Netflix aims to take cloud gaming to the TV set and it may succeed where others have failed

21 August 2023 | Research and Insights

Article | PDF (4 pages) | Video, Gaming and Entertainment

Netflix began to beta test a cloud gaming service in August 2023, initially rolling it out to select users in Canada and the UK. A full launch is expected later in 2023. Unlike established cloud gaming services from Microsoft and Sony, Netflix is targeting a distinct and easier-to-address audience.

Netflix stands a good chance of succeeding where others, like Rovio’s Hatch, did not, because Netflix has lower technical demands and lower costs. Its success will probably have several knock-on effects for telecoms operators in terms of increasing customer support calls and eventually increasing demand for improved Wi-Fi.

Cloud gaming will take a growing share of the digital gaming market over time but is limited by poor customer awareness

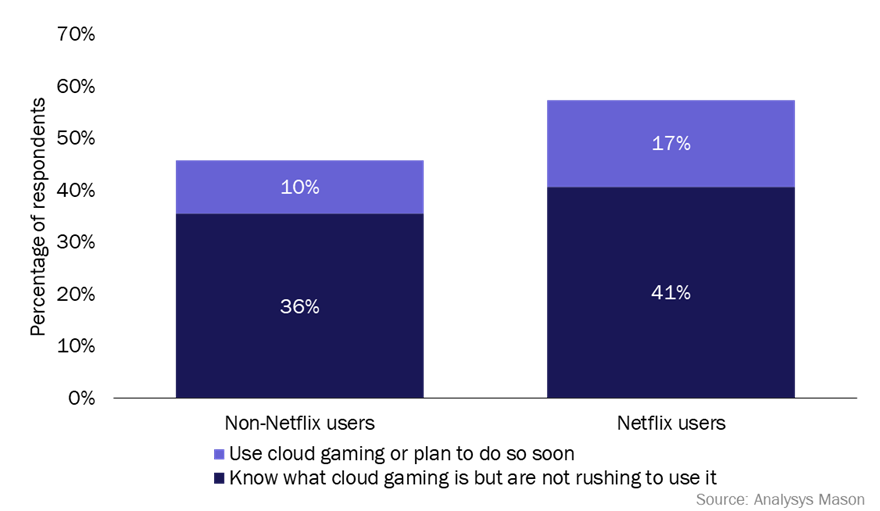

Cloud gaming faces a challenge: many adults are unaware of its existence. Our July 2023 survey of 18 000 adults around the world suggests that only 52% know about cloud gaming. Among them, a mere 14% used, or planned to use, such services.

High-end cloud gaming services, such as Microsoft’s Xbox Cloud, NVIDIA GeForce NOW and Sony’s new 4K cloud gaming service, have high infrastructure costs and this has necessarily kept the retail price for such services high. If consumers do not understand what cloud gaming is, and what its benefits are, then they will struggle to perceive the value of the service. Netflix users are more likely to be interested in cloud gaming (Figure 1), which may improve the company’s prospects in this area, but there is potentially still that hurdle of awareness to overcome.

Figure 1: Awareness of cloud gaming among Netflix users and non-Netflix users

Questions: “Are you familiar with any of the following terms? If so, how familiar are you? Cloud gaming”; and “ Are you currently a user of any of the following services? Netflix”.

Despite the present lack of consumer awareness, cloud gaming is likely to become a more-significant part of the digital gaming market in the next 5 years and Netflix may play a role in raising that awareness.

Digital gaming is big business; Analysys Mason expects revenue to reach USD184 billion in 2022. Subscription gaming – the payment model upon which cloud gaming is based – is becoming increasingly popular, used by 43% of adult gamers in July 2023. Furthermore, Netflix users do not need to know what cloud gaming is to be willing to use it especially as there is no extra fee.

