MVNO launches in Nigeria will test the viability of the MVNO market in Sub-Saharan Africa

21 August 2024 | Research and Insights

Article | PDF (3 pages) | Middle East and Africa Metrics and Forecasts

The MVNO market in Sub-Saharan Africa (SSA) is underdeveloped. However, this may be about to change as the Nigerian Communication Commission (NCC) has granted over 40 MVNO licences with the deadline to launch by October 2024. If Nigeria’s telecoms market is able to support this influx of new MVNOs without sacrificing revenue growth, it may inspire MVNOs to launch in the growing mobile markets in other SSA countries.

Nigerian regulators hope that introducing MVNOs will encourage mobile network operators to complete their network expansion

Nigeria’s mobile market was the largest in SSA both in terms of connections and revenue in 1Q 2024. However Nigeria’s mobile penetration (connections as a share of population) of 94.4% remains below the regional average (114.1%) partly because large areas of the country lack network coverage.1

The NCC announced a plan in August 2022 to introduce MVNOs to the market with the following goals:

- expand mobile coverage in unserved and underserved regions

- engender competition among the country’s MNOs

- increase consumer choice when selecting mobile tariffs.2

The NCC advertised five tiers of MVNO licences ranging from virtual operators (tier 1), which merely leverage network capacity without offering their own SIM, to virtual aggregators (tier 4), which purchase bulk capacity from an MNO and resell it to lower-tier MVNOs. The fifth tier (unified virtual operators) is the most complex, allowing licensees to offer a bespoke combination of tier 1 to tier 4 services.3 As of July 2024, 46 MVNO licences have been awarded to potential operators.

MNOs feel threatened by MVNOs offering low-cost data services and have therefore made it difficult for MVNOs to launch

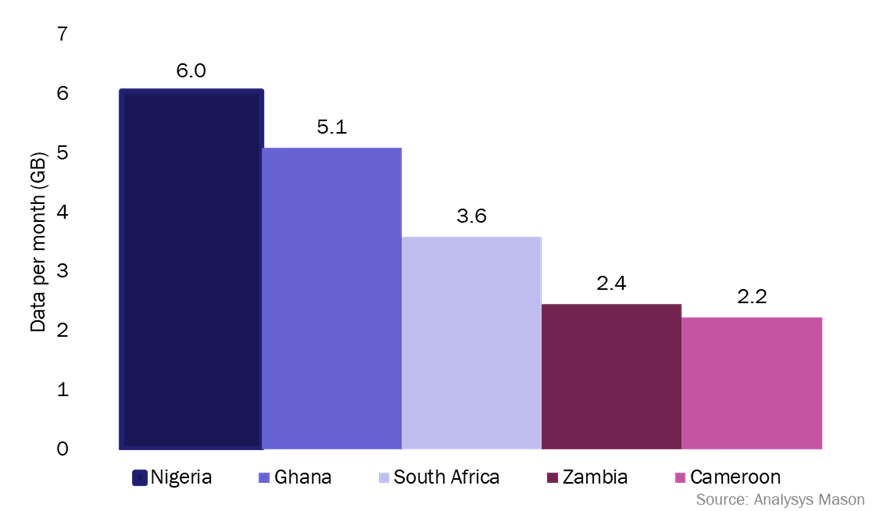

MVNOs entering Nigeria’s mobile market are likely to focus on providing affordable handset data services. Nigerian mobile data consumption is significantly higher than elsewhere in SSA (Figure 1). Increasing data traffic has led Nigerian data revenue to increase by 78.3% between 1Q 2022 and 1Q 2024 with more growth expected in the future.

Currently, Nigerian MNOs do not compete to offer lower data tariffs and instead prioritise expanding and improving their network coverage. As a result, new MVNOs could successfully distinguish themselves by offering low-cost data tariffs. However, the launch of MVNO services in Nigeria has been repeatedly delayed because licensees have been unable to secure wholesale access to MNOs’ networks.

Figure 1: Mobile data traffic per connection in Nigeria and its regional neighbours, 1Q 2024

Like many SSA countries, Nigeria’s mobile market is dominated by a small number of MNOs (Airtel, Globacom and MTN) that together accounted for 94.6% of connections in 1Q 2024. Any new entrant would threaten their market share of connections. Moreover, given that MVNOs typically distinguish themselves with low tariffs, attempts by MNOs to compete on price would further negatively impact ARPU.

