Operators should consider partnering with hyperscalers to improve capex efficiency

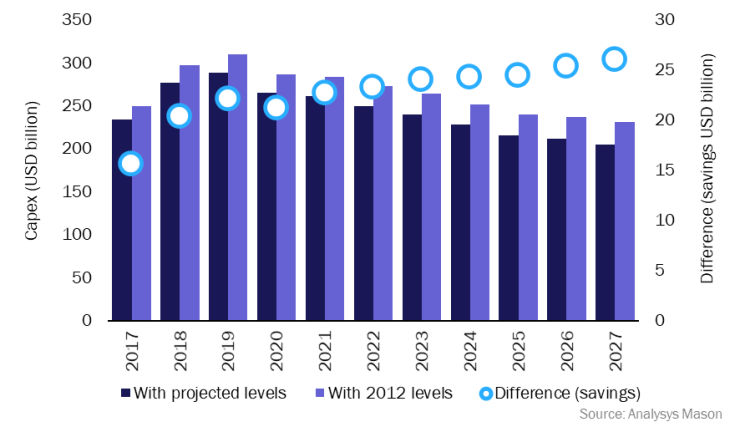

Operators are in a period of high capital expenditure (capex) because of the convergence of two capex-intensive cycles: 5G and fibre. 5G will involve unparalleled network investments, especially as operators migrate to 5G standalone (SA) architecture, which requires the roll-out of additional sites as well as investment in core and cloud infrastructure. Telecoms capex will grow until 2023, but operators can no longer shoulder the burden alone. They need to establish co-investment partnerships to help relieve this capex pressure. Operators can save USD249 billion cumulatively between 2017 and 2027 by sharing the capex costs of new network deployments with partners (see Figure 1).

This article provides an overview of the key insights from our report 5G capex: co-investment models for telecoms operators, which provides a detailed assessment of the telecoms partnership landscape.

Figure 1: Telecoms capex by level of sharing compared to 2012 standard of sharing, and difference in capex savings because of partnerships, worldwide, 2017–2027

Operators have multiple partner options, and some of these are relatively well established.

- Competitive operators. Agreements are established with competing operators to co-construct and share fibre or 5G networks.

- Wholesale. In this type of partnership, operators rely on wholesale providers for network elements such as fibre or cell towers.

A more-diverse array of companies has recently shown interest in developing telecoms networks.

- Non-operator partners. Co-investment is sought with players in other industries (for example, energy utilities).

- Adjacent sector partners. Operators co-invest with partners from sectors closely associated with the telecoms industry, such as TV and cloud providers.

Notably, hyperscalers1 are increasing their involvement in the telecoms market.

Hyperscalers represent a new co-investment partner for operators

Over 34 partnerships have been established between operators and public cloud providers (PCPs) as of July 2021.2 PCP partnerships present operators with an opportunity to gain a competitive edge as they begin to migrate their networks to the cloud. Operators can use third-party cloud infrastructure to support cloud-native networks to reduce capex associated with building their own clouds. For example, Dish Network, a service provider in the USA, will run some of its virtualised RAN on Amazon Web Services’ public cloud.

In addition, operators can take advantage of PCPs’ network-centric tools and services to enhance their own network capabilities. These services include open cloud platform-as-a-service (PaaS), edge computing, network function virtualisation (NFV) and artificial intelligence/machine learning (AI/ML) analytics. Deploying these advanced capabilities ahead of competitors can help operators to differentiate their services and generate additional revenue.

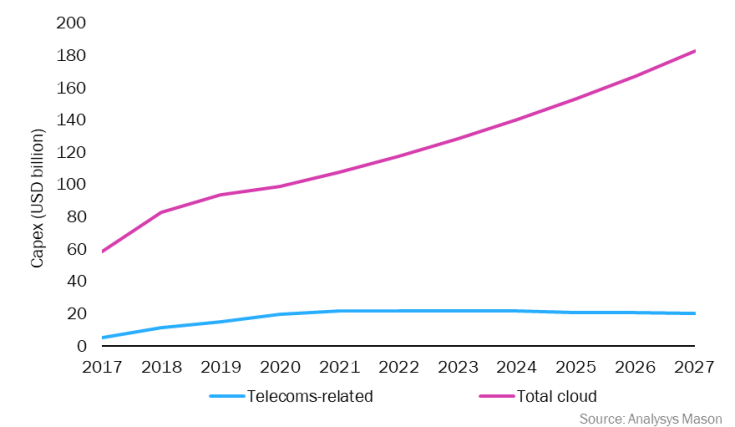

Hyperscalers are expected to become more involved in the telecoms industry as operators migrate their networks to the cloud. This means, for example, that a significant proportion of PCP capex will be dedicated to telecoms-related investments (see Figure 2).

