Metaverse strategies: operators are well-placed to succeed in three specific areas

05 July 2022 | Research and Insights

Article | PDF (4 pages) | Fixed Services| Mobile Services| Video, Gaming and Entertainment| Fixed–Mobile Convergence

The metaverse will be important for telecoms operators because it depends on the high-speed, low-latency connectivity that operators provide. However, telecoms operators can do more than just offer connectivity. We have identified ten different elements of the metaverse, three of which we believe telecoms operators are particularly well-placed to operate in – connectivity, edge computing and the facilitating, development and curation of content, services and assets.

The metaverse is too big for telecoms operators to ignore

Research and development investment in the metaverse is becoming significant and the potential value of metaverse-related business is high: McKinsey recently estimated USD5 trillion by 2030, Citigroup estimated USD13 trillion.1

Major hyperscaler players, in particular Meta, have articulated ambitious plans to redirect their business interests towards the metaverse. Roblox noted during its investor day in 2021 that the metaverse would span the addressable market for mobile gaming, streaming video and social media – all areas in which telecoms operators have a commercial interest.

The metaverse will depend on high-bandwidth, low-latency connectivity – telecoms operators’ core competency. It will also depend on edge computing resources, which may also become an important element of telecoms operators’ strategies. Operators frequently offer pay-TV and other services, such as gaming, alongside telecoms. Telecoms operators have relevant experience and established relationships with consumers to extend this approach to metaverse contexts. Accordingly, the metaverse will be important for telecoms operators.

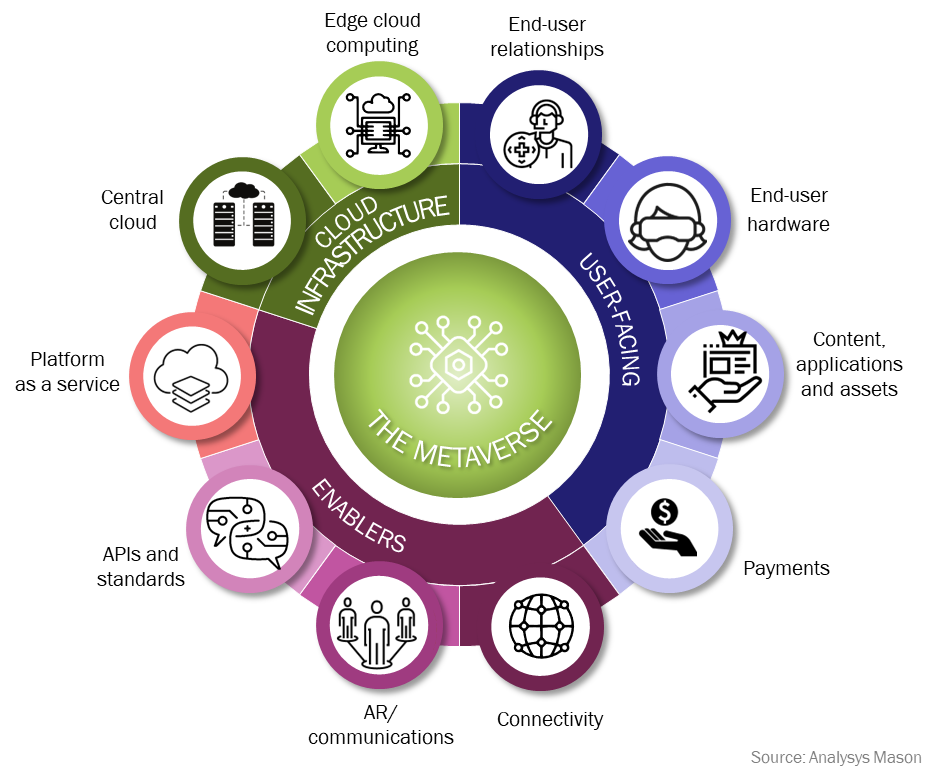

The principal aspects of the metaverse ecosystem can be grouped into three super-categories and ten sub-categories

In the Analysys Mason report, Metaverse strategies: case studies and analysis, we posit that the different aspects of the metaverse ecosystem can be grouped into ten sub-categories and three super-categories.2 No single player needs to excel in all aspects in order to be successful and operators will more naturally succeed in some areas (such as connectivity) and hyperscalers in others (such as central cloud).

