Operators’ investments in advanced 5G connectivity must enable a broad range of applications

Listen to or download the associated podcast

Operators will struggle to generate new revenue streams from 5G without investing in advanced RAN capabilities such as ultra-low latency. However, the business case for advanced 5G services is still unclear, so investment is risky.

Emerging advanced 5G use cases such as robotics have diverse and demanding connectivity requirements and distinct value chains. This disrupts the traditional economies of scale of the established generic mobile broadband model.

This article is based on our report, The impact of new applications on 5G RAN strategies, which recommends strategies for operators that intend to differentiate their 5G services based on KPIs that are enabled by advanced RAN capabilities, such as very high quality of service. Operators must prioritise RAN capabilities that support a wide range of markets and use cases in order to mitigate the risk of a fragmented commercial landscape and to enable flexible support for emerging opportunities. Investment in such capabilities is crucial to maximise return on investment (RoI).

Revenue opportunities from advanced 5G applications are fragmented and their size is uncertain

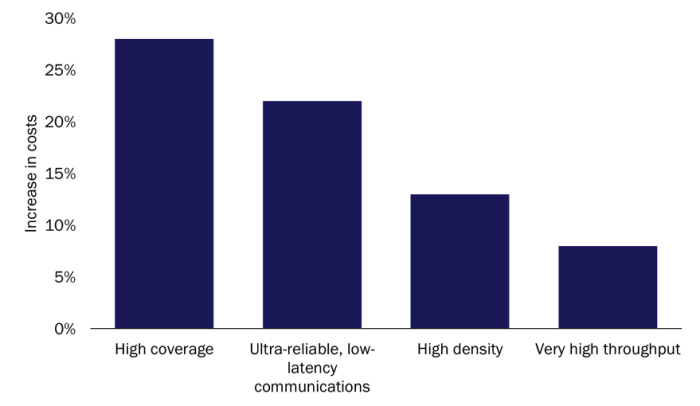

Approximately one third of operators aim to have established new revenue streams enabled by a highly differentiated 5G RAN by 2026. However, implementing RAN-centric differentiators will add significantly to the cost of building and optimising a 5G network (Figure 1), and the magnitudes of the associated revenue opportunities are unclear (apart from for a few applications such as cloud gaming1). These magnitudes will often not become apparent until after the window for an operator to gain an edge in addressing users’ requirements has closed. This means that operators who choose to differentiate using advanced RAN capabilities will have to deal with the risk of investing before the business case for new services is clear. This is unlike the traditional mobile business model, which has historically been centred on best effort connectivity built at a large scale.

Figure 1: Average increase in RAN deployment costs over 10 years when supporting advanced 5G RAN capabilities compared to enhanced mobile broadband only

Source: Analysys Mason, 2021

There is also no single ‘killer app’ for 5G. We profiled 19 operators and found that together, they are trialling over 200 5G-specific applications. The business model will lack scale and risk being unprofitable and fragmented if each of these applications has to be developed individually, with its own set of partners.

Identifying broad categories of applications and services to focus on will mitigate risk

Operators are in the process of selecting a small number of 5G applications to deploy and support. They must identify broad categories of applications with common characteristics in terms of RAN requirements to ensure that they can support the widest range of applications with minimal investment. Figure 2 shows the seven categories that account for 95% of 5G use cases; AR/VR, sensors with AI and drone control/unmanned automated vehicles (UAVs) account for the most. Investing in capabilities to address the RAN requirements of applications in these categories will enable operators to provide many applications in a common, scalable way. This also allows operators to use their expertise in connectivity while increasing the value of that connectivity to enterprises, partners and wholesale customers.

Figure 2: Selected applications within the main categories that have been deployed or trialled by the 19 operators profiled

| Application category | Selected applications |

|---|---|

| Robotics | Mobile and dynamic factory robots, remotely controlled elderly care robots, autonomous field robots, precision farming, virtual kayaking robotics, COVID-19 cleaning robots and automated construction robotics. |

| AR/VR | Immersive gaming and content, immersive e-sports, digital twins, industrial training, VR learning, VR medical training, 5G video social experiences, interactive reading, AR for operations support, VR for live video streaming, AR in-store retail experiences, VR for virtual property visits and visualisation of new developments and remote control with AR overlay. |

| Sensors with AI | Smart city applications (such as smart lighting), waste management, transport, smart grid, traffic safety (such as collision avoidance and connected bike helmets), smart meters and water pipeline monitoring. |

| Image and vision | Factory control, automated driving, smart surveillance (facial recognition and traffic flow analysis), industrial vision, smart CCTV and machine vision. |

| UAVs | Drone-based delivery, infrastructure monitoring and emergency response, inspection drones, unattended factory vehicles and driverless vehicles, automated container transport in ports, co-operative AGVs in a production line and automated train control. |

| AI diagnostics | Remote healthcare, remote surgery, veterinary services and preventative engine or infrastructure maintenance. |

| 5G positioning | Emergency response (locating victims), drone tracking, connected ambulances, warehouse locators and personal emergency response systems. |

Source: Analysys Mason, 2021

Operators must identify broad categories of services with established demand across multiple sectors and applications to mitigate the risk of reduced economies of scale. Each category must support applications that are sufficiently valuable to justify a user paying extra for them. Studying what other operators are investing in can be useful. For example, our detailed case studies show that AR/VR solutions are foundational to 33% of the 5G applications under consideration by 19 operators that are commercially deploying non-mobile broadband 5G services. AR/VR is very adaptable and is appropriate for a variety of verticals and services such as gaming and training.

Operators can maximise their RoI by building channels and partnerships to reach many industries and value chains

Some advanced operators will adopt emerging solutions such as cloud-based RAN, service platforms and slicing in order to pursue new revenue and mitigate investment risks. However, this will be too ambitious for most operators, so they must instead focus on maximising the monetisation of their key area of expertise, the RAN. Operators expect that extended coverage, edge compute integration and indoor quality of experience will be the biggest areas of new investment in the RAN. The amount of RAN spending dedicated to generating new business is expected to rise from 7% in 2017 to 20% in 2027.

Ultra-reliable, low-latency communication (URLLC) is one example of an advanced 5G RAN capability that will support a wide range of applications and industry sectors. URLLC is complex to implement and optimise, but it enables many advanced user experiences that can deliver benefits for a range of industries and consumer applications such as immersive gaming. RAN has the biggest effect on latency and is responsible for 70–80% of the round-trip time. Enabling URLLC will potentially increase the average cost of ownership by 15% compared to a non-optimised RAN and these costs will need to be justified by the revenue, customer loyalty and market share that may result from highly differentiated user experiences and quality of service guarantees.

Implementing multiple advanced capabilities together can produce synergies in terms of network differentiation, which can magnify the benefits compared to investing in just one. For example, extending network coverage and density would complement URLLC, enable new applications and provide cumulative benefits.

In conclusion, operators should mitigate the risks of fragmentation and uncertain revenue potential by identifying broad categories of services with proven demand, rather than individual applications. They must then invest in enabling categories of advanced 5G services that have broadly the same RAN requirements, and which complement each other, thereby increasing the RoI.

1 For more information, see Analysys Mason’s 5G mobile services: case studies and analysis.

Article (PDF)

Download