Hyperscalers are investing directly in network roll-outs and connectivity primarily to fill the gaps in areas that operators have yet to reach. For example, Facebook is providing financial support to Nayatel for the roll-out of fibre in Islamabad, Pakistan. This is an example of the mutual benefits of a collaborative relationship in which a hyperscaler partners with an operator rather than entering into direct competition.

Hyperscalers are also investing in subsea cables3 to improve global connectivity in less-developed regions and to increase the accessibility of their services. For example, Google is constructing Firmina, a subsea cable that will connect Latin America and the USA. This venture is prohibitively expensive for many operators, but once construction of the subsea cable is complete, operators will be able to benefit from increased network capacity.

Figure 2: Public cloud provider capex by type, worldwide, 2017–2027

Operators should seek out hyperscaler co-investment to achieve capex efficiency

Operators should treat the entry of hyperscalers into the telecoms space as an opportunity to improve capex efficiency and network capabilities, and to scale up their new networks more rapidly than they could otherwise do alone. In most cases, these new investors will not be seeking to challenge established operators in their core business but will be targeting a role in a value chain that is being transformed by cloudification.

The global influence of hyperscalers could be highly beneficial for operators. Indeed, if operators do not expand their partnership ecosystem, they may limit the potential to differentiate their services cost-efficiently.

Operators must balance the benefits of hyperscaler partnerships with the risk of losing control of the network

Hyperscalers’ global presence, economic influence and adjacent position to the telecoms industry have raised questions about whether these companies will enter the telecoms networks market directly. If so, operators risk losing their market leadership. However, hyperscalers are not access network operators, and at present, show no desire to take on this role.

The critical concern is that operators must ensure that they retain control of the network, especially its quality, when they migrate the network to the cloud. AT&T's decision4,5 to outsource its 5G core network to Microsoft Azure is a landmark decision and provides an example of a future role that hyperscalers may take to support telecoms networks. AT&T will benefit from Azure's cloud expertise and scale, and will target improved QoS, as well as aiming to reduce costs. However, this partnership means that AT&T having less influence in the running of the network. This might offer AT&T the freedom and additional funds to improve other areas of its business, but it leaves the company at risk of losing control of a critical asset. Operators must weigh up these risks and benefits when considering partnerships with hyperscalers.

Partnerships of any nature carry risks, and operators will have to juggle stakeholders’ interests alongside the loss of some network autonomy. Operators need to set limits on these partnerships, particularly in relation to the influence that the hyperscalers may have on network operations, to ensure that co-investment is mutually beneficial, and to safeguard operators’ valuable role in the cloudified value chain. Partnerships can help operators to reduce capex expenditure and to achieve a higher ROI in 5G compared to a fully standalone deployment.

1 A hyperscaler refers to a company that offers networking, cloud and internet services with an established data centre footprint. In the context of this article, we are primarily referring to public cloud providers. Facebook, an atypical hyperscaler because it does not provide public cloud services, is also investing in the telecoms industry.

2 Further information is available from Analysys Mason’s Public cloud provider and CSP partnership tracker.

3 For more information, see Analysys Mason’s Submarine cables: opportunities for operators in Africa.

4 For more information, see Analysys Mason’s AT&T and Microsoft Azure’s deal is a major milestone for the adoption of public cloud stacks for 5G networks.

5 For more information, see Analysys Mason’s Cloud migration will enable vendors to increase their revenue from operators, even while capex falls.

Article (PDF)

DownloadRelated items

Case studies report

Telecoms operator opex reduction strategies: case studies and analysis (North American operators)

Podcast

The end of big capex in telecoms: causes and implications

Case studies report

Telecoms operator opex reduction strategies: case studies and analysis (pan-European operators)