Operators in Central and Eastern Europe should raise prices on all plans or on none of them

Mobile operators in Central and Eastern Europe have taken different approaches to pricing. Each of these approaches has had a clear impact on market shares of connections and service revenue. Many operators, such as A1 in Croatia, have elected to increase prices to combat rising costs. Some challenger operators, such as RCS&RDS in Romania, have been using the uncertain economic situation as an opportunity to attract new customers by keeping prices low. LMT in Latvia has tried a third and less successful strategy of only increasing the prices of some plans.

Price increases boosted ARPU and drove revenue growth, but keeping prices flat had a big marketing impact. However, increasing the prices of some plans does not bring either of these benefits.

This article is based on 1Q 2023 data that is available in Analysys Mason’s DataHub.

Many operators have increased prices to offset rising costs caused by inflation

High inflation and economic pressures have forced mobile operators in Central and Eastern Europe to alter their strategies to achieve revenue growth. One strategy has been to increase prices. Operators that have used this strategy have achieved revenue growth by increasing ARPU.

In Croatia, A1 used price increases to gain 1.0 percentage point of service revenue market share between 1Q 2022 and 1Q 2023, despite losing 0.4 percentage point of connections market share. The main loser in Croatia was Hrvatski Telekom, which lost market share for connections (0.6 percentage point) and service revenue (1.0 percentage point), despite keeping prices the same.

A1 increased the data allowance on some of its plans to accompany the price increases. For example, its Mala+ plan included 3GB of data for HRK99 (EUR13.5) per month in February 2022. The data allowance had been increased to 5GB by March 2023, while the price had increased by 6.1% to HRK105.03 (EUR14) per month. This data increase encouraged enough customers to accept the price increase and helped A1 to boost its share of revenue.

Meanwhile, Croatia’s other mobile operator Telemach benefited from offering cheaper tariffs than its rivals. Its Top plan offers 40GB of data. In January 2023, this plan cost HRK134.87 (EUR18) per month, a 4.6% increase from March 2022. Despite this increase, the price is still lower than the HRK205 (EUR27.5) per month that Hrvatski Telekom charges for its 40GB plan. This enabled Telemach to boost its share of connections despite increasing prices, while Hrvatski Telekom’s share of connections declined.

Challenger operators have taken the opportunity to gain customer market share by keeping prices low

Challenger operators providing cheaper tariffs have achieved revenue growth by keeping prices flat and increasing their customer base, rather than by growing their ARPU.

RCS&RDS in Romania is successfully implementing this strategy. It offers unlimited data plans ranging from EUR2 to EUR5 per month. These prices remained unchanged from March 2022 to March 2023. In this time, it grew its shares of connections and service revenue by 3.7 percentage points and 2.7 percentage points respectively. Orange, which has higher prices, lost connections and service revenue market share by 2.8 percentage points and 3.3 percentage points respectively from 1Q 2022 to 1Q 2023. RCS&RDS offers tariffs that are lower than those offered by Orange. These lower tariffs proved to be attractive to customers and helped the operator to boost its revenue market share.

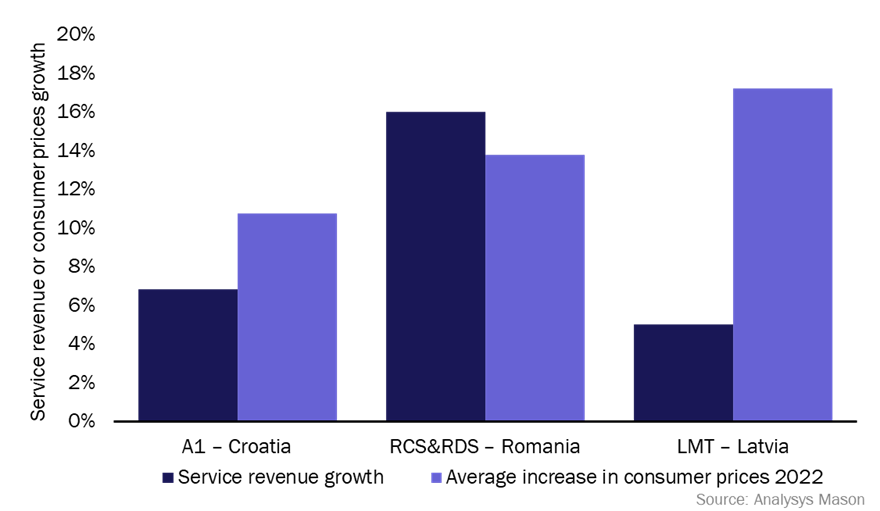

Most indicative of RCS&RDS’s success was its revenue growth compared to inflation. Its service revenue increased by 16.0% year-on-year to 1Q 2023. This exceeded the increase in consumer prices, which was 13.8% in Romania in 2022. The fact that it achieved real-terms revenue growth in the current economic climate shows that it sufficiently increased its customer base to offset the lack of ARPU growth.

Figure 1: Change in connections and service revenue market shares by selected operators, 1Q 2022–1Q 2023

| Operator | Strategy | Change in connections market share 1Q 2022–1Q 2023 (percentage points) | Change in service revenue market share 1Q 2022–1Q 2023 (percentage points) |

| A1 Croatia | Increased prices | –0.4 | 1.0 |

| RCS&RDS Romania | Kept prices the same | 3.7 | 2.7 |

| LMT Latvia | Increased prices of some plans | 1.3 | –1.4 |

Source: Analysys Mason

The strategy of increasing the prices of some plans rather than all has not proven successful

A third possible strategy for operators is that of targeted price increases, as implemented by LMT in Latvia. The operator increased the prices of its premium plans only. For example, it increased the price of its Freedom + Independence plan, offering unlimited calls, SMS and data, by 7.8% to EUR28.98 per month from May 2022 to February 2023.

This strategy did not prove successful for LMT. It did achieve year-on-year service revenue growth of 5.0% to 1Q 2023, but this was less than that of its competitors. Tele2 and Bite achieved service revenue growth of 12.2% and 10.2% respectively in the same period, having both increased prices across their full range of plans. This was despite LMT being the only operator to increase its share of connections (by 1.3 percentage points) in this period.

LMT was not able to benefit from the revenue increase of raising all tariffs, but nor could it benefit from the marketing opportunities afforded by keeping all prices flat.

Figure 2 shows the year-on-year service revenue growth to 1Q 2023 achieved by A1, RCS&RDS and LMT, compared to the average increase in consumer prices in their respective countries in 2022.

Figure 2: Service revenue growth by operator, 1Q 2022−1Q 2023, and average increase in consumer prices by country, 2022

No one strategy has proven to be the most effective, although the results from LMT suggest that operators must choose a definitive direction with their pricing strategy. A1 and RCS&RDS strengthened their positions in the market by focusing on one strategy; A1, an incumbent operator, increased prices, while RCS&RDS, a challenger operator, attracted new customers by keeping prices low.

Article (PDF)

DownloadAuthor