Is Kuiper a bigger threat than Starlink?

Starlink has made significant strides in the satellite industry, positioning itself as a major threat to established players. Within a short period, the company has emerged as a major market shareholder in the consumer broadband sector, achieving a subscriber base of 1.5 million users worldwide. This unprecedented growth is translating to a consistent reduction in GEO capacity pricing in the Consumer Broadband segment to achieve competitive and affordable service offerings. Amidst Starlink’s growing impact in the consumer broadband market, the industry must not ignore another competitor – Kuiper, a subsidiary of the tech giant Amazon. With Amazon’s considerable resources and global reach, Kuiper poses a substantial challenge to the satellite industry, extending beyond the Consumer Market to impact the Enterprise VSAT market as well.

Factors impacting capacity pricing

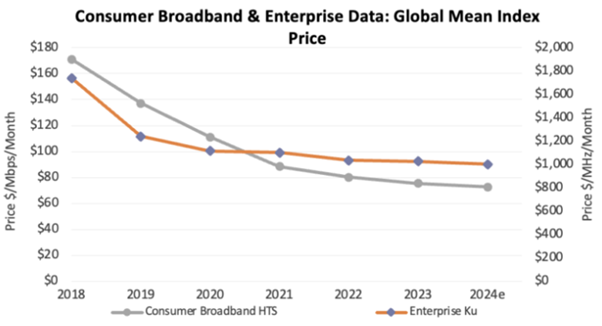

According to NSR’s Satellite Capacity Pricing Index, 9th Edition report, consumer broadband HTS capacity pricing will continue to witness consistent decline, at around 4%-6% annually because of competition, reaching $73/Mbps/Month in 2024. Historically, in the last 7 years, Consumer Broadband average capacity pricing has dropped by 57%. 2018-2021 witnessed steeper decline owing to the increase in HTS sites and terrestrial competition. The addition of new Starlink subscribers and migration from incumbents to Starlink, is another major factor resulting in lower prices.

Source: NSR, An Analysys Mason Company

On the Enterprise VSAT side, price erosion has been relatively slower, owing to the nature of the business. The Service Level Agreement (SLA)-based Enterprise grade sites have longer contracts and hence lower churn. Currently, GEO & GEO+MEO incumbents control the total Enterprise VSAT market, as Starlink continues its focus on Consumer grade non-SLA sites.

Kuiper is at least 3-4 years away from deploying its services in the market. Resultantly, GEO Enterprise Ku pricing is expected to decline 1%-2.5%, in the near term. Additionally, other factors are driving pricing across regions and use cases, including capacity constraints, migration to HTS, regulatory approvals, supply chain challenges and many others. Will the scenarios be same with the entry of Kuiper services in the coming years? Highly unlikely.

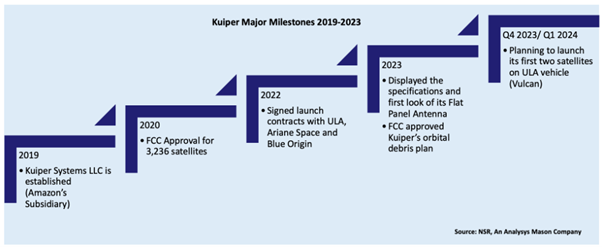

Kuiper’s development timeline

Kuiper Systems LLC, established in 2019, has achieved major milestones in the last 4 years. The company is planning to build a Ka-band LEO satellite constellation of 3,236 satellites to target Consumer Broadband, Enterprise VSAT & other use cases such as Mobility markets. Among recent developments, Kuiper is planning to launch its first two satellites on a United Launch Alliance (ULA) vehicle in Q4, 2023. In terms of equipment, NSR has always stated that design & development of affordable Flat Panel Antenna (FPA) will be the key success factor for Non-GEO constellation players, especially in the price sensitive market such as Consumer Broadband. Starlink has been offering subsidised FPA for the last two years as part of its customer acquisition strategy in the segment. There has been consistent decline in the cost as it is producing increasing volumes. In early 2023, Kuiper showcased the first look and technical specifications of its FPA. The antenna will be able to achieve 400 Mbps of maximum throughput, and the likely pricing will be lower than $500. With all these developments, Kuiper is aiming to deploy its services across Consumer Broadband & other use cases around 2025-2026.