Netflix is aiming to target an underpenetrated area: casual gaming on the TV set and PC

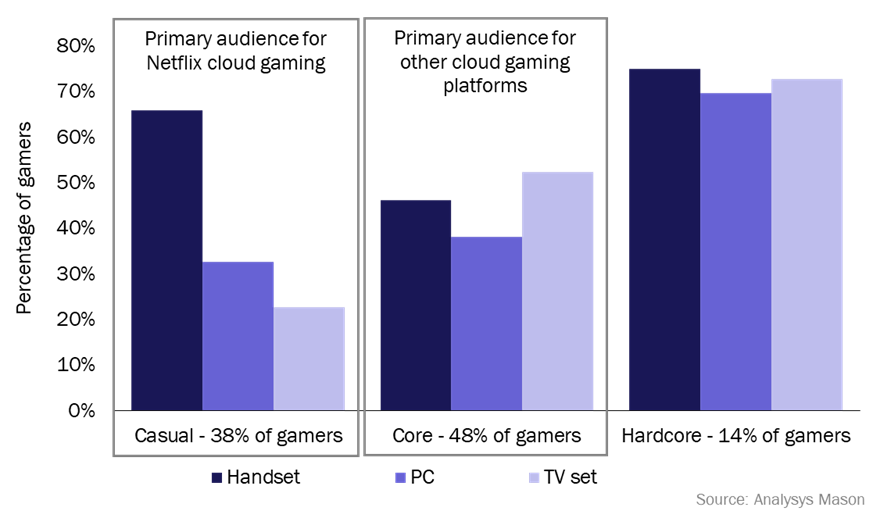

Netflix entered the digital gaming market in 2021 when it made mobile games available free to its streaming video subscribers. Its launch of cloud gaming aims to broaden the range of devices through which it engages gamers, extending from their existing mobile gaming base to gamers on TV sets and PCs.

Netflix’s focus remains on casual gaming – short, free-to-play sessions that have historically been predominantly played on mobile devices (Figure 2) – even though Netflix’s service will not be ‘free’, as such, simply ‘no extra charge’ for existing Netflix customers.

Figure 2: Devices that different segments of the digital gaming market use to play games

Questions: various. For more information, see Analysys Mason’s Segmenting the gaming market for telecoms operators.

Netflix’s established presence on PCs and TV sets offers an opportunity to shift casual gaming behaviour from mobile devices onto larger screens. This untapped market, which has few direct competitors, might be a key to Netflix’s success.

In contrast, Microsoft and Sony cater to core gamers, who are willing to pay for cloud gaming services even though they may not include the latest AAA-rated titles. Although these services are often consumed on PCs and TV sets (often via consoles), Netflix is not aiming to compete directly with these services. Cleverly, it targets casual gamers to enhance customer retention for its core streaming video service, to justify price hikes, and boost engagement on its existing platform. To Netflix, this is a value-added service, not a core service, much like streaming video is an important value-added service for Amazon, but not its core business

This strategy is more achievable than launching a standalone cloud gaming service for casual gamers, such as the aborted service Hatch, or legacy bundles of casual games that operators in France, for example, bundled alongside pay-TV services, often for a fee.

Operators may be unwitting partners as Netflix’s cloud gaming service arrives on their STBs, so they may as well embrace it

Netflix is focusing on cloud gaming on larger screens, which are also the preserve of operators’ pay-TV services. Its cloud gaming beta service is available on major streaming devices like Amazon, Google, Roku and Samsung smart TVs, but it is probably only a matter of time before it reaches operator set-top boxes (STBs) that integrate Netflix.

Reliable home Wi-Fi is crucial for cloud gaming. Buffering allows Netflix to overcome jitter and latency concerns for streaming video, but the quality of experience for cloud gaming applications is more sensitive to poor performance in these areas. If the issue is apparent on operators or pay-TV providers’ set-top boxes, then it is likely to be telecoms operators’ customer service teams that get the call for support, rather than Netflix.

Therefore, telecoms operators are likely to find themselves drawn into supporting such services indirectly. If Netflix increases engagement with cloud gaming among casual gamers and increases gaming engagement among this demographic on TV sets, in particular, it could also amplify engagement with affordable cloud gaming services like Prime Gaming from Amazon’s Luna platform, potentially increasing the demand for high-quality Wi-Fi connectivity at home. Netflix may succeed in bringing mass-market subscription gaming to pay-TV set-top boxes, something that several operators have previously failed to do.

Article (PDF)

DownloadAuthor

Martin Scott

Research DirectorRelated items

Tracker

Pay-TV quarterly metrics 2Q 2025

Article

Operators that want to reinvent their TV offers should learn from peers in the USA

Strategy report

Reinventing pay TV: lessons from US platform partnerships