Network investment remained high in 2022 while accelerated cost cuts mitigated inflationary pressure

Listen to or download the associated podcast

2022 was a challenging year for telecoms operators amid global inflationary pressures and increasing competition. This article reviews the performance for a sample of 13 large operators in a mix of high-income countries worldwide and, despite these economic challenges, their financial positions remained stable, with the average EBITDA margin and capex (as a percentage of revenue) remaining unchanged from 2021 at 32%–33% and 15%, respectively.

European operators’ revenue increased slightly in 2022 compared to 2021, and they also managed to cut down on operational expenses by reducing the number of employees as well as lowering capex following deacceleration of 5G and fibre build-out. In the USA and Asia–Pacific customer demand for operators’ services in both the mobile and fixed segments increased, which (in most cases) led to higher revenue. However, revenue growth for most operators was offset by high local inflation rates. Furthermore, capex rates remain high worldwide.

This article is based on Analysys Mason’s recently released operator financial KPIs (FinKPIs) dataset, which includes data updated to 2022.

Operators’ total revenue growth in 2022 was driven by several factors, including new subscribers

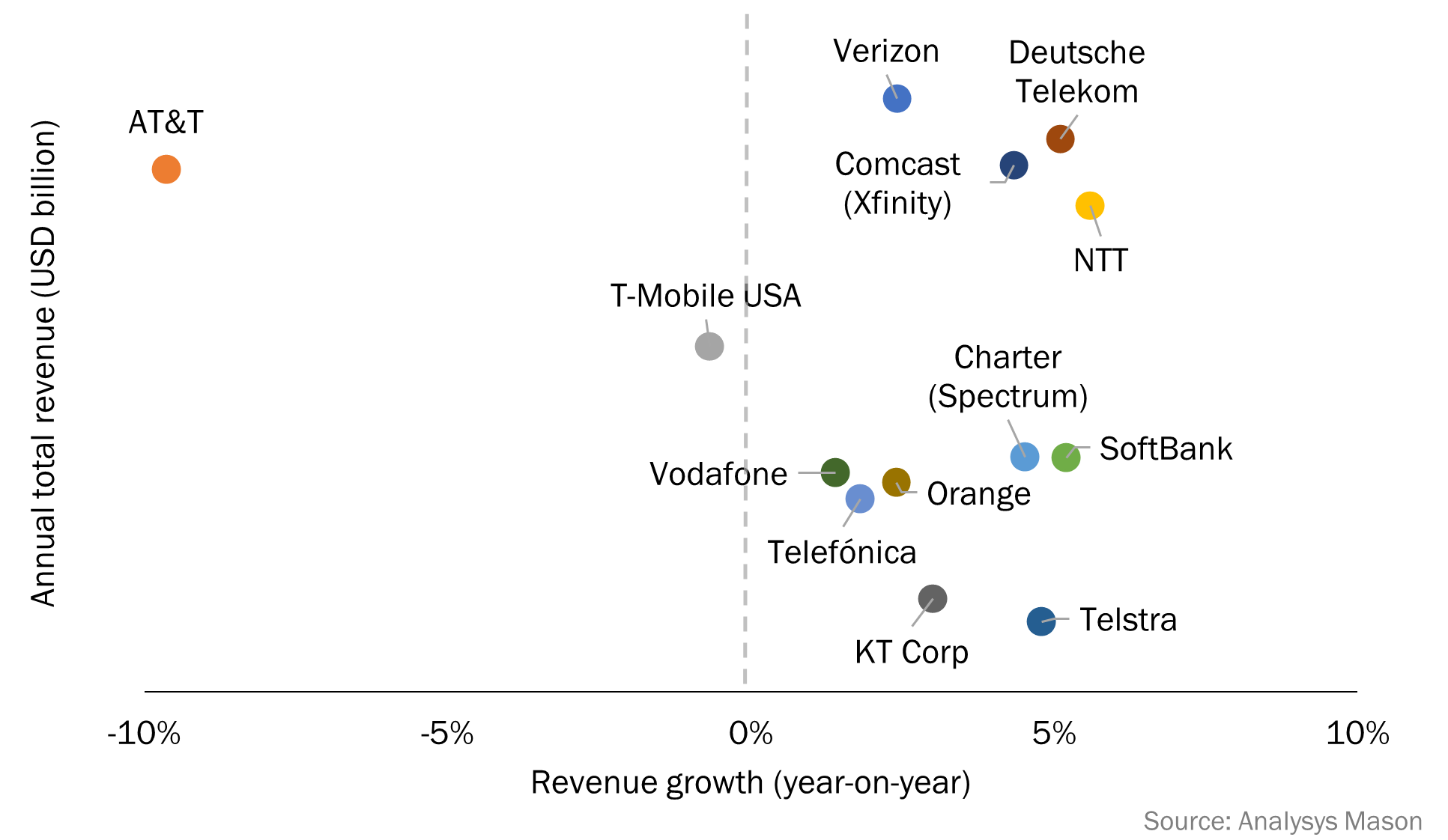

Figure 1: Operators’ total revenue, 2022, USD, and year-on-year revenue growth in local currencies, worldwide, 2021–2022

