting that a large player such as Kaseya may not be able to provide. Larger competitors with established channel programmes will use the merger as an opportunity to raise concerns related to the future of channel programmes. These competitors will hope that a well-established, stable channel programme will be more appealing to MSPs than the possible disruption that Kaseya’s customers may face.

We may see further consolidation of MSP-focused software vendors in the long term

The integrated Kaseya–Datto offerings are differentiated from other solutions in the marketplace, and large MSP-focused solutions vendors will need to find new ways to compete with the merged entity. Kaseya’s competitors will be on the lookout for opportunities to acquire firms to fill their technology gaps. Such activity is not uncommon: ConnectWise has acquired 12 firms to secure its position in the marketplace. Private equity firms will also drive the consolidation of MSP-focused software vendors to create larger, stable and more profitable platforms.

1 CRN (2022), Syncro CEO On Kaseya-Datto Deal: It’s An Opportunity For Us. Available at: https://www.crn.com/news/channel-programs/syncro-ceo-on-kaseya-datto-deal-it-s-an-opportunity-for-us.

Article (PDF)

DownloadAuthor