Multi-cloud networking software should become an ACSON platform, similar to how SD-WAN became SASE

25 September 2024 | Research

Article | PDF (3 pages) | NaaS Platforms and Infrastructure

The multi-cloud networking (MCN) software market has grown rapidly in recent years, driven by enterprises’ need to connect distributed applications across multiple clouds efficiently. However, discussions with MCN vendors and users indicate that while the market is expanding, it has lost some of the initial momentum. For example, Cisco discontinued its MCN software, Cloud Network Controller, this year to refocus on its SD-WAN cloud on-ramp solution. Additionally, Aviatrix, which previously highlighted its growth, including 600 customers and USD100 million in revenue in 2022, has become reticent about recent figures. This article examines the challenges facing the MCN software market and offers recommendations for its evolution to maximise its potential.

MCN software must transcend its tactical, point solution perception and be seen as a strategic, application-centric platform

Enterprises are struggling to manage and automate their complex application environments, which involve a diverse range of connectivity, security and application delivery vendors, technologies and cloud platforms, each suited to specific application architecture. Applications require seamless, secure connections across multiple platforms, but each platform has its own connectivity, security tools and interfaces. Enterprises need various specialists to operate the underlying networks that connect their applications, including the specific security and application delivery functions within these networks.

Enterprises view MCN software as another point solution in their complex stack, typically adopting it when their multi-cloud setups reach a tipping point, where existing cloud connectivity (for example, VPN, SD-WAN) and service mesh solutions begin to show limitations. As a result, it is often adopted tactically to address specific problems rather than as a strategic corporate decision. Younger members of the cloud team, such as those in DevOps, are usually driving its adoption, while traditional buyers like NetOps and data-centre owners have been slower to embrace it. These factors are limiting the market potential of MCN software.

MCN software vendors have the opportunity to reposition multi-cloud networking, much like SD-WAN evolved into SASE, by shifting its perception from a point solution for connectivity to a comprehensive, application-centric platform integrated into the application development lifecycle rather than being layered on as an afterthought. Just as SASE unified networking and security to enhance user access across distributed environments, MCN software should be positioned as a holistic platform for enterprise application networking and management, serving as a single, coherent networking fabric and orchestration framework across any cloud (public, private, edge), while streamlining vendor, technology, and tool silos in existing application environments.

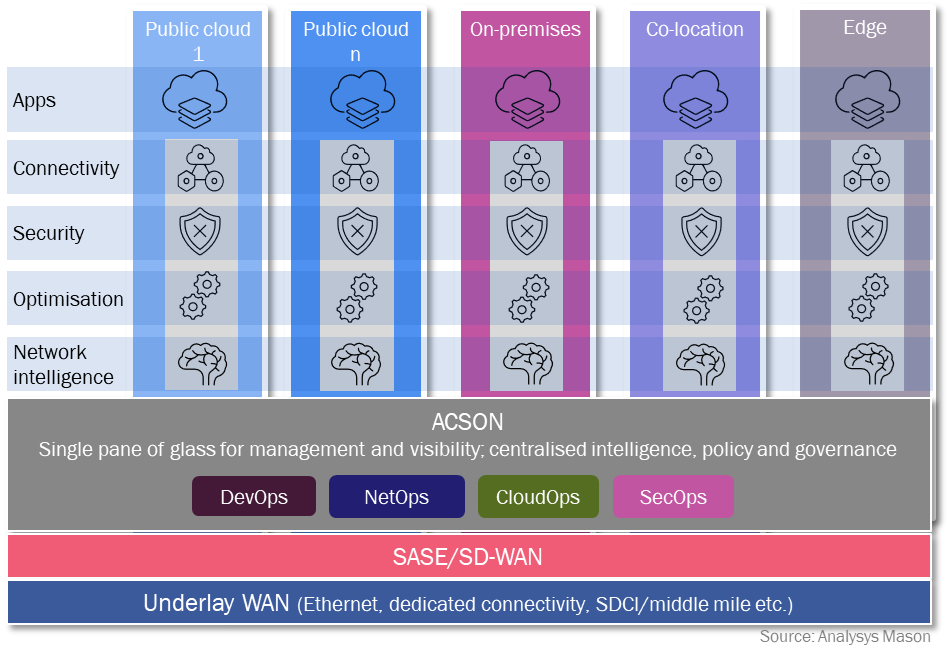

The market needs a new concept that encapsulates this platform and its value, in order to influence enterprises effectively. We suggest the acronym ACSON for this, based on the main components of the platform (Application Connectivity, Security, Optimisation and Network intelligence) (Figure 1).