Figure 1 shows that European operators’ revenue has increased since 2021. However, inflation has been high in Europe, meaning that, in real terms, revenue has declined. The primary reason for the decline in revenue, in real terms, is that the telecoms markets in these countries are competitive and operators are facing several challenges including being pushed on price, they are unable to adjust for inflation and they are losing subscribers to challenger operators.

In the USA, all selected operators managed to grow their core telecoms service revenue, driven by an increasing number of subscribers as well as increased ARPU. As a result, most of these operators grew their total revenue year-on-year, with the two cable operators, Charter and Comcast, seeing the biggest growth. However, T-Mobile reported a slight decline in total revenue because of a fall in hardware sales, and AT&T’s revenue declined due after it sold Warner Media.

All selected operators in Asia–Pacific managed to increase their revenue in 2022. SoftBank’s revenue increased at a CAGR of 5.2% between 2021 and 2022. However, this increase in revenue was driven by mergers and acquisitions rather than organic consumer telecoms revenue growth, which declined due to falling ARPU. Conversely, Telstra and KT Corp managed to increase ARPU because of data higher demand for data in both the consumer and business sectors in their footprints. Meanwhile, NTT saw increases in revenue in the business segment as well as in equipment sales.

Some operators improved and/or maintained their EBITDA margins through cost cutting amid inflationary pressure

