Vendors of automated marketing solutions should prepare for strong growth in the SMB segment

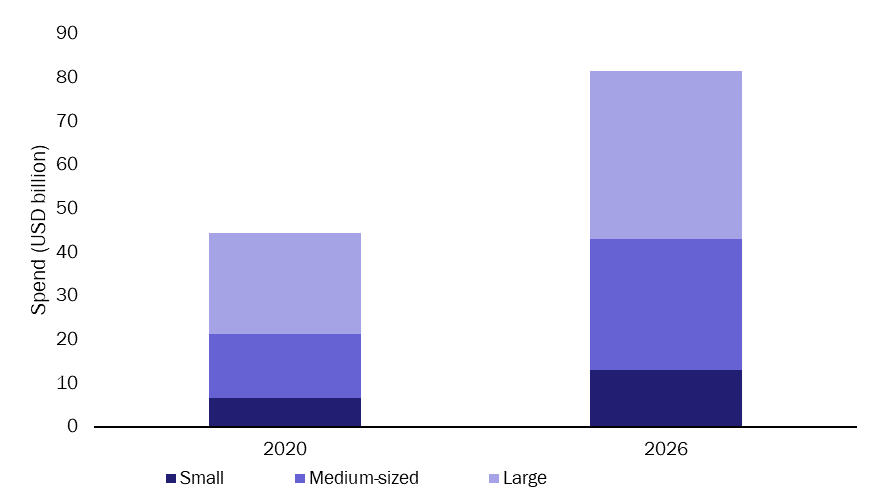

Spending on marketing automation and cloud customer relationship management (CRM) solutions is set to grow to USD81 billion worldwide by 2026, at a CAGR of 10.7%. Spend by small and medium-sized businesses (SMBs) (firms with fewer than 1000 employees) is expected to surpass that of large businesses (firms with 1000 employees or more) in the next 5 years; SMBs’ share of total spend will increase from 48% in 2020 to 53% in 2026 (see Figure 1).

The rapid market shift towards online business boosted SMBs’ investments in marketing-related solutions during the pandemic, and this trend will continue in the coming years. The growing demand from SMBs is helping SMB-focused emerging vendors to outperform established leading vendors.

This article provides suggestions for how leading vendors can capture growth opportunities in the SMB market. The forecasts are taken from Analysys Mason’s SMB Technology Forecaster.

Figure 1: Spending on marketing automation and cloud CRM solutions by business size, worldwide, 2020 and 2026

Source: Analysys Mason

Market disruptions are creating significant opportunities for vendors of marketing solutions

Digitalising marketing was a top business priority for SMBs even before the pandemic. Over a third of SMBs were interested in automating marketing in 2019. The pandemic pushed SMBs to adopt online business and an additional one-third of SMBs will pursue digital transformation in the next 12 months. Where the pandemic caused significant shifts in customer behaviour, improving marketing efficiency should continue to be a high priority for SMBs.

In addition, the forthcoming termination of third-party cookies is creating confusion among marketers and the advertising technology ecosystem. The changes create more opportunities for vendors of comprehensive marketing solutions to capture business from users of entry-level solutions.

Vendors that focus on SMBs are beginning to threaten the position of market leaders

Competition between vendors in the SMB space is accelerating. Market leaders, such as Salesforce with Pardot and Adobe with Experience Cloud, experienced revenue growth of nearly 25% in the marketing-related solution segment in 1Q 2021, but they were outpaced by smaller players.

For example, Hubspot’s revenue growth was 41% in the same period, and its revenue is expected to reach USD1.2 billion in 2021.1 Mailchimp, a vendor that specialises in email marketing solutions for SMBs, serves 12 million customers worldwide and has been evolving to offer a full marketing platform. Mailchimp’s dominant stance in the email marketing space puts it in a strong position to expand its share in the marketing automation space.

Salesforce Pardot and Adobe Experience Cloud are enterprise-grade end-to-end solutions primarily targeting the medium-sized to large enterprise segments. Both have been adapting their solutions to meet the growing demand in the SMB segment. Hubspot, Mailchimp and other SMB-focused vendors started with simple basic products and have been adding features as required by customers. Hubspot and Mailchimp offer free basic tools and services to minimise adoption barriers, then upsell more advanced solutions. This strategy is difficult for larger vendors to replicate.

Understanding the pattern of growth in different regions and countries is key to expanding market share

Leading vendors should consider three key areas that could help them to expand SMB sales.

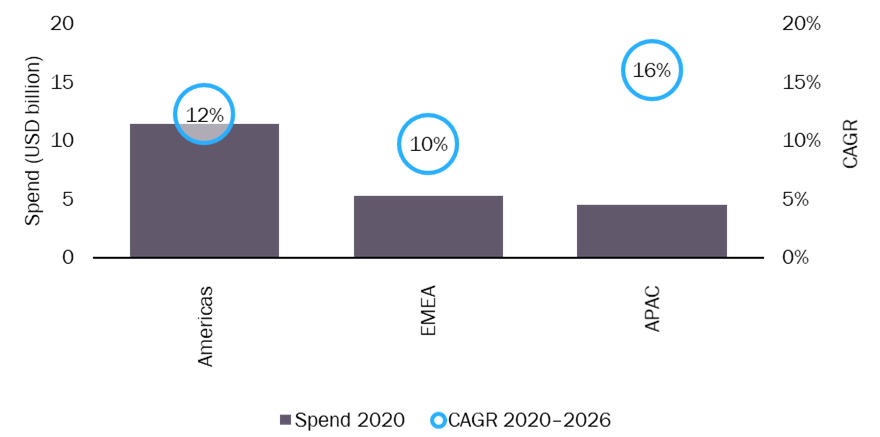

- Develop a strong international strategy. The growth of digital marketing is a global phenomenon and vendors should look at opportunities for growth outside North America. The Americas account for more than half of SMB spending on marketing automation and cloud CRM solutions. The Americas will continue to dominate, but other regions will become increasingly important. Asia–Pacific is roughly half the size of the Americas market throughout the forecast period, but will have the highest growth of 16.1% in the next 5 years (see Figure 2). Increased spend in APAC is driven by the growth of online business in emerging APAC countries, as well as the high penetration and growth of social networking and digital marketing on mobile platforms.

Figure 2: SMB spending on marketing automation and cloud CRM solutions by region, 2020, and CAGR 2020–2026

Source: Analysys Mason

- Partner ecosystem. APAC is a difficult region for US-based global vendors to expand into because the culture, diversity and local regulations are quite different. Therefore, developing robust partner ecosystems in the local countries is essential to support growth. Adobe and Salesforce have local partners in China. These partnerships were designed to help with the large business market, but they will also help Adobe and Salesforce to target the SMB segment. Smaller vendors, such as Hubspot and Mailchimp, either do not have official presence in China, or are not able to trade in China at all. The larger vendors should therefore capitalise on their advantages.

- Localised training. Marketers’ skills and knowledge significantly influence the selection of solutions and vendors. It is important to update and upskill marketers within SMBs through information and training programmes. Many major vendors offer free training programmes to marketers in North America, but in other regions these programmes are often weak or not available. Online free training courses that cater for fragmented local trends and interests are key to capturing mindshare and increasing ARPU.

1 Hubspot (NYSE: HUBS) full-year perspective 2021 in financial report, 5 May 2021.

Article (PDF)

Download