- Application connectivity. An application-aware, highly programmable, complete Layer 3–7 networking fabric with automated provisioning and configuration of connectivity between microservices, clusters, virtual private clouds (VPCs) across distributed regions, clouds, and edge sites.

- Security. Embedded set of security components, including web application firewalls (WAF), DDoS mitigation, API security, bot protection, encryption and threat detection, all integrated within a zero-trust framework to ensure comprehensive security and data protection both at rest and in transit.

- Optimisation. Enhancing application performance and efficiency through adaptive load balancing and traffic optimisation (for example, dynamically adjusting network resources and traffic flows for latency, bandwidth etc.) capabilities based on real-time data.

- Network intelligence. AI and analytics-driven observability to deliver comprehensive insights into network and application performance, security events, and user behaviour. This includes real-time monitoring, anomaly detection, predictive analytics, and automated, proactive responses to maintain optimal network operations and security across multi-cloud environments.

Figure 1: Overview of ACSON platform architecture

An ACSON platform would converge these components into a seamlessly integrated, cloud-native system, providing a single pane of glass for management and visibility, centralised intelligence, and an integrated partner ecosystem of solutions for greater consistency, reduced complexity and more automated application environments.

The success of the ACSON platform will rely on it convincing decision makers in large enterprises, especially in data-centre and NetOps domains, that it will be a strategic asset in delivering their objectives. Currently, MCN software operates independently of enterprise networks, relying on public cloud backbones and the internet, which falls short of the performance and security needs of critical business applications. ACSON can unify the networking environment by integrating (or potentially converging) with SASE and underlay networks to meet SLA, QoS, and security requirements. By enabling consistent policies and governance, ACSON can elevate its status among traditional networking decision makers. The partnerships between Equinix and Megaport with MCN software vendors like Aviatrix and Prosimo, as well as IBM and Vapor IO, highlight the market’s evolving understanding and the early steps being taken to bridge these gaps.

ACSON’s future belongs to those bridging multi-cloud networking, application development and NetOps into a unified platform

F5 and Prosimo are currently the frontrunners to achieve the ACSON platform vision. F5, with its strong background in application delivery and a broad portfolio enhanced by acquiring Volterra and NGINX, has made progress in integrating its solutions into a single platform. However, despite partnering with several vendors, F5 needs to expand its ecosystem further to fully establish itself as a flexible platform provider.

Prosimo’s approach is similar to F5’s, offering a complete Layer 3–7 stack with a focus on application networking. It has strong partners like Equinix and Palo Alto Networks but, as a start-up, lacks the portfolio depth, resources and customer relationships of established vendors. An acquisition by a larger company could boost Prosimo’s market position.

Aviatrix and IBM are strong contenders as well. Aviatrix, the creator of the MCN software market, is expanding its security components and partnerships but lacks the application networking focus of F5 and Prosimo. IBM, while building an application-centric multi-cloud networking portfolio, has a Hybrid Mesh solution focused mainly on connectivity, with less depth in security and application delivery. However, IBM’s stronger C-level influence and resources could allow it to address these gaps through acquisitions.

Overall, we expect that the winners in the MCN software landscape will be those that can successfully transition into broader, application-centric platforms, such as ACSON, bring DevOps, CloudOps, SecOps and NetOps worlds closer together, and win the minds and wallets of corporate decision makers and traditional buyers.

Article (PDF)

DownloadAuthor

Gorkem Yigit

Research DirectorRelated items

Strategy report

Strategies for telecoms operators to evolve their network-as-a-service (NaaS) propositions

Article

The QoD network API is increasingly being rolled out by CSPs, but monetisation remains limited

Article

The network API ecosystem is seeking opportunities beyond its strong traction in bank anti-fraud