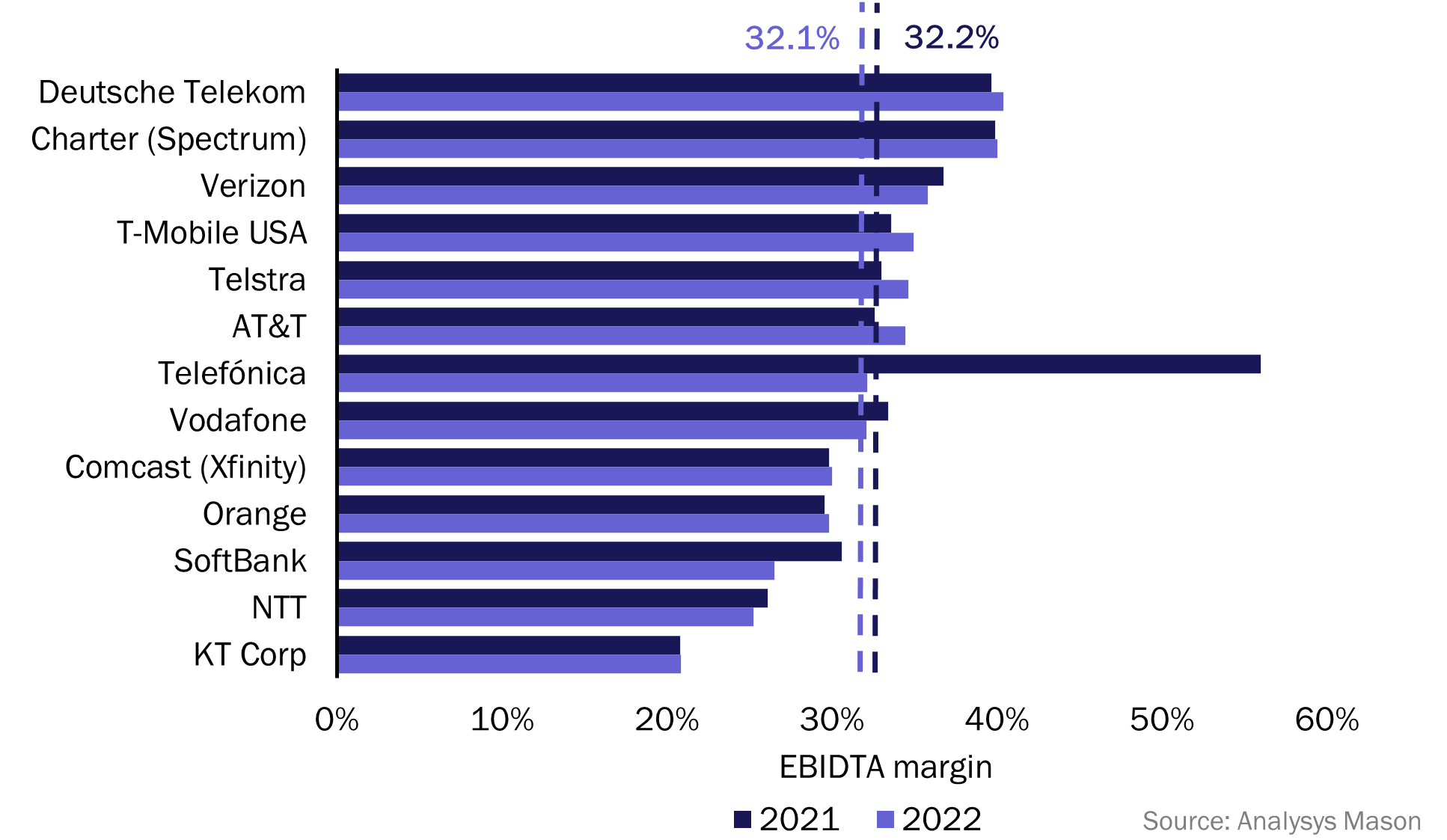

Figure 2: EBITDA margin, selected operators worldwide, 2021 and 20221,2,3

On average, the EBITDA margin of our sample group decreased from 32.2% in 2021 to 32.1% in 2022. However, 8 of the selected 13 operators managed to increase their margin. Amid the inflationary pressures in 2022, these results are surprising because operational costs (including labour and energy costs) should have increased.

Revenue, in real terms, for the two European operators, Deutsche Telekom and Orange, declined YoY, but their EBITDA margins increased as a result of cost efficiency programmes, which were driven by reducing the number of employees. Conversely, Verizon’s EBITDA margin declined but its revenue increased due to higher promotional expenses, a decline in its high-margin legacy wireline business and inflationary cost pressures.

