Optical equipment manufacturers should target the government/military vertical and MEO and GEO orders

At the end of 2023, Amazon successfully tested inter-satellite optical links between its two Project Kuiper prototypes, as the company prepares to launch its mesh broadband network of 3200 satellites. However, optical equipment manufacturers cannot benefit from the opportunities that this constellation could bring because Amazon, and many other constellation operators, such as SpaceX, are developing their constellations in-house.

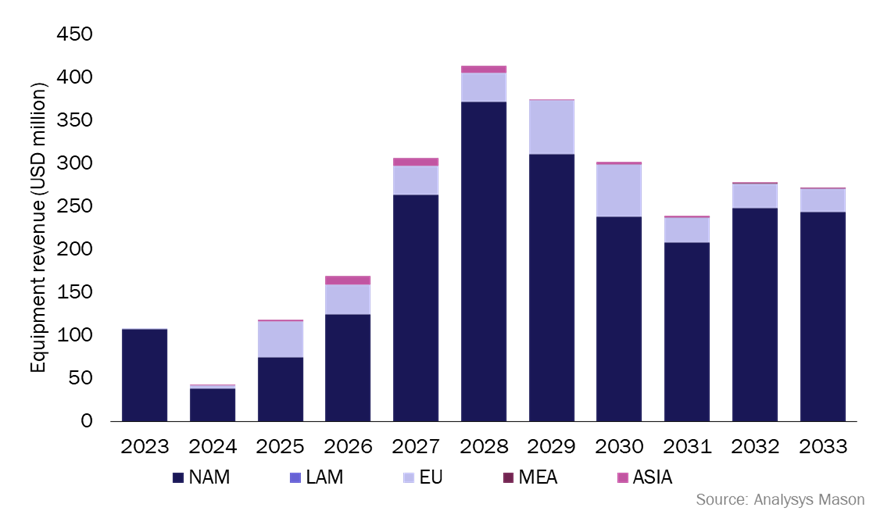

Analysys Mason’s Optical satellite communications, 6th edition forecasts more than 8000 laser communication terminals (LCTs) to launch between 2023 and 2033 and will generate a USD2.6 billion revenue opportunity during the same period (Figure 1). The market is predominantly closed to optical equipment manufacturers, but replacements or a second generation of satellite constellations will fuel the growth in the market in the medium and long term. In addition, projects will start to open up in the government and military vertical, and MEO and GEO terminals will also offer a revenue opportunity. After 2027, the market will open up considerably and the prospects for optical equipment manufacturers will improve.

Figure 1: LCT equipment revenue by region, 2023–2033

The addressable market for optical equipment manufacturers is small

The optical communications market remains largely equipment-centric, with numerous players, including specialised terminal manufacturers, vertically integrated relay system and ground network providers, pursuing the opportunity. Most of the demand will come from the commercial non-GEO market because non-GEO constellations are large and need high volumes of LCTs.

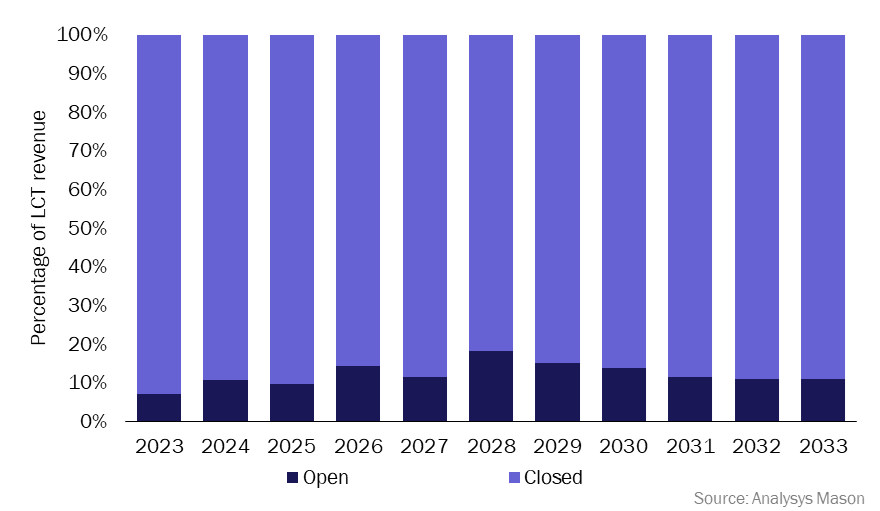

Analysys Mason has calculated the total addressable market (TAM) as the total number of satellites planned to launch between 2023 and 2033 that could potentially host optical inter-satellite links (OISLs) or direct-to-earth (DTE) systems. A large proportion of the TAM is closed in the sense that satellite operators are building their optical terminals in-house. We have concluded that only 12% of the market will be open (that is, outsourced and addressed by other manufacturers) (Figure 2).

Figure 2: LCT revenue by market addressability type, 2023–2033

The largest demand in this market comes from communications satellite constellations because of the need for OISLs that enable higher data rates. Satellite operators need higher data rates and inter-satellite links to provide low-latency services and meet their key value proposition. The best way to achieve this is by using OISLs. Even after removing the in-house production of terminals, the communications vertical will account for 74% of the open market.

Equipment manufacturers should target government and military opportunities, and MEO and GEO markets

Initially, most of the market will be driven by government and military customers; SDA’s Tracking Layer and the EU’s IRIS constellations will play a role in the early adoption and standardisation of products. Indeed, the government and military sector will account for 72% of revenue during 2023–2027. The market landscape is expected to change and commercial opportunities will increase after 2027, but early government and military contracts will boost the reliability of the LCTs and will help to define the competitive landscape for optical manufacturers.

On a regional basis, almost 90% of the total number of LCTs will be launched from the North America (NAM) region, which will generate 85% of the cumulative revenue during 2023–2033. Equipment manufacturers would do well to target contracts in this region.

US military-backed programmes such as Space-BACN are pushing for interoperability and will increase the government/military’s ability to use commercial vendors to develop technology and leverage commercial assets as and when required, rather than solely depending on government and military infrastructure.

MEO and GEO markets are also a compelling opportunity for equipment manufacturers. The volume of MEO and GEO terminals will be lower than those in the LEO market but will be a useful addition to revenue because the price per terminal is higher than for LEO terminals. Therefore, equipment manufacturers should build a value proposition around the idea that MEO and GEO terminals can achieve higher data rates (in the range of tens and hundreds of gigabits per second), which could significantly ease the ever-increasing volume of data generated by satellites. Similar cases are seen in science missions and beyond-Earth applications, which will pave the way to more demand in the longer term.

Demand for products from optical equipment manufacturers will increase after 2027

After 2027, replacements or second-generation satellite constellations will fuel revenue growth in the market and more commercial players will enter the market. Analysys Mason expects the adoption of OISLs to be higher for communication and data relay constellations due to their impact on and need to close the business case. On the other hand, addressability is lower for Earth observation (EO) applications due to the lack of sizeable contracts.

Article (PDF)

DownloadAuthor

Dafni Christodoulopoulou

AnalystRelated items

Tracker

Starlink's maritime broadband plans and pricing tracker 4Q 2024

Article

New entrants can thrive in the optical communications terminal market, but there are challenges

Case studies report

Chinese satellite constellations: case studies and analysis