The success of the optical satcom market is tied to the Space Development Agency

The US Space Development Agency (SDA) allocated USD2.5 billion to key industry players, L3Harris, Lockheed Martin and Sierra Space, in January 2024 for the development of the Tranche 2 Tracking Layer satellites. This strategic allocation has sparked a remarkable increase in engagement from commercial players, spurred by the SDA’s ambitious launch agendas. The initial surge in demand for optical communication terminals (OCTs) has come from the SDA and a group of smaller constellations, which indicates that government contracts are a major driver of the OCT market.

The initial success of the optical satellite communications (satcom) market has been undeniably linked to the SDA’s investments and demand, but its long-term sustainability and growth are contingent upon a myriad of factors. These include diversification of the customer base, technological advances, strategic industry responses to pricing pressure and a favourable regulatory environment. It is becoming increasingly clear that the continued success of the optical satcom market is not solely tethered to the SDA; it is instead reliant upon the collective progress of the entire ecosystem.

The optical satcom market’s dynamics are greatly affected by the SDA’s actions

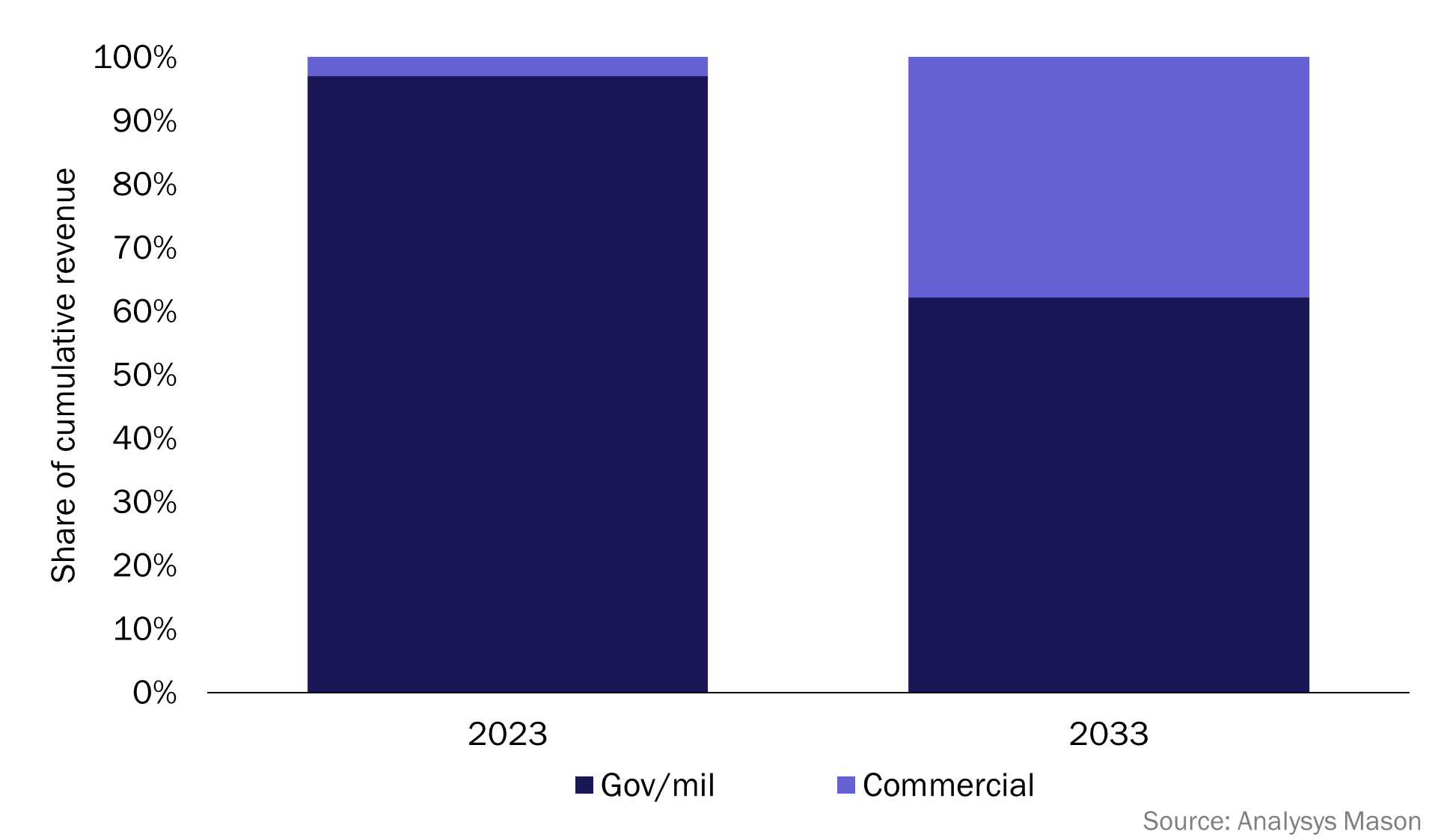

Analysys Mason’s Optical satellite communications market, 6th edition report forecasts that over 8000 OCTs will be deployed between 2023 and 2033. The government and military (gov/mil) sector, and thus the SDA, will account for 72% of deployments between 2023 and 2027, though this will fall to 38.4% between 2028 and 2033 (44.7% over the forecast period as a whole). Similarly, the gov/mil sector will account for the majority of OCT revenue during the early years of the forecast period, followed by a shift towards volume-driven demand from commercial constellation operators after 2027 (Figure 1).

Figure 1: Breakdown of cumulative OCT equipment revenue, by sector, worldwide, 2023 and 2033

The SDA’s OCT standards allow stakeholders to integrate interoperable OCTs and seamlessly engage with the SDA’s Tranche and Tracking Layers programmes, thereby amplifying commercial opportunities in the Earth observation (EO) space. Companies such as Kepler are leading in this area and are rolling out SDA-compatible data relay networks that are designed to bolster the resilience of government networks, thus fuelling further demand for OCTs. The SDA’s influence extends beyond the SDA’s own constellations and is especially pronounced in North America. The early phase of OCT ecosystem development and revenue generation is therefore deeply intertwined with the SDA’s constellation initiatives and networks that adhere to the SDA’s standards.

Industry players need to explore commercial and international opportunities beyond the SDA

