Analysys Mason forecasts that the multi-cloud networking market will reach USD15 billion by 2028

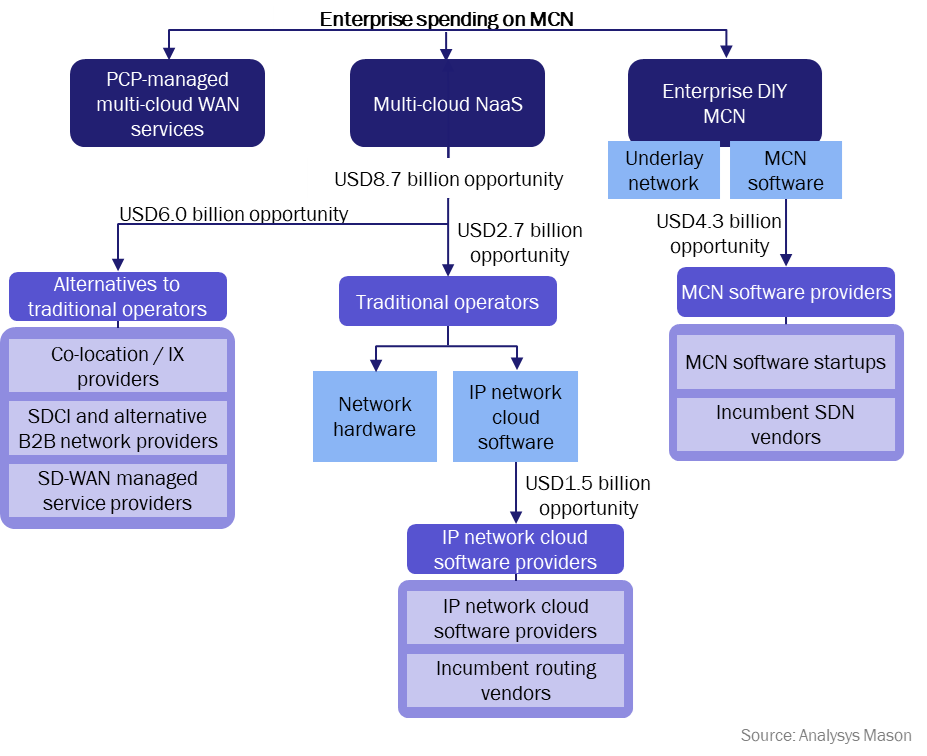

Enterprises are distributing their workloads across a growing number of public, SaaS and edge clouds in addition to their on-premises data centres, and require reliable and programmable connectivity between these environments. Standard internet connectivity is insufficient on performance and security grounds, while traditional enterprise WANs (including SD-WANs) lack the flexibility and automation capabilities needed to accommodate rapidly changing networking requirements. Therefore, enterprises are investing in specialist multi-cloud networking (MCN) solutions, including multi-cloud network-as-a-service (NaaS) and MCN software that enterprises can use to build a ‘do-it-yourself’ (DIY) overlay network for their existing underlay networks. We forecast that enterprise spending on these components of MCN will reach USD13.0 billion in 2028. In addition, by 2028 there will be a USD1.5 billion opportunity for the provision of IP network cloud software to traditional operators that are transforming their networks to enable them to offer multi-cloud NaaS.

Figure 1: Overview of the multi-cloud networking market opportunity for 2028

This article is based on data from Analysys Mason’s Multi-cloud networking: worldwide forecast 2023–2028.

Enterprises require multi-cloud NaaS that can provide consistent connectivity that can straightforwardly be provisioned on-demand

Multi-cloud NaaS providers combine underlay and overlay capabilities to delivery programmable connectivity with automated, self-service provisioning, configuration and scaling. These NaaS solutions also incorporate network-related value-added services delivered through a marketplace. Multi-cloud NaaS unburdens enterprises from the complexity of setting up their own multi-cloud networks, and the agility and flexibility of these solutions allows enterprises to consume network resources as they would cloud resources. This means the resulting networks can be scaled up and down on demand, eliminating networking bottlenecks faced by enterprises and enabling them to optimise costs. In addition, either by virtue of having their own underlay networks or through partnerships with underlay network providers, multi-cloud NaaS providers can offer the SLA/QoS guarantees that enterprises require for their mission-critical applications.

