Operators should invest in their cloud portfolios to benefit from demand for emerging services

Listen to or download the associated podcast

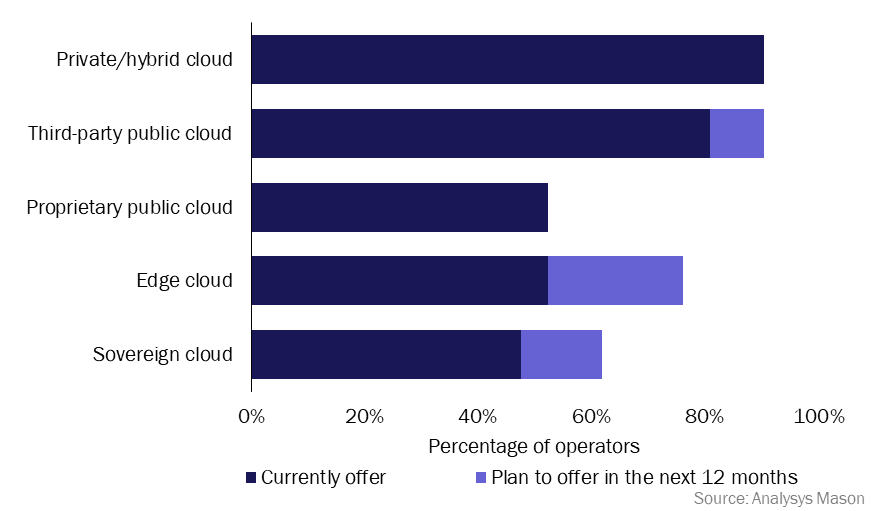

Cloud services have delivered strong revenue growth for operators recently and there is good reason to believe there is significant further growth potential. Most operators with a cloud services portfolio already offer private/hybrid cloud and third-party public cloud services; a smaller number offer proprietary public cloud solutions (Figure 1). Operators are achieving strong revenue growth from these services and have a considerable opportunity to upsell them to a larger share of their customer base.1

Some operators have also invested in edge cloud and sovereign cloud solutions. These are not yet delivering significant revenue but businesses demand is anticipated to increase. Operators should invest now in expanding their cloud services portfolios to benefit from this demand.

Much of the data referenced in this article is taken from Analysys Mason’s Cloud compute services: survey of telecoms operators.

Figure 1: Share of operators that offer, or plan to offer, cloud solutions, by type of solution, 20222

Established cloud solutions will continue to have revenue growth potential

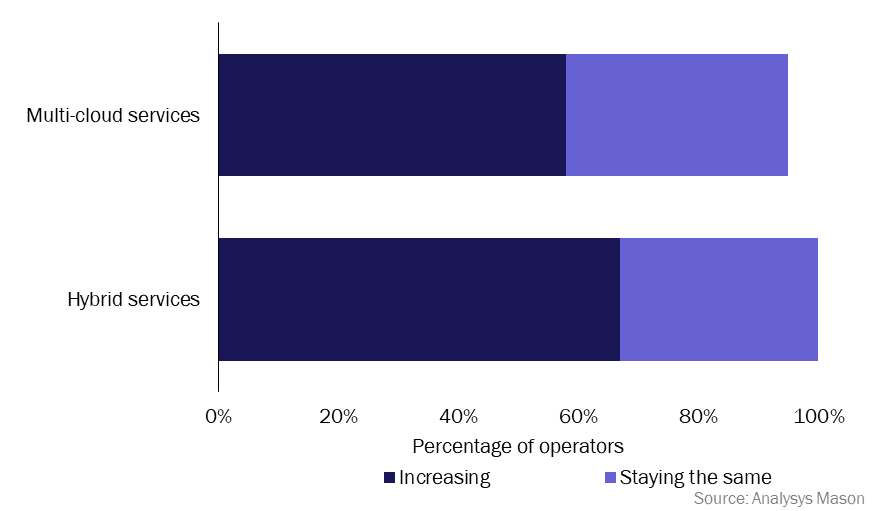

Demand for hybrid and multi-cloud services is increasing among operators’ public cloud compute customers, but it is increasing from a small base. Most operators reported that less than half of their public cloud customers currently take hybrid and multi-cloud services. However, for both categories most operators said this share was increasing (67% for hybrid services and 58% for multi-cloud) and the overwhelming majority said the share was either increasing or staying the same (Figure 2).

Figure 2: Share of operators that reported whether the share of their public cloud compute customers taking hybrid or multi-cloud services was increasing or staying the same, 20223

Most operators already offer hybrid cloud services, and are therefore well-placed to meet this demand. Figure 1 shows that 90% of operators currently offer hybrid/private cloud services. In addition to this high percentage, many operators also have significant experience in private cloud deployments, so will be well-placed to further benefit from the growing demand for managed hybrid services.