The future of the optical satcom market extends beyond the confines of SDA contracts; there is significant potential from commercial constellations and international collaborations. For example, the European Commission’s IRIS project is expected to mirror the impact of the SDA in North America and drive growth in the optical satcom market in Europe.

Much of the commercial demand for OCTs will come from the need for inter-satellite links (ISLs) in large communication constellations to help to develop the business case and deliver low-latency services. However, this demand has already been affected by market challenges such as funding delays and constellation players’ changing strategies. Additionally, strategic decisions such as Eutelsat’s scaling back of its OneWeb Gen 2 satellite launches have resulted in a temporary decrease in OCT demand. Nonetheless, the market is expected to grow in the long term, and more constellation launches are expected. Indeed, successful demonstrations, such as Amazon’s 100 Gbit/s data rate for its Kuiper satellites, indicate a positive direction for OCT technology development.

Technological advances, pricing pressure and market sustainability are all linked

Technological innovation serves as a foundational pillar for the expansion of the optical satcom market. Advances in OCT efficiency, data throughput and cost-effective manufacturing processes are crucial to enhance the value proposition of optical satcom solutions. These technological leaps not only open up the market to a broader user base, but they also strengthen the market’s resilience against pricing pressure, thereby setting the stage for a more competitive and diverse marketplace. Optical technology development is capital-intensive and requires specialised expertise, so the gov/mil segment is the main driver of any advances in the optical satcom market. Indeed, the SDA and the European Space Agency (ESA) have been instrumental in fostering technological developments via initiatives such as Skylight and HydRON.

However, there remain challenges in the optical satcom market, particularly regarding pricing pressure. The fixed low-price procurement strategy imposed by the SDA introduces significant pressure on larger players that are accustomed to more substantial contracts, while the response from newer market entrants towards this pricing pressure is varied. New players must secure large contracts from constellation providers to ensure long-term viability and capitalise on scalability and volume, which in turn maintains price competition. Without this, a ‘new normal’ for OCT pricing would need to be established to enable the optical satcom market to continue to grow. However, technological innovations backed by strategic initiatives will enable equipment manufacturers to mitigate these pricing pressures and herald in a new era of affordability and efficiency in the optical satcom domain.

Article (PDF)

DownloadAuthor