NSR expects increased competition will result in significant erosion in pricing as Kuiper enters services, adding challenges to the established players, even Starlink. What makes Kuiper a possible bigger threat?

Kuiper’s extended roles and capabilities in the value chain

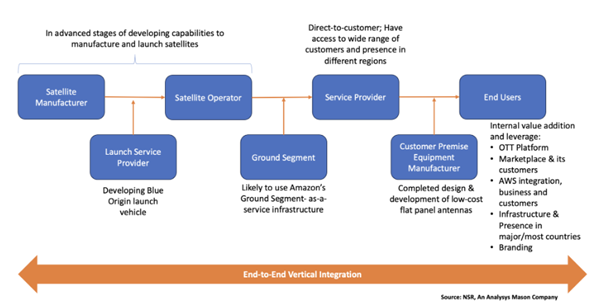

Vertical integration or extended roles in the value chain allows better control over lead time, cost, and quality. But to achieve it, a company requires to integrate different links in the value chain and acquire wide technical, supply chain and business expertise. Below are Kuiper’s positioning and developments across different stages of Satcom value chain:

- Satellite Manufacturing & Operations: Kuiper is in the advanced stages of developing capabilities to serial produce satellites and operate them.

- Launch Vehicle: Developing reusable launch capabilities.

- Ground Segment: Likely to use and extend Amazon’s Ground Segment- as-a-service infrastructure.

- Flat Panel Antenna: Completed the design phase of low-cost flat panel antennas. Advancing to achieve economy of scale.

- Downstream Services: The above vertical integration capabilities are similar to Starlink to control costs. The access to downstream customers is the major differentiator for Kuiper. For the Consumer Broadband market, it has access to a massive customer base via the Amazon Prime OTT platform and Amazon Marketplace. On the Enterprise VSAT side, it can certainly leverage the large customer base of AWS.

- Global Presence: Infrastructure and Presence in major / most countries is another key attribute which will reduce the entry barriers for Kuiper services.

- Access to Capital: As an Amazon subsidiary, Kuiper has access to the required capital for design, development, and deployment.

Undoubtedly, the above factors make Kuiper a major threat to existing players. Additionally, the brand value of Amazon & Jeff Bezos is certainly comparable to SpaceX & Elon Musk, if not more.

The bottom line

Starlink’s exponential growth in the satellite industry has raised concerns among established players. Its low Earth orbit (LEO) services, global coverage, and expanding reach have prompted competitors to adjust and lower pricing to stay competitive. NSR expects capacity pricing for the Consumer Broadband market to decline below $50/Mbps/Month in the coming years. The industry will witness some resistance to price erosion with the ViaSat-3 failure, especially in the Americas region, but eventually the price decline is more certain. Consolidation is another effect that the industry is witnessing due to Non-GEO competition, both ongoing and upcoming. The industry is consolidating vertically to have better control over pricing and horizontally to remove redundancies.

While Starlink’s influence continue to expand, it is crucial for the industry to closely monitor Kuiper’s developments. Kuiper has achieved significant milestones during 2019-2023, such as FCC approvals, satellite design, FPA design and launch contracts. It aims to introduce further disruption and innovation, not only in the Consumer Market, but Enterprise VSAT & other market segments as well. Kuiper can clearly leverage the existing customer base of Amazon’s AWS, OTT platform and Marketplace. It is highly probable that Amazon will bundle Kuiper’s services to its existing customers depending on the use cases and requirements in the future.

In conclusion, while Starlink benefits from first-mover advantage, NSR envisions Kuiper as a larger threat in the Satcom Industry, owing to its existing businesses and infrastructure. And its impact in the overall pricing for SatCom? Kuiper will definitely exert added pressure to an already tight and thinly margined market.

Article (PDF)

DownloadAuthor

Vivek Prasad

Principal Analyst, space and satellite, expert in satellite capacityRelated items

Forecast report

Satellite capacity supply and demand, 4Q 2024 update

Article

Geopolitics and sovereignty are (once again) a driving force for the space industry

Strategy report

The pulse of the satellite industry: questions and answers for senior executives 2025