Vendors need to defend themselves from competition from new players targeting the micro-MSP market

Managed service providers (MSPs) are in high demand by small and medium-sized businesses (SMBs).1 SMBs are increasingly seeking support with their IT workloads. In our report Rethinking your 2021 SMB strategy: COVID-19 survey insights for IT vendors, we highlight that COVID-19 has accelerated the trend towards managed service adoption.

This growing demand is resulting in a rapid increase in the number of MSPs and the number of new players that provide MSP-focused technologies. As a result, established players such as ConnectWise, Datto, Kaseya and N-able face strong competition from new entrants such as Atera, HaloPSA and SyncroMSP. These new entrants are gaining market share by offering simple tools at competitive prices that are attractive to small, early-stage/start-up MSPs.

SMB spending on managed services is growing strongly, making this an attractive space for IT solution providers

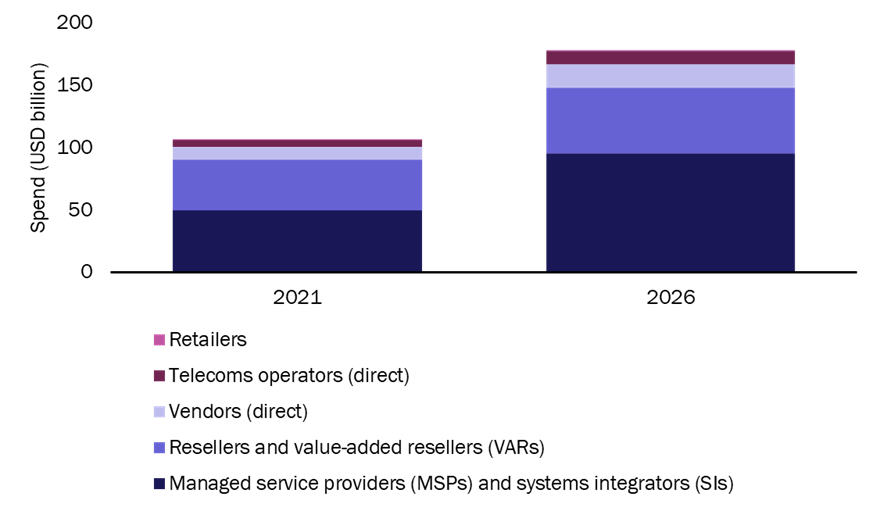

Managed services are IT tasks and processes that can be offered 24/7 on a contractual basis either over the internet or on-premises by MSPs and other third-party IT service providers. We forecast that SMB spending on managed services will grow from USD106 billion in 2021 to USD178 billion by 2026 at a CAGR of 11% (Figure 1). Spending through MSPs and systems integrators (SIs) will grow at a CAGR of 14%. MSPs and SIs will capture 54% of all SMB spending on managed services by 2026.

Figure 1: SMB spending on managed services by channel, worldwide, 2021 and 2026

Source: Analysys Mason

MSP-focused vendors such as ConnectWise, Datto, Kaseya and N-able sell tools such as professional service automation (PSA), remote monitoring and management software (RMM) and business continuity and disaster recovery (BCDR) to MSPs. However, competition in the MSP space is intensifying and each of these vendors is facing challenges from MSPs with fewer than five full-time employees (or micro-MSPs) as these smaller vendors enter the market with attractive offerings.

Micro-MSPs represent a large opportunity for vendors

Micro-MSPs represent a significant proportion of the market; they account for more than 50% of all MSP companies. MSP-focused vendors that can gain MSPs as customers early in the MSP’s lifecycle can promote long-term loyalty as the business grows. For this reason, vendors need a strategy to capture and retain micro-MSPs.

Three vendors that are making headway with micro-MSPs are Atera, SyncroMSP and HaloPSA. In addition to selling PSA, RMM and other MSP-centric solutions, these companies have in common their relatively low/transparent prices, contract flexibility and easy integration with other vendors’ products. They focus on simple solutions that are attractive to MSPs that are just starting out. Their offerings are typically limited and not as mature as those of some of the incumbents, which puts them at a disadvantage with larger MSPs. However, their strategy is to attract smaller MSPs with core solutions and to add features and functionalities to their products over time. This allows them to grow alongside their customers while building loyalty.

Smaller MSPs are highly price sensitive and are willing to try new products as they build their business. Low prices and contract flexibility gives MSPs the confidence that they can try a solution and move on if they are not satisfied. While this can create the potential for churn, a vendor that can get an MSP in the door and keep them on board increases their chances of capturing a long-term, high-value customer. MSPs that have reached a certain threshold find it difficult to switch providers when a solution has been embedded with end clients. Therefore, it is critical for vendors to focus on providing value and support in addition to competitive pricing in order to boost satisfaction and limit churn.

Vendors should incentivise MSPs with pricing strategies and by offering value and support

Established MSP-focused vendors will need to develop a strategy for targeting micro-MSPs.

- Pricing. Vendors should provide different tiers of solutions based on the size and needs of the MSP. Micro-MSPs generally serve small businesses (fewer than 100 employees) with limited budgets for outsourcing their IT. Established vendors will need to offer competitive pricing to stay relevant in this space. N-able is following this approach with its offer to “beat the price” of other RMM solutions.

Beyond pricing, MSP-focused vendors will need to provide strong incentives to keep MSPs from moving to other vendors. MSP-focused vendors should consider differentiating their offers in the following ways.

- Market-proven solutions. Established vendors need to show that they can provide services that are superior to what is available from new entrants. MSPs will want a solution that they are confident will always work and will include the features that they need to serve their customers.

- Technical support. MSPs are looking for their vendors to provide a high level of support from both a technical and selling perspective. Timely technical support when issues arise is critical for maintaining MSP satisfaction.

- Sales support and training. Vendors can differentiate their products from those of new entrants by offering consultative support around sales and marketing to help MSPs to increase their own customer bases. MSPs are looking to vendors to help them to realise their market opportunity. This includes supporting in marketing initiatives and passing on best practices for communicating with potential end customers. A vendor that can offer tools and sales training to help MSPs to develop their businesses has an advantage when it comes to maintaining customer loyalty.

Despite the growing number of new entrants, established vendors have several advantages when it comes to winning in the micro-MSP space. They well established and have reliable financial results (so micro-MSPs can be sure they will still be around in 5–10 years’ time), they can help MSPs to grow, and they have a large product set. They have tried and tested technology, unlike some of the new entrants. They have experience and processes in place to enable them to shift strategies. If they can provide good value at a price that micro-MSPs can afford, they will be successful in continuing to capture the micro-MSP market.

1 Businesses with 1 to 999 employees.

Article (PDF)

Download