Mobile operators in Spain raised their prices but lost customers and revenue to competitors

15 May 2024 | Research

Article | PDF (3 pages) | Mobile Services| European Quarterly Metrics| European Core Forecasts

Many mobile operators have increased prices as a way of boosting revenue, and have used high inflation to justify the increases. They are considering the prevalence of cheaper competitors in the market when deciding the size of price increases.

Results suggest that operators in the UK have used above-inflation price increases to achieve revenue growth. Operators in Sweden achieved revenue growth with much smaller price rises thanks to limited competition. However, operators in Spain increased prices in line with inflation but suffered revenue declines because of the presence of Digi, an increasingly competitive MVNO.

In-depth data on the mobile market in Western Europe can be found in Analysys Mason’s DataHub.

Operators in the UK are growing revenue having increased prices by more than inflation

Inflation-linked price increases have been written into contracts for several years, but recent high inflation has raised questions about the effectiveness of this strategy. At the start of 2023, BT, Three and Vodafone implemented increases of consumer price index (CPI) plus 3.9 percentage points, while O2 used the higher retail price index (RPI) plus 3.9 percentage points. This resulted in price increases of around 14%.

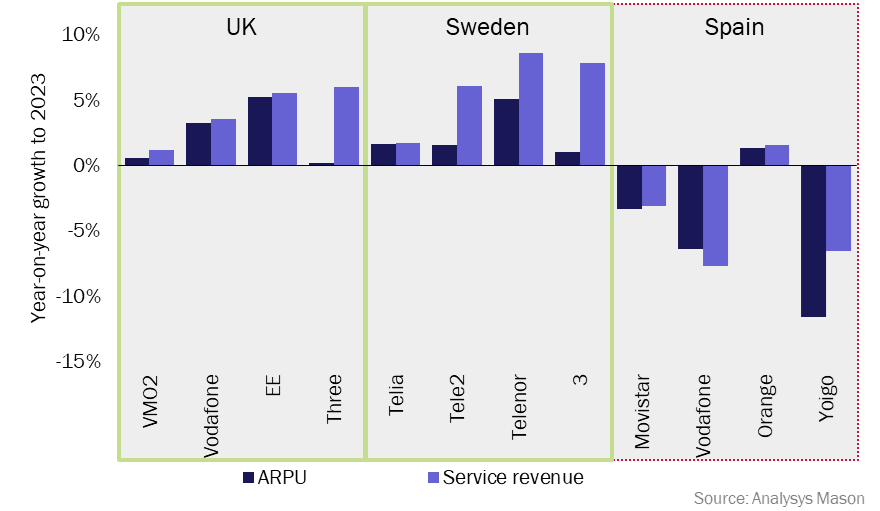

Operator results show that contract ARPU was stable or grew in 2023, with BT in particular achieving strong year-on-year growth (5.2%) (Figure 1). However, this is well below the rate of price increases, showing that customers are negotiating or finding better deals when they reach the end of their contracts. All four MNOs achieved year-on-year contract service revenue growth in 2023.

Figure 1: Contract ARPU and service revenue growth for MNOs in the UK, Sweden and Spain, 2022 to 2023

There is no stand-out challenger MNO in the UK. The largest MVNO, Tesco Mobile, had a 5.8% share of contract connections in 2023, but it is jointly owned by Virgin Media O2, and so is unlikely to pursue a strategy that will threaten the MNO. This lack of an aggressive challenger has enabled MNOs to retain enough customers who are willing to accept the price increases and boost contract service revenue.

Operators in the UK are continuing with the same strategy in 2024; they increased their prices by 7.9% on average in 1Q 2024. However, BT was the first operator to announce that it will stop using inflation-linked price increases after April 2024, following Ofcom’s proposal in December 2023 to ban the practice.

Swedish operators’ revenue grew even though their price increases were lower than those in the UK

MNOs in Sweden have also grown contract ARPU and service revenue despite more limited price increases than those in the UK. Although prices in Sweden increased in 2023, the increases were not as widespread as in the UK. Tele2 and Telenor for example did not change the price of any of the plans included in our Mobile handset data pricing benchmark 4Q 2023 (excluding promotions), and yet contract ARPU grew by 5.3% and 1.6% respectively in 2023. Telia and 3 also grew contract ARPU, and contract service revenue increased for all four MNOs from 2022 to 2023, with Telenor seeing the highest growth (8.6%).

The limited number of competitive alternatives in Sweden allowed operators to keep price rises lower and still grow revenue. MVNOs accounted for just 3.6% of contract connections in 2023. MNOs’ customer retention rates were higher than those in the UK. MNOs’ total share of contract connections increased by 0.1 percentage points in Sweden in 2023, while it decreased by 1.2 percentage points in the UK. This higher customer retention than in the UK meant smaller price increases were sufficient to grow revenue.

Figure 2: Market share of, and year-on-year change in, contract connections held by MNOs in Spain, Sweden and the UK

| Country | MNOs' share of contract connections (2023) | Year-on-year change in MNOs’ share of contract connections (2022 to 2023) |

| Spain | 83.0% | –1.2 percentage points |

| Sweden | 96.4% | +0.9 percentage points |

| UK | 91.4% | –1.9 percentage points |

Source: Analysys Mason

Contract ARPU is falling in Spain due to more competition from challenger operators

Spanish operators increased prices in early 2023, with increases averaging around 6.5%. This is in line with inflation, although different plans increased by varying amounts. For example, data from our Mobile handset data pricing benchmark 4Q 2023 shows that Telefónica’s ‘Contrato Ilimitado 8GB’ and ‘Contrato Ilimitado Plus’ plans increased in cost by 13.4% and 4.8% respectively in 2023.

However, despite these increases in published rates, contract ARPU for Másmóvil, Telefónica and Vodafone declined year-on-year in 2023, with Másmóvil seeing the biggest drop (–11.6%).

The presence of Digi, a highly competitive MVNO that is undercutting the market with low tariffs, meant that the MNOs lost a combined contract market share of 1.9 percentage points year-on-year to 2023. Digi has a higher market share than any MVNO in the UK or Sweden, and provides an attractive alternative for customers that are looking for cheaper tariffs. The price increases implemented by the MNOs were not sufficient to grow revenue because they lost customers to Digi.

MNOs must consider how many customers they are likely to lose to cheaper competitors during times of economic pressure, and also which customers will accept large price increases. Operators in the UK and Sweden are increasing prices and revenue because there is relatively little competition from challenger operators. Operators in Spain are experiencing revenue declines because of the competitive pricing strategy of Digi. Raising prices may seem like an obvious way to increase revenue but the experience of MNOs in Spain shows that it can have the opposite effect.

Article (PDF)

DownloadAuthor

Stephen Day

AnalystRelated items

Article

KDDI’s results demonstrate the challenges of entering new markets such as energy and finance

Article

European quarterly metrics update 4Q 2024: mobile service revenue declined in Western Europe

Tracker

European quarterly metrics: Western Europe 4Q 2024