Wholesale agreements between MNOs and MVNO licensees have been repeatedly delayed. One reason for these delays has been operators’ concerns regarding the threat to their revenue posed by these new entrants. The CEO of Hazon Technologies, which purchased a tier 2 MVNO licence, reported being treated with “resistance and suspicion” by MNOs during wholesale negotiations.4 In response, the NCC has said it will intervene in wholesale negotiations where necessary.

Regulators in SSA need to support new MVNO entrants in order to overcome resistance from MNOs

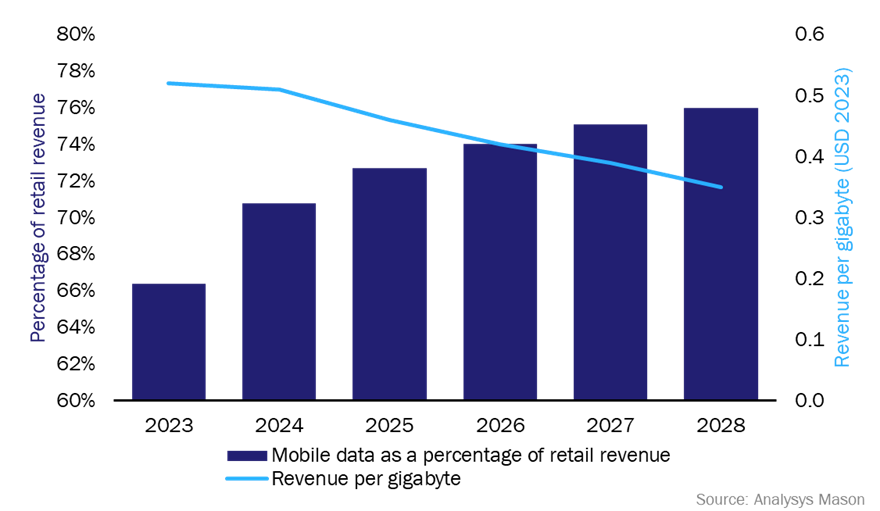

The outcome of Nigeria’s regulatory push for MVNOs will provide valuable insight into the viability of MVNOs launching elsewhere in the region. Mobile retail revenue in SSA is forecast to grow 34% between 2023 and 2028, with data accounting for an increasing proportion of revenue (Figure 2).5 This presents a significant opportunity for MVNOs, especially those already operating outside the region, to enter SSA’s mobile markets as low-cost data providers.

Figure 2: Mobile data as a percentage of retail revenue and retail revenue per gigabyte of mobile data in Nigeria, 2023–2028

Moreover, regulators throughout the region are focused on expanding network coverage in underserved areas. If the introduction of MVNOs in Nigeria can be shown to successfully accelerate MNOs’ network expansion, this will stand as an example for SSA regulators hoping to do the same.

MVNOs and regulators will both be watching the outcome of the NCC’s push to launch MVNOs. Of particular interest to regulators in the region will be whether the introduction of MVNOs will help to encourage MNOs to expand their coverage.

1 MTN’s 2G network covered 92.3% of Nigeria’s population as of April 2023, whereas its 4G network covered less than 80%. For more information about operators’ network coverage and expansion projects, see Analysys Mason’s Nigeria: state of the telecoms market report.

2 The Nigerian Communication Commission (11 August 2022), Advertisement of Mobile Virtual Network Operators’ (MVNOS) License.

3 For more information about specific MVNO tiers, see the NCC’s License framework for the establishment of MVNOs in Nigeria.

4 The Guardian (14 April 2024), Mistrust, greed stall take-off of new telephony licensees in 31 states.

5 Revenue growth is calculated using a constant USD:LCU exchange rate in order to mitigate the impact of currency devaluation in the region. For a discussion of currency devaluation and its impact on revenue trends in SSA, see Analysys Mason’s Sub-Saharan Africa telecoms market: trends and forecasts 2023–2028.

Article (PDF)

DownloadAuthor

George Meyerowitz

AnalystRelated items

Country report

Egypt: state of the telecoms market 2025

Report

Analysys Mason research and insights topics for 2026

Article

Fixed broadband revenue growth in MENA between 2025 and 2030 will offset declining mobile ARPU