Figure 1: Framework for considering approaches to the metaverse

The three super-categories are as follows.

- User-facing. This includes end users and their ‘digital life’; the hardware that enables them to interact with the metaverse, the content that they consume, and the applications and payment systems through which they engage in commerce.

- Enablers. We use this term broadly so as to incorporate all elements that enable metaverse services to operate and users to interact: connectivity, real-time communication both within different points in the metaverse and from the metaverse out to the ‘real world’ (for example via AR), the APIs and standards, and platforms that support and enable that activity.

- Cloud infrastructure. The hardware and processing resources upon which the metaverse software and platforms run.

Telecoms operators are already involved to some extent in all four user-facing sub-categories of the metaverse.

- End-user relationships. Includes the users (enterprise or consumer) of the metaverse, changes in their behaviour and the associated customer engagement and support, brand management, marketing and advertising. Telecoms operators have well-established subscription relationships with their customers.

- End-user hardware. Includes input and output devices such as VR headsets, handsets, haptic technology, cameras, projection and tracking systems, and scanning sensors. Operators have well-established retail channels.

- Content, applications and assets. Includes media that is consumed (for example, entertainment content), the applications through which users collaborate, socialise, game, work, engage in economic activity and access digital assets (for example, avatars, non-fungible tokens (NFTs) and other platform-independent items that are portable across the metaverse).

- Payments. Includes processes, platforms, exchanges, financial services and crypto that enable users to engage in commerce.

Telecoms operators are key enablers of the metaverse primarily through connectivity. The key enablement elements of the metaverse are as follows.

- Connectivity. The end-to-end low-latency high-bandwidth connectivity that is telecoms operators’ core business.

- AR/comms. Real-time communication and interfaces within the metaverse; also interconnecting the metaverse and the ‘real world’ including via traditional communication services such as voice and video, and also via AR. Hyperscalers such as Microsoft may take the lead in this area.

- APIs and standards. Includes aspects that ensure interoperability, such as standards for asset formats, portability and identity management.

- Platform as a service. Includes data management, AI and analytics and software development tools that create the metaverse platform(s) on which metaverse applications run. This is a key focus for Meta.

Cloud infrastructure is primarily the domain of hyperscalers, but telecoms operators’ involvement in edge cloud computing is potentially significant. We define the two facets of cloud infrastructure that enables the metaverse as follows.

- Central cloud. Cloud infrastructure that is located centrally in data centres. This is a key focus for Amazon and Google.

- Edge cloud. Cloud infrastructure that is located at the edge of the network. This is a potential area of focus for operators.

Telcos are well-positioned to play a major role in three specific aspects of the metaverse

Collaboration between organisations will be key to making the metaverse a commercial success. In the report, Metaverse strategies: case studies and analysis, we identify the specific aspects of the metaverse where major telecoms players are already making progress.

Connectivity is a core competency for all telecoms operators by definition. Telcos’ edge computing capabilities will also be important: edge computing capacity will be necessary in order to make metaverse experiences immersive and conducted in real time. Telecoms operators have established edge cloud computing capabilities to satisfy a number of other non-metaverse (particularly enterprise) applications, albeit often using technology supplied by hyperscalers such as AWS. Operators should investigate how their solutions might support both their own metaverse initiatives and those of other players.

Operators are also reasonably well positioned to play a significant role in the ‘content, applications and assets’ area. Telecoms operators are already aggregators of entertainment experiences – they frequently offer pay-TV services and other services, like gaming, alongside telecoms. Telecoms operators have relevant experience and established consumer relationships to extend this approach to metaverse contexts, positioning themselves as curators of experiences in the metaverse.

1 For more information, see Metaverse could be worth $5 trillion by 2030: McKinsey report and As Meta Ditches FB Ticker, Investors Shun Metaverse.

2 We have established this framework based on an original idea by Matthew Ball. For more information, see www.matthewball.vc/the-metaverse-primer.

Article (PDF)

DownloadAuthor