Operator Wi-Fi strategies will become more important as fibre and 1Gbit/s speeds become commonplace

Listen to or download the associated podcast

Two thirds of premises worldwide will have access to gigabit-capable downstream bandwidths, and some countries, such as France and Spain, will have near-ubiquitous fibre coverage, by 2028. Fixed broadband operators have fewer opportunities to differentiate their tariffs by headline download speeds.

Moreover, as gigabit and multi-gigabit download speeds become more common, customers’ home Wi-Fi networks are becoming a bottleneck for improved customer experience due to low throughput and poor reliability.

Therefore, operators are increasingly focusing on home Wi-Fi services to avoid price-based competition and improve customer satisfaction. They have also begun to offer other services that build on, or complement, their existing Wi-Fi offerings. We refer to these services collectively as connected home services and have identified three categories of operator offerings: improved home Wi-Fi, smart home services and additional Wi-Fi functions (Figure 1). These categories are not mutually exclusive, and operators have developed connected home offerings that combine all three.

Figure 1: Examples of connected home services in each category, 2023

Most operators have integrated improved home Wi-Fi offerings with their fixed broadband tariffs

Improved home Wi-Fi refers to services that enhance aspects of customers’ Wi-Fi connectivity, such as throughput, coverage and reliability. This is most commonly achieved by offering premium Wi-Fi routers, with Wi-Fi 6 capabilities, and Wi-Fi mesh access points. Many operators, such as Telefónica and BT, have invested in developing their own branded routers and mesh access points. Although, the continued availability of off-the-shelf Wi-Fi solutions from vendors, such as Plume’s SuperPods, means that smaller operators are able to incorporate home Wi-Fi into their broadband offerings with little upfront cost. For example, a number of challenger UK internet service providers (ISPs), such as Rebel Internet and Pine Media Communications, offer Plume’s SuperPods to their fixed broadband customers.

