MSPs will play a critical role in SMBs’ digital transformation initiatives amid a tough outlook

11 August 2022 | SMB IT

Article | PDF (3 pages) | IT and Managed Services| IT Infrastructure

Small and medium-sized businesses (SMBs) have faced myriad challenges in the past few years. They have struggled to transition to remote working and employee engagement, including hiring, recruiting and retaining skilled workers. They have also faced increasingly complex cyber threats, which have been magnified by geopolitical events, and have struggled to secure business-critical data. At the same time, technical stacks have grown more complex. Now, SMBs face the prospect of supply chain constraints, political instability, rising inflation and a worsening economic outlook.

Digital initiatives will be critical to SMBs’ success in this environment. SMBs will require long-term partnerships with managed services providers (MSPs) to drive initiatives forward, while maintaining a focus on their businesses.

Analysys Mason surveyed 1149 SMBs in Germany, Singapore, the UK and the USA between December 2021 and January 2022 to understand where MSPs can have the greatest impact on SMBs. The survey results provide visibility for MSPs, as well as their software vendor partners, into SMBs’ pain points, current and future projected use of managed services and revenue growth potential in various verticals and geographies.

The remotely managed IT services market will have double-digit year-on-year growth by 2026

Analysys Mason’s SMB Technology Forecaster shows that SMBs’ spending on remotely managed IT services (RMITS) will grow at a CAGR of 11% between 2021 and 2026 to reach USD179 billion. There are several catalysts for this growth.

- Enabling remote and hybrid working. SMBs in Germany, Singapore, the UK and the USA reported plans to increase their spending on managed technology services in order to normalise business operations and cement a transition to a new, post-pandemic working environment.

- Managing complexity. IT operations have become more complex than ever, and complexity in the technology stack will further increase as businesses seek to address the challenges of remote and hybrid working. Only half of all SMBs (and just 25% of all small businesses) employ full-time, dedicated IT staff.

- Staffing challenges. SMBs face a staffing shortage and will rely on MSPs for business continuity.

Investments will not look the same everywhere

Our survey revealed that there are many growth opportunities for MSPs and MSP-focused software vendors outside the USA. Indeed, roughly 40% of SMBs (60% of medium-sized businesses) in Germany, Singapore and the UK are planning to increase their managed services spend in the next 12 months.

