Operators in MENA risk missing out on revenue growth opportunities from cloud services

17 March 2021 | Research

Article | PDF (3 pages) | Middle East and Africa Metrics and Forecasts| SME Services| Enterprise Services

Operators in the Middle East and North Africa (MENA) have expanded their ICT portfolios to capitalise on the growing demand for cloud services and offset the slow revenue growth of core telecoms services. However, many businesses perceive that operators’ cloud offerings have limited features and are expensive, and that their sales and support processes are not well-designed for cloud service delivery.

Operators need to act quickly to increase their role in the buoyant cloud ecosystem by offering differentiated cloud services and strengthening their partnerships with hyper-scalers. Operators that fail to do that will risk missing out on revenue-growth opportunities.

Business demand in MENA is shifting from co-location and hosting to public cloud services

Telecoms operators in MENA are keen to increase their share of the growing cloud services market to offset the stagnating revenue from core telecoms services. However, increased competition and the changing demands from businesses are threatening their growth ambitions.

For years, large businesses have co-located their servers in third-party data centres or used fully managed hosting services (also known as private cloud). Telecoms operators account for a sizeable share of the market but are being challenged by a growing number of players including managed service providers (MSPs), such as eHosting DataFort and Shabakah, and data-centre services specialists, such as Equinix and Khazna.

Many large enterprises have moved some of their applications, computing and storage resources to the public cloud (using internet-as-a-service (IaaS), platform-as-a-service (PaaS) and software-as-a-service (SaaS) delivery models) because of concerns about security and governance, and hyperscale players have established a presence in the region. Small and medium-sized enterprises (SMEs) are considering migrating their on-premises IT infrastructure and are increasingly adopting SaaS solutions. Businesses see public cloud services as a way of reducing costs, simplifying deployments and increasing functionality.

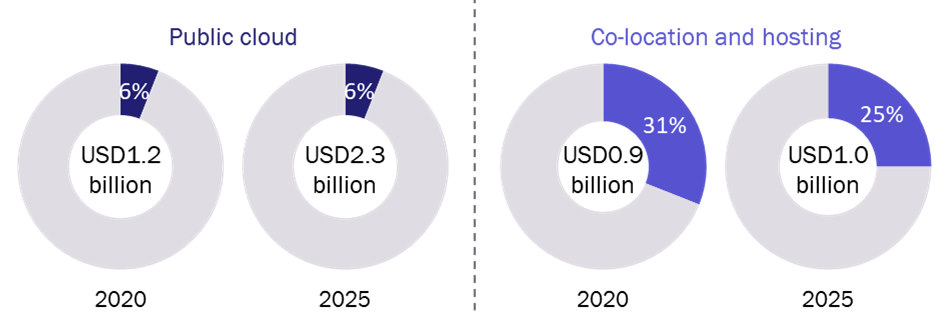

Telecoms operators risk missing out on revenue growth opportunities in cloud services. We forecast that the total addressable market for co-location, private and public cloud services in MENA will increase at a CAGR of 10% between 2020 and 2025. Revenue from public cloud services will double during that period while co-location and hosting will grow at 2% CAGR (see Figure 1).

Figure 1: Total addressable market for co-location and hosting, and public cloud, and operator shares, Middle East and North Africa, 2020 and 2025

Source: the Analysys Mason DataHub

Operator growth in the cloud market is hindered by a legacy operating model and poor customer perception

Operators suffer from a negative perception when serving businesses. The latter are reticent to select operators as their primary cloud service providers because they regard operators as:

- expensive

- lacking in qualified pre-sales teams

- overly reliant on legacy sales and delivery models

- having inadequate customer support.

Many enterprises prefer to deal with their incumbent IT or managed service provider to serve their cloud needs. Global hyper-scalers, such as AWS, IBM, Microsoft and Oracle, have built a strong presence in MENA. AWS has a regional centre in Bahrain. Microsoft and Oracle each have two data centres in the UAE and Oracle plans to build two in Saudi Arabia in 2021. Most of them sell directly to large enterprises or use MSPs to serve the local market. Only a few, like Microsoft, have strong ties with the local telecoms operators.

Operators should use their competitive advantages to offer a differentiated cloud proposition

Operators have many options for how to position themselves in the cloud market. Those in the region with extensive cloud portfolios have mostly adopted a managed hybrid cloud approach to serve local businesses. They combine public cloud services from third parties (such as Azure or local providers) with their own data centre services, which include co-location, dedicated or private cloud (see Figure 2).

Figure 2: Examples of operator partnerships with hyper-scalers, Middle East and North Africa

| Operator | Partnerships |

| Etisalat | We understand that Microsoft hosts its Office 365 and Azure services in Etisalat’s data centres in the UAE. Etisalat also has partnerships with AWS and Oracle. |

| Omantel | We understand that Microsoft’s cloud services are hosted in the data centres of Omantel’s subsidiary Oman Data Park (ODP). Omantel also offers SAP’s Business One ERP SaaS application. |

| stc (Saudi Arabia) | stc aggregates services from mostly local players (such as Bluvalt) that offer business SaaS, IaaS, and PaaS solutions. It does not offer Azure services. |

| Telecom Egypt | Telecom Egypt hosts Microsoft’s cloud point-of-presence (PoP) in its data centre. |

Source: Analysys Mason

Operators can do more to differentiate their cloud offerings from those offered by generalist service providers. They can offer a one-stop-shop experience to address businesses’ connectivity and cloud service needs with a unified pricing model. They can also develop professional services capabilities (like Etisalat Digital in the UAE) or work with professional services companies (like Ooredoo did with Wipro) to deliver consulting and support services to support businesses during their cloud migration. Operators are highly regulated and are therefore in a better position than global hyper-scalers to offer services in sectors with high entry barriers such as health, education and finance.

Operators could do more to capitalise on established relationships to deliver end-to-end solutions to these verticals. They could also combine public cloud, their internal proprietary cloud and their network management capabilities to offer integrated and differentiated propositions.

Operators can also improve their attractiveness to global cloud players that are looking to establish a local point-of-presence. Operators can provide service quality and security guarantees to their end customers and comply with regulations. Those that have invested in building data centres and expanding their connectivity infrastructure can even become national or regional cloud brokers or aggregators.

More importantly, operators need to develop internal capabilities to better advise enterprises on the different cloud options that they offer and guide them through that transition. They should also review their operating model to ensure that the customer experience is comparable to that provided by MSPs and other cloud providers in terms of sales, customer care and billing. Combining these capabilities with their competitive advantages (that is, infrastructure, relationships with businesses and industry partnerships) should help them to play a more central role in the fast-moving cloud market.

Article (PDF)

DownloadRelated items

Strategy report

Strategies for telecoms operators to evolve their network-as-a-service (NaaS) propositions

Tracker

Cloud service providers' revenue tracker 2024

Article

Nigeria will experience strong growth in telecoms service revenue in 2025, after price increases were approved