Both traditional operators and other players are attracting a share of enterprise spending on multi-cloud NaaS, which we forecast will reach USD8.7 billion in 2028. We estimate that in 2028, around 32% of spending on multi-cloud NaaS will go to traditional operators, such as BT, Deutsche Telekom and Orange, which offer platform-based NaaS having introduced sufficient automation and programmability in their IP networks. In addition, co-location/internet exchange providers (such as Equinix and Digital Realty), SDCI and alternative B2B network providers (such as Megaport and Packet Fabric) and SD-WAN managed service providers (such as Alkira and Teridion) are coveting this enterprise spending. These players are all approaching the multi-cloud NaaS market from different starting points and are actively working to enhance their NaaS offerings, for example, by expanding their geographical coverage, improving their automation and self-service capabilities, offering a broader range of L4–7 services in their marketplaces and exposing capabilities through open APIs and SDKs.

Enterprises are using MCN software platforms to simplify the management of DIY multi-cloud networks

MCN software includes cloud-based control and user plane solutions, such as cloud routers, gateways and load balancers, that can be used for provisioning and orchestrating networks that connect multiple cloud environments. MCN software platforms can either be embedded as part of MCN NaaS offerings or offered directly to enterprises that want to build their own network overlays. This segment also includes app-to-app networking solutions, the market for which is growing rapidly as applications are increasingly transformed from monoliths into microservices and Kubernetes (K8s) clusters that run across multiple cloud and on-premises environments.

Enterprise spending on MCN software will reach USD4.3 billion in 2028. This spending will be split between new entrant MCN software players (such as Aviatrix and Prosimo), which offer overlay solutions that provide underlay abstraction and automation capabilities, and incumbent SDN vendors (such as Cisco, F5 and Juniper) that are extending their existing data centre networking solutions to support MCN. Incumbent vendors as well as open-source-based start-ups such as Solo.io are leveraging open-source K8s networking and service mesh initiatives to help build their multi-cloud app-to-app networking propositions.

Operators are transforming their underlay networks by adopting disaggregated IP networking solutions

Operators that want to offer multi-cloud NaaS need to invest in improving the programmability and automation capabilities of their networks. To do this, they must transform their legacy IP/optical networks with cloud-native, disaggregated networking components and software-defined, automated operations. This will include the adoption of IP network clouds, which consist of CUPS-based, cloud-native routing control plane running on open, merchant-silicon-based hardware infrastructure. The cloudification of operators’ underlay networks enables improved routing agility and programmability, and is therefore often an essential first step before operators begin to offer multi-cloud NaaS. However, operators are adopting these cloud-native approaches in their IP/transport networks slowly due to their radical, disruptive nature. For many operators, the primary driver behind adopting disaggregated IP networking solutions is currently lowering TCO and improving supply-chain flexibility rather than enabling them to fulfil a multi-cloud NaaS vision.

We forecast that operator spending on IP network cloud software will reach USD1.5 billion in 2028. This opportunity will be divided between end-to-end IP network cloud platform vendors (such as Arrcus and DriveNets), domain-focused IP network cloud vendors (such as IP Infusion and RtBrick) and incumbent routing vendors that are looking to evolve their traditional appliance-based networking portfolios to fend off competition from new-entrant disaggregated networking vendors.

Article (PDF)

DownloadAuthor

Joseph Attwood

AnalystRelated items

Strategy report

Strategies for telecoms operators to evolve their network-as-a-service (NaaS) propositions

Article

The QoD network API is increasingly being rolled out by CSPs, but monetisation remains limited

Article

The network API ecosystem is seeking opportunities beyond its strong traction in bank anti-fraud