5G and fibre roll-out continued to be the focus of capital spending

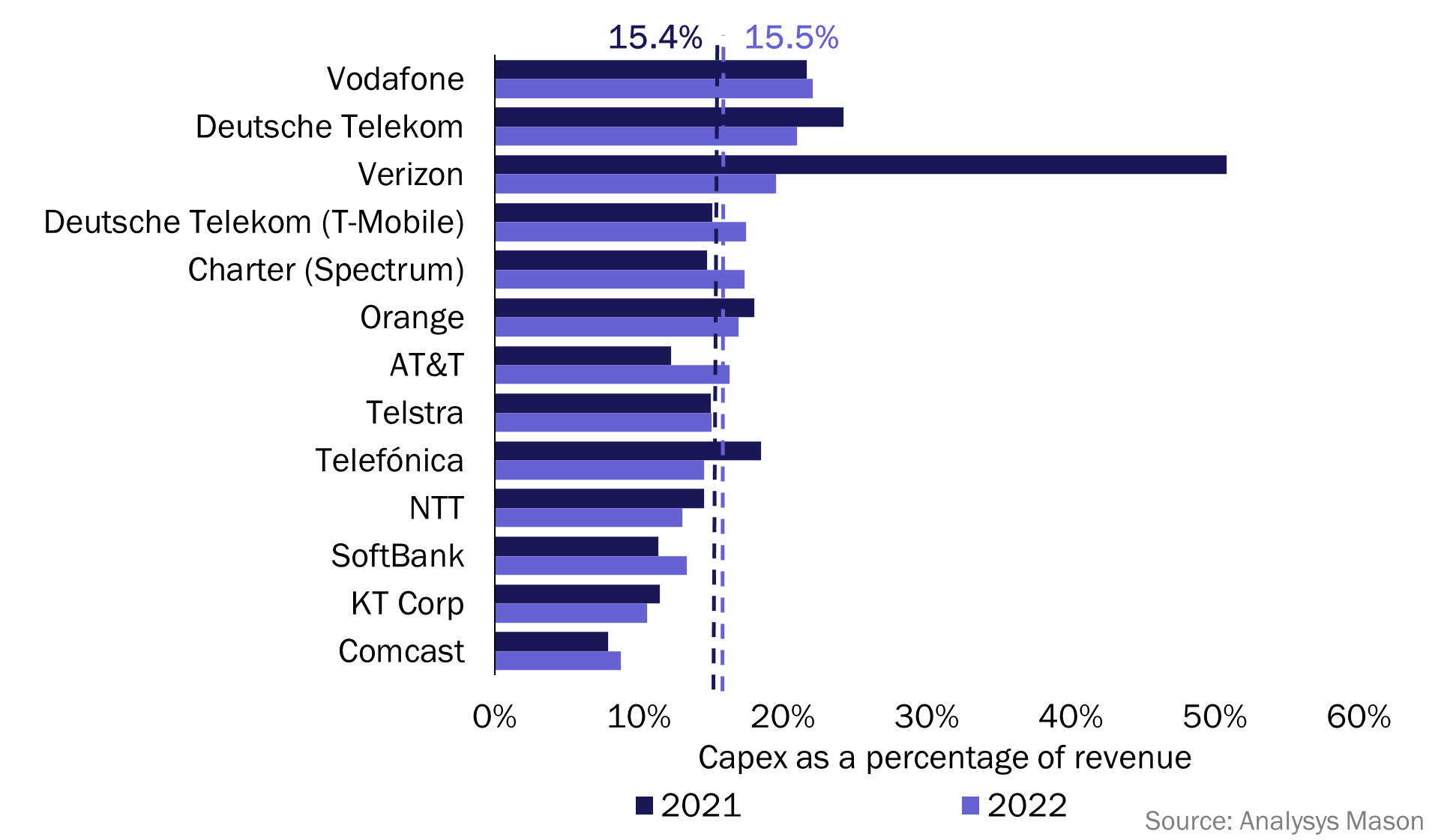

Figure 3: Capex as a percentage of revenue, and average capex as a percentage of revenue (indicated by dashed lines), selected operators, 2021 and 20224,5,6

On average, capex as a percentage of revenue remained stable between 2021 and 2022 at about 15.5%. Out of the 13 selected operators, 6 managed to reduce the capex percentage of revenue. Operators in Europe have been most successful in reducing capex as a percentage of revenue because 5G build-out is decelerating in the region now that 5G spectrum auctions are complete.

Similarly, fibre build-outs have reached an advanced stage in certain countries worldwide (for example, in France), which has helped to reduce fixed network capex. Conversely, mobile operators in the USA have accelerated their 5G build-outs following a mid-band spectrum auction held in 2022. This has resulted in an increase in capex as a percentage of revenue. Fixed operators Charter and Comcast also increased their capex amid their network upgrades/expansions.

Our sample group of telecoms operators have managed to successfully stabilise their financial position despite the financial pressures that they have endured during 2022. Although these operators have not managed to increase their revenue in line with local inflation rates, their EBITDA margins have remained stable, on average, through cost efficiency programmes.

1 Vodafone and Softbank’s results are from 1Q 2023. For more information, see Vodafone (May 2023), FY23 Results and SoftBank (10 May 2023), Consolidated Financial Report for the Fiscal Year Ended March 31, 2023.

2 Telefónica’s EBITDA is excluded from the average.

3 Telefónica’s significant decline in EBITDA margin in 2022 compared with 2021 related to the hyper-inflation in Argentina and Venezuela.

4 Vodafone and Softbank’s results are from 1Q 2023. For more information, see Vodafone (May 2023), FY23 Results and SoftBank (10 May 2023), Consolidated Financial Report for the Fiscal Year Ended March 31, 2023.

5 Verizon’s capex as a percentage of revenue is excluded from the average.

6 Verizon’s capex as a percentage of revenue was higher in 2021 due to the C-Band spectrum payment of USD45 billion in 1Q 2021.

Article (PDF)

DownloadAuthors

Qingyi Liang

Analyst