Almost all (90%) of operators also offer, or plan to offer within the next 12 months, third-party public cloud compute services. To meet the growing demand for multi-cloud services, most operators are partnering with multiple public cloud platforms (PCPs). Analysys Mason’s tracker of operator partnerships with PCPs shows that most partnerships are with Azure and AWS, but increasingly, operators are partnering with three or more PCPs, and Google Cloud is becoming the most popular third-choice PCP by operators.

Despite the large number of operators partnering with PCPs, take-up of these cloud services among operators’ traditional fixed connectivity customers is still relatively low. Most of the operators that we surveyed said that less than 20% of their fixed connectivity customers also took public cloud compute solutions from them. This is true of all business sizes, but especially smaller businesses.

Operators have a significant opportunity to upsell cloud compute services to their fixed connectivity customers, especially as more businesses are adopting public cloud solutions. A small number of operators reported that more that 80% of their fixed connectivity customers also take public cloud compute. A percentage this high will not be possible for most operators, but roughly 20% of operators reported that at least 50% of their fixed connectivity customers also take public cloud compute (across all business sizes). This suggests that more moderate cloud compute take-up is achievable for a larger range of operators.

New cloud solutions that provide sovereignty and edge capabilities may drive revenue growth in the longer term

The edge computing market is an area that can provide strong revenue growth for operators. Indeed, Analysys Mason estimates that the public edge market will be worth USD34 billion by 2025. 50% of operators surveyed currently offer edge computing, with a further 25% planning to launch within the next 12 months (Figure 1). Other operators should consider launching edge compute services quickly so they do not miss out on potential future revenue growth.

Sovereign cloud services4 also have the potential to drive revenue growth for operators. We expect that the demand for sovereign cloud solutions will grow from a range of (mainly regulated) industries including critical infrastructure, healthcare, finance, technology and professional services. Some operators believe that all industries will increasingly demand sovereign cloud solutions because the data sovereignty framework is evolving rapidly in Europe and worldwide. The sovereign cloud market is currently less developed than the edge market; less than 50% of operators currently offer sovereign cloud solutions.

Sovereign clouds come in a range of forms; some are based on VMware technology and run in operators’ data centres, while others are formed in partnerships with PCPs. The latter solutions allow customers to access SaaS solutions from hyperscalers that they may not have been able to use due to sovereignty laws. Partnerships with PCPs are less common than other types of sovereign cloud, although both Orange Business Services and T-Systems have made announcements in recent months. This approach may be more suitable for larger, regional operators (this is discussed in Analysys Mason’s report Operators’ approaches to sovereign cloud). Nevertheless, we believe that the demand for such sovereign public cloud solutions will increase, and that if this demand is met by operators it is likely to be met by other players such as cloud and IT specialists.

Expanding operators’ cloud portfolios will deliver revenue growth now and in the longer term

Established cloud services including hybrid and public multi-cloud services can provide operators with good revenue growth with limited further development cost. Operators should consider enhancing these services by:

- investing in skills and tools that are associated with providing multi-cloud professional services and implementation support

- increasing the number of PCP partners to include at least the three main hyperscalers

- developing effective service bundling and delivery alongside connectivity services.

To secure longer-term revenue growth from cloud, operators should also launch new services including edge and sovereign cloud solutions.

1 For example, Orange reported 15% revenue growth in cloud services in 1H 2022 compared to 1H 2021.

2 Questions: “Which of the following cloud compute solutions does your company currently offer to business customers (or plan to start offering in the next 12 months)?”; n = 21. “Do you currently offer sovereign cloud solutions to business customers (or plan to offer within the next 12 months)?”; n = 21. “Do you currently offer edge cloud solutions to business customers (or plan to offer within the next 12 months)?”’ n = 21.

3 Questions: “Is the share of your public cloud compute customers buying services from more than one public cloud platform from you increasing, decreasing or roughly staying the same?”; n = 21. “Is the share of your public cloud compute customers also buying hybrid public/private cloud services from you increasing, decreasing or roughly staying the same?”; n = 21.

4 This is not a precisely defined term, although it typically involves imposing strict national (or regional) controls over the storing and processing of data.

Article (PDF)

DownloadAuthor

Matt Small

AnalystRelated items

Article

KDDI’s results demonstrate the challenges of entering new markets such as energy and finance

Strategy report

Strategies for telecoms operators to evolve their network-as-a-service (NaaS) propositions

Tracker

Cloud service providers' revenue tracker 2024