Operators’ cloud services revenue continued to grow in 2023 despite a slow-down in the market

Many operators that have invested in their B2B cloud services capabilities have seen consistent growth in revenue from these services since 2020. Some operators continued to report impressive revenue growth rates in 2023, despite a slow-down in the wider cloud services market. This article highlights a few operators worldwide and assesses their approaches to growing revenue in the B2B cloud services market.

The article is based on Analysys Mason’s Cloud service providers’ revenue tracker 2023.

Some operators reported impressive growth in cloud revenue in 2023

Cloud services are an important source of business revenue growth for operators. The following section highlights some examples of operators that have achieved strong growth rates in B2B cloud revenue and the specific areas they have focused on.

- Managed cloud services and consultancy support. Telstra’s cloud services offer includes Azure and AWS Managed Services, multi-cloud solutions and Microsoft SaaS implementation. In October 2023, it acquired Versent, a digital transformation consultancy, to enhance its cloud-led transformation capabilities. Telstra’s cloud revenue increased by 12% year-on-year in 2023. TIM also provides consultancy support for cloud services. It operates in the cloud market mainly through its ICT consultancy subsidiary, Noovle (acquired by TIM in 2020), one of the main partners of Google Cloud in Italy. In FY2023, TIM reported cloud revenue of EUR1 billion, which represents growth of 31% year-on-year.

- Multi-cloud solutions and business applications. Telefónica Tech made several acquisitions in 2021 and 2022 in areas of cloud computing, cloud managed services, business applications and digital transformation solutions (such as BE-terna and Cancom UK&I). It also established a partnership with Snowflake in September 2023 to improve its multi-cloud services that it offers in collaboration with major cloud service providers. Telefónica Tech achieved 24.1% revenue growth in its cyber-security and cloud segment in FY2023.

- Secure and sovereign cloud solutions for the public sector. Macquarie Telecom Group provides the Australian Federal Government and state governments with cyber-security, secure cloud and co-location services; it also provides sovereign cloud services via a partnership with VMware. It has reported consistent revenue growth in its Cloud Services and Government unit since 2020, including 11% in 2023 (down from 26% in 2022). Orange and Capgemini launched a joint venture Bleu in 2022, in collaboration with Microsoft, to provide the French government with sovereign cloud services. Bleu commenced commercial operations in January 2024. This adds another facet to Orange’s cloud portfolio, which was already enjoying modest growth. In FY2023, Orange reported revenue growth of 6.3% year-on-year in cloud services in its IT and Integration segment (slightly down from 6.6% in FY2022).

- Cloud infrastructure and AI. KT Cloud, a subsidiary of KT Corporation, reported revenue growth of 57% year-on-year in 2023 in its public cloud and international data centre (IDC) segments. It was established as a separate entity in February 2022 to improve the value of KT’s cloud business. Its main offerings include CloudFarm (hybrid cloud services), KCI (KT Cloud container instances) and Data Lake (big data platform). KT Cloud developed a partnership with Acornsoft to integrate its PaaS capabilities with KT Cloud’s IaaS technologies. KT Cloud aims to use this strategic partnership to support its expansion in the SaaS market. It is also keen to develop AI cloud capabilities. It announced the strategy AICT in April 2024, aiming to further incorporate AI in its Cloud and IDC services.

- Cloud infrastructure and public sector services. China Telecom reported growth of 67.9% year-on-year in its cloud revenue in 2023, which was higher than that of other large cloud service providers in the local market (such as Alibaba and Tencent). It also has the highest share of cloud services revenue of the three telecoms operators in China. Its cloud revenue primarily comes from IaaS, but it is now expanding into the PaaS and SaaS markets. Its state-owned nature has also helped it secure numerous large contracts in the government, construction and energy sectors.

Cloud service providers’ revenue growth has slowed down and telecoms operators are no exception

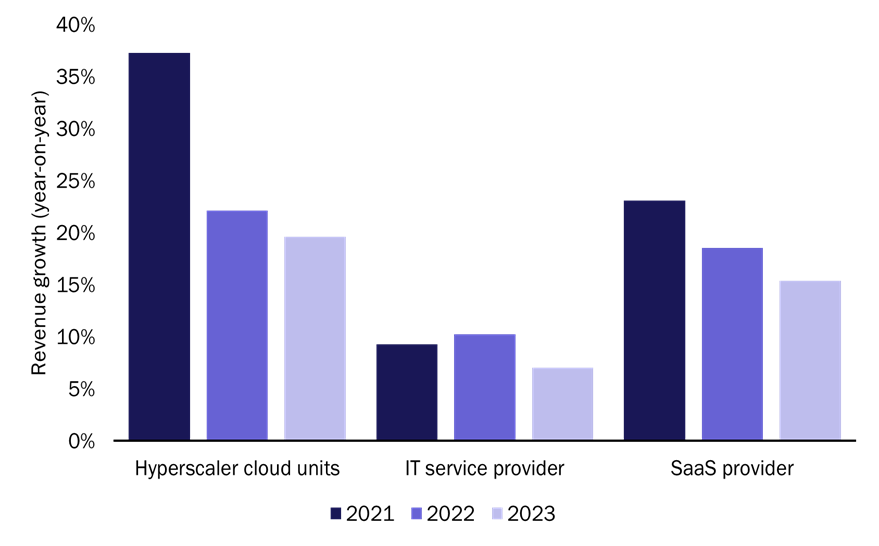

Cloud service providers’ revenue growth rates are generally declining (Figure 1), as captured in our Cloud services revenue tracker. In 2023, AWS, Azure and GCP had an average revenue growth of 19%, which was 10 percentage points lower than in 2022. The revenue growth rate also decreased for IT service providers and SaaS providers to a lesser extent. Telecoms operators that disclose their cloud revenue consistently also reported a similar trend. AWS attributed this decline in its 2023 annual report to ‘substantial cost optimisation, with most companies trying to save money in an uncertain economy’. However, it does not expect this downturn in cloud revenue to continue in the long term. AWS reported in late 2023 that the number of cloud migration deals was increasing again.

Figure 1: Revenue growth rates, by type of service provider, worldwide, 2021–2023

Operators should continue to enhance their cloud capabilities to benefit from the increasing demand

Despite the falling growth rates, operators should continue to invest in improving their cloud services because it is likely to contribute more incremental revenue growth than many other types of B2B services (apart from cyber security and IoT). Operators worldwide recognise the importance of expanding in the cloud market. According to Analysys Mason’s Business-services-related M&A tracker 2017-2023, cloud-related acquisitions were the most common acquisition type in 2022 and 2023. Cloud consultancy and managed service companies were popular acquisition targets, suggesting that operators are focusing on improving professional and managed services support.

There is no ‘one-size-fits-all’ approach for operators to grow in the cloud market. Operators must tailor their approaches to align with their capabilities and the local market context. Operators with strong capabilities in some areas should capitalise on this to support further expansion into other areas (for example, KT Cloud and China Telecom expanding into SaaS and PaaS). Others can use partnerships to strengthen their cloud services portfolio or can improve their professional and managed services to meet the evolving demands.

Article (PDF)

DownloadAuthor

Dongye Liu

Research AnalystRelated items

Article

KDDI’s results demonstrate the challenges of entering new markets such as energy and finance

Strategy report

Strategies for telecoms operators to evolve their network-as-a-service (NaaS) propositions

Tracker

Cloud service providers' revenue tracker 2024