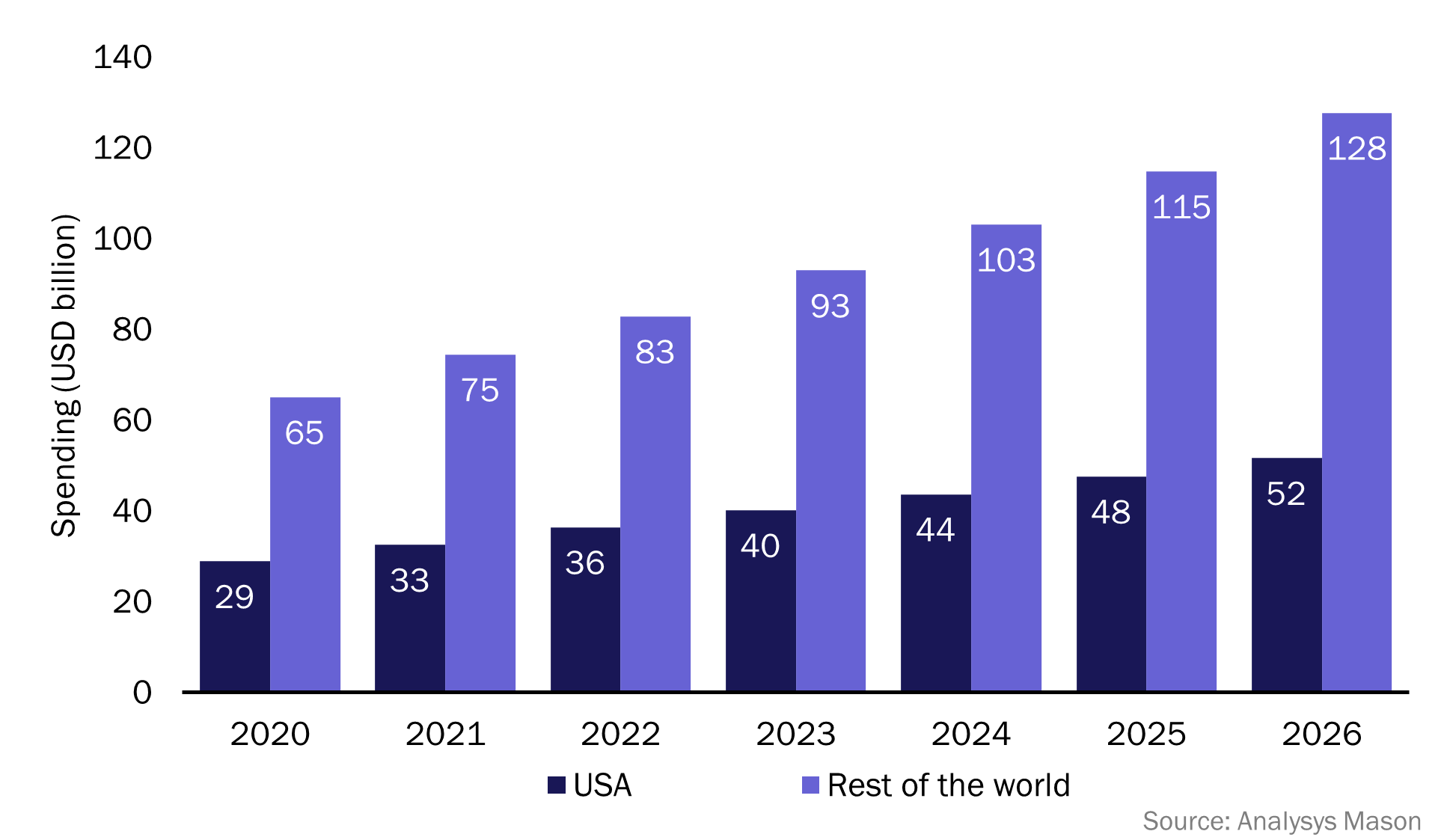

US SMBs account for more than 30% of the total SMB spend on RMITS, but our research shows that SMBs outside the USA will increase their investments in managed services significantly in the upcoming years. According to Analysys Mason’s SMB Technology Forecaster, spending on RMITS by SMBs outside the USA is expected to increase from USD75 billion in 2021 to USD128 billion in 2026, at a CAGR of 11% (Figure 1).

Figure 1: SMB spending on RMITS, worldwide, 2020–2026

This growth will be driven by SMBs’ heavy investments in cloud infrastructure and services for their employees as well as business operations. Spending among medium-sized businesses (MBs), who were better able to weather the pandemic than their smaller counterparts due to size and scale, will grow faster. Indeed, spending by MBs outside the USA will grow at a CAGR of 13% during the forecast period.

The pandemic has changed expectations, and businesses will need to support remote and hybrid workforces in the future. Indeed, approximately 40% of employees still expect to work from home or in a hybrid format in the next 2 years.

This number is even higher in the finance, insurance and real estate (FIRE) sector: more than 60% of employees expect to continue to work remotely. As in other sectors with high numbers of remote and hybrid workers, SMBs in the FIRE sector plan to increase their spending on managed services to ensure that workers receive adequate IT support while enforcing data security and protection policies. These sectors represent a significant near-term opportunity for MSPs and MSP-focused software vendors.

Capturing revenue growth will require a localised approach

MSPs should align their go-to-market (GTM) efforts with local requirements as they expand to new geographies. For example, SMBs in Germany and the USA place a higher value on security services than peers in other countries. SMBs in Singapore and the UK place the greatest value on remote IT support. Investment priorities also differ by geography. Storage, back-up and recovery services are among the top investment priorities in Germany and the USA, while email security and anti-spam solutions are among the main priorities in Singapore.

Nearly a third of SMBs in our survey said that they will look to channel partners for strategic help beyond just IT support to help grow their businesses. MSPs should therefore further tailor their solutions and services based on their target market to help SMBs to achieve their growth goals.