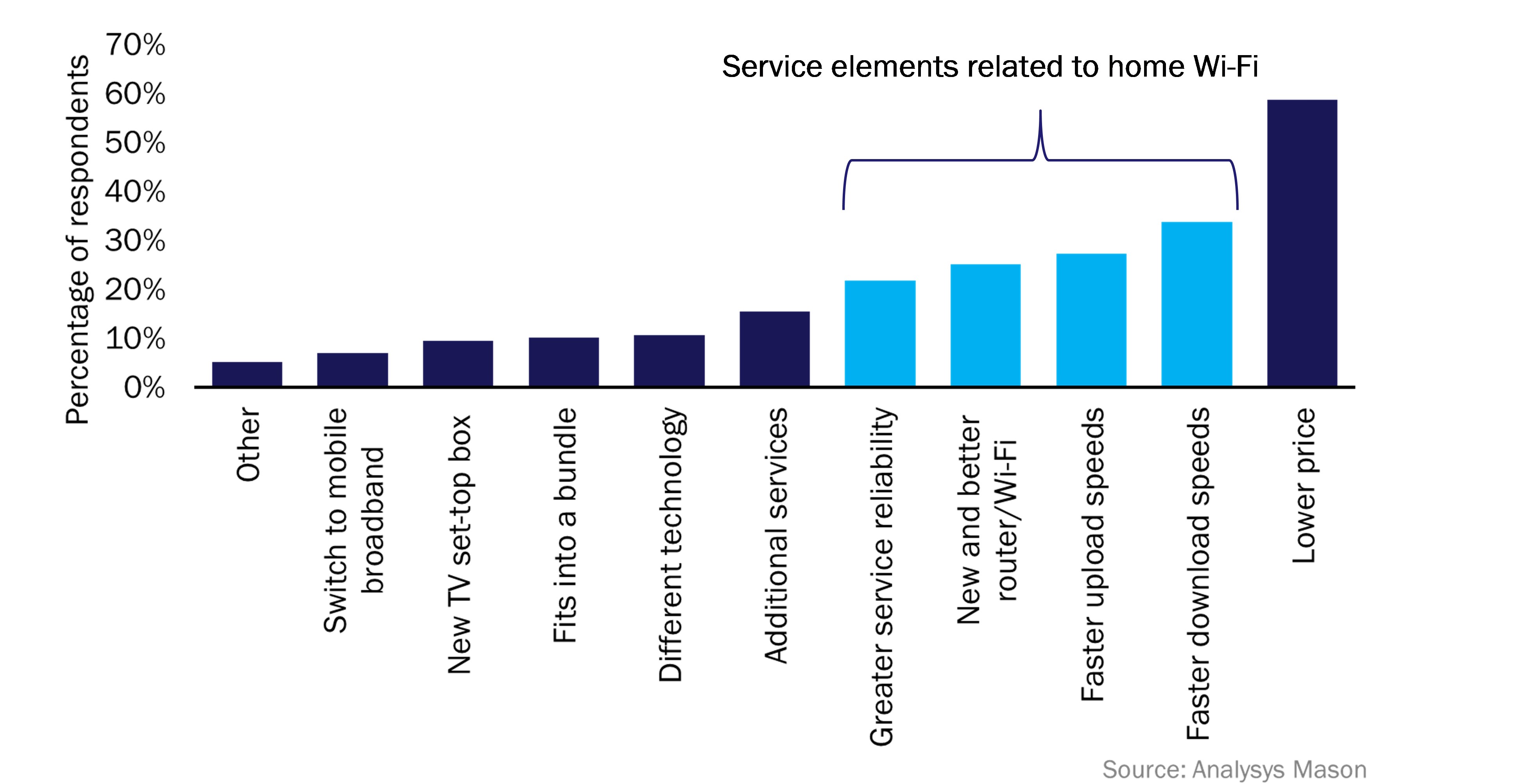

Data from Analysys Mason’s 2022 consumer survey suggests that a significant share of consumers value home Wi-Fi. Figure 2 shows that, after price, service elements related to home Wi-Fi such as download speed and reliability, were the most commonly cited factors that would attract survey respondents to a new broadband plan. Moreover, offering premium Wi-Fi hardware has a strong positive impact on customer satisfaction. Regression analysis shows that bundling additional Wi-Fi units in fixed broadband tariffs has the strongest impact on fixed broadband Net Promoter Score (NPS) out of all services and equipment that survey respondents bundled with fixed broadband.

Figure 2: Service elements that would attract respondents to new fixed broadband plans, 2022

Question asked: ‘Which one of the following factors would most attract you to a new fixed broadband package? / How could your current fixed broadband plan be improved?’ ; n = 17 122 respondents

Therefore, improved Wi-Fi services can differentiate fixed broadband services and improve customer satisfaction. However, this strategy does not create opportunities for operators to generate revenue from new services. It is also easily replicable by other operators and competes with Wi-Fi mesh solutions that can be purchased directly from vendors.

Operators can leverage their Wi-Fi CPE to aggregate third-party smart home solutions

Smart home services relate to consumer IoT devices with home automation and surveillance capabilities. Operators, such as Deutsche Telekom, have offered consumer IoT services for the past decade and have experimented with a variety of retail strategies. Many operators attempted to offer consumer IoT services across multiple segments as standalone solutions, but a lack of demand has forced them to narrow their attention to one or two segments.

Nonetheless, many operators integrate smart home services into their fixed broadband services. Indeed, some operators leverage their Wi-Fi customer premises equipment (CPE) as platforms for aggregating third-party smart home solutions.

For example, Deutsche Telekom has developed its HomeOS suite of APIs, which act as a communication layer between its CPE and third-party devices. This enables Deutsche Telekom to create new use cases for third-party solutions. Using Wi-Fi CPE to aggregate smart home services plays to operators’ strengths as it allows them to leverage their existing assets and avoid directly competing with smart home vendors.

The fact that demand for smart home solutions is often unpredictable means that strategies that are flexible and allow operators to incorporate solutions from different vendors are often the most successful. Operators can leverage their existing capabilities in Wi-Fi to achieve this.

Additional Wi-Fi functions that are nascent can differentiate operators’ fixed broadband tariffs

Additional Wi-Fi functions are software functions provided over operators’ Wi-Fi CPE. Some of these functions are well established. For example, many operators, such as Comcast and Liberty Global, offer parental control features which include the ability to turn Wi-Fi connectivity off for specific devices.

Other Wi-Fi functions are more nascent. It is possible to provide motion sensing solutions over Wi-Fi hardware. This technology has home security and wellbeing monitoring use cases, but few operators offer Wi-Fi motion sensing to their fixed broadband customers. Nonetheless, Plume’s Wi-Fi mesh access points do have Wi-Fi sensing capabilities.

Additional Wi-Fi functions can add value to operators’ fixed broadband propositions. However, as the market develops, certain functions can be replicated by other operators. Functions such as cyber security and parental controls are commonplace in developed markets and therefore do not differentiate one operator’s services relative to others’. Operators that adopt nascent functions early will gain the most from this strategy.

Like smart home services, additional Wi-Fi functions enable operators to leverage their Wi-Fi capabilities to differentiate their fixed broadband tariffs with services other than connectivity. Indeed, Wi-Fi is an integral part of each of the categories of operator connected home services identified above, as well as being a part of operators’ will to continue to develop their Wi-Fi offerings as competition in fixed broadband markets grows.

Opportunities for fixed broadband operators in the connected home is a key theme for Analysys Mason’s research in 2023 and we will publish a number of reports on this topic in the coming months.

Article (PDF)

DownloadAuthor

Martin Scott

Research DirectorRelated items

Podcast

What is 'best practice' for broadband customer retention?

Article

KDDI’s results demonstrate the challenges of entering new markets such as energy and finance

Forecast report

Fibre conversion: worldwide trends and forecasts 2024–2030