MSPs desperately need solutions to manage relationships and boost retention

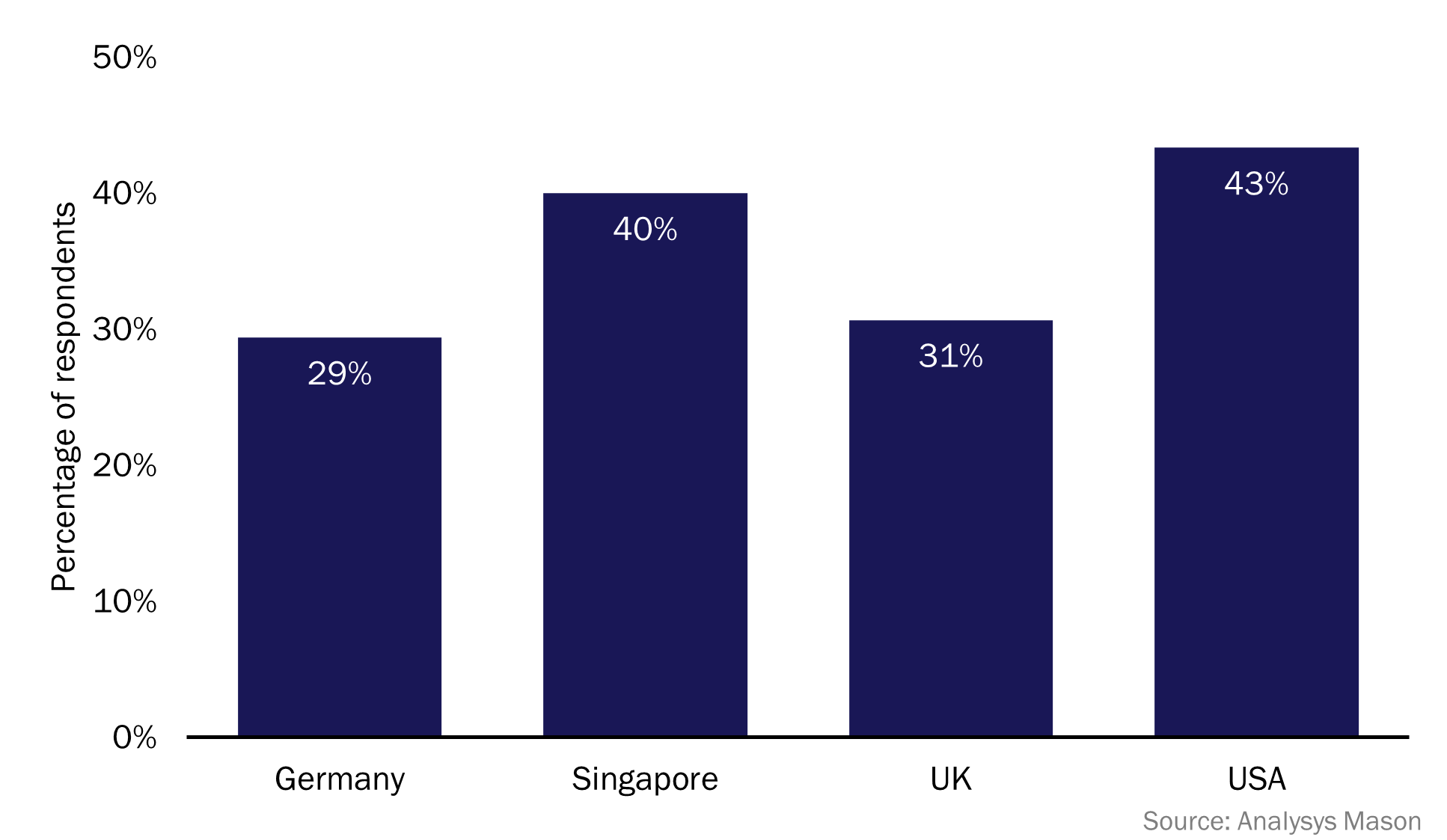

More than 30% of the SMBs that we surveyed reported having switched IT service providers during the past year (Figure 2). Churn will threaten MSPs’ profitability and prospects for success, despite increased spending by SMBs.

Figure 2: Percentage of SMBs that reported having churned from IT services channel partners in the last 12 months, Germany, Singapore, UK and USA, 2022

MSPs should invest in their own technology stacks to improve the quality of their customer experience (CX). The range of potential CX technologies is vast and includes portals, reporting and assessment tools. However, MSPs must identify the combination that enables a mix of self-service and personalised support experiences. Some vendors, such as Invarosoft and CloudRadial, have developed specialised solutions for MSPs that integrate with various systems and provide a holistic view of the customer experience in response to the unique challenges of MSPs.

We expect that the business environment will continue to challenge SMBs, and many will look to digital solutions to drive efficiency and improve outcomes. MSPs will play a key role in technology delivery, but not all will benefit equally. The big winners will be those who strategically offer development and continually align with the needs of their SMB customers. They will also carefully select targets for international expansion and invest in their own technology stacks to improve the customer experience and boost retention.

Article (PDF)

DownloadAuthor

Youngeun Shin

Senior AnalystRelated items

Report

SMB IT spending forecast report: driving business growth and increasing efficiency

Report

SMB IT spending forecast report: a new beginning

Article

SMBs in manufacturing and professional service industries are making big investments in CRM solutions