The case for IoT partnerships between operators and public cloud providers is strong for some services

Operators with IoT business units are building partnerships with public cloud providers (PCPs) such as AWS, Google Cloud and Microsoft Azure, but the rationale for these partnerships varies by operator and is not always clear. PCPs pose a threat to operators’ IoT businesses in some service areas but can also add value to other service areas. The case for partnering with a PCP is highly complex: it will depend on the service in question and the operator’s strategy for IoT. For some services though, such as IoT-to-cloud connectivity, the case is strong and should be pursued by all operators. This article is based on our report Collaborations between MNOs and public cloud providers for IoT: framework and analysis.

PCPs pose a number of threats to operators’ IoT businesses

Both operators and PCPs are moving beyond their core businesses of connectivity and cloud compute, respectively, to develop services in other areas of the IoT value chain. This increases the risk of direct competition. The risks for operators are linked to the following factors.

- Investment. Operators that have already invested in developing or acquiring platform and application assets are more at risk from competition from PCPs than those that only provide connectivity. Operators that have invested in applications or platforms will be competing directly with PCPs in the most-lucrative area of the IoT value chain.

- Future options. Operators could be constrained to a connectivity-only strategy if it is not possible to compete with PCPs further along the value chain. PCPs have built their own infrastructure and platforms to accelerate their go-to-market plans and to lower their costs. Operators will want to keep their options open for competing in other parts of the value chain beyond connectivity, even if their solutions in these areas are not fully developed.

- Differentiation. Operators are just one of several routes to market for PCPs. The latter also partner with firms that potentially compete with operators, such as connectivity disruptors and systems integrators. Operators must consider how to create a differentiated offer if they partner with PCPs.

- Market position. Operators could lose their direct relationship with enterprise users if they become dependent on PCPs as a channel to market.

These risks will vary depending on the operator type. For example, a new entrant will have a different approach to risk than an established IoT player, which may consider these risks to represent a more-significant threat to their IoT revenue.

Operators are collaborating with PCPs in a number of IoT service areas

We categorised operators’ collaborations with PCPs into six service areas (see Figure 1).

Figure 1: IoT service areas and propensity for competition between operators and PCPs

| IoT service area | Description | Propensity for competition |

|---|---|---|

| IoT network (public) | Operators deploy the core network and connectivity platform on PCPs’ infrastructure. | Low. The PCP is an enabler. |

| IoT-to-cloud connectivity | Network solutions deliver IoT data from the operator’s network to the PCP’s cloud. | Low. Operators do not compete with PCPs for this service. |

| IoT network (private) | Operators use technology from PCPs for their private 5G network offer. | Medium. Some PCPs are building their own network assets for private networks. |

| Edge computing | Operators use technology from PCPs for customer and network edge computing. | Medium. PCPs have their own edge computing solutions that are independent of operator sites. |

| IoT platform | Operator takes the IaaS/PaaS from a PCP to either create its own IoT platform, or it takes the IoT platform from the PCP to develop features/services on top. | High. PCPs’ IoT applications and services compete directly with operators’ own IoT services. |

| Channel to market | Operators use PCPs’ marketplaces as channels to market for their IoT connectivity and platforms. | Medium. Using PCPs as a channel may relegate the operator to a wholesale IoT connectivity provider. |

Source: Analysys Mason, 2022

Collaboration with PCPs in all the service areas detailed in Figure 1 can provide benefits to an operator. For example, using a PCP’s infrastructure to build an IoT core network could create capex savings and increase the speed to market for the operator. The challenge for each operator is to calculate whether the benefits in terms of capex efficiencies, revenue generation or competitive advantage outweigh the potential disadvantages.

All operators should explore how PCPs can help to advance their future IoT options

Operators that are present across the IoT value chain have more areas of conflict with PCPs than those that are pursuing a connectivity-only strategy. Operators’ IoT strategies vary significantly, and it is not possible to categorise operators’ PCP partnership strategies based solely on each operator’s position in the IoT value chain. However, there are some general trends.

- Operators that have built IoT assets internally (such as Vodafone) have made these investments in order to provide horizontal- and vertical-specific IoT services directly to enterprises. Such services are important revenue generators and are potential sites of competition with PCPs.

- Operators that have built enabling capabilities – including some vertical-specific applications (such as Telenor, Telia and Telstra) – have partnered with PCPs to take advantage of their IaaS and PaaS services for IoT. These operators view PCPs’ assets as key enablers of their ability to move further along the IoT value chain.

- Operators that specialise in IoT connectivity (such as Tele2) have fewer platform assets to defend from PCPs but are developing multi-cloud approaches through partnerships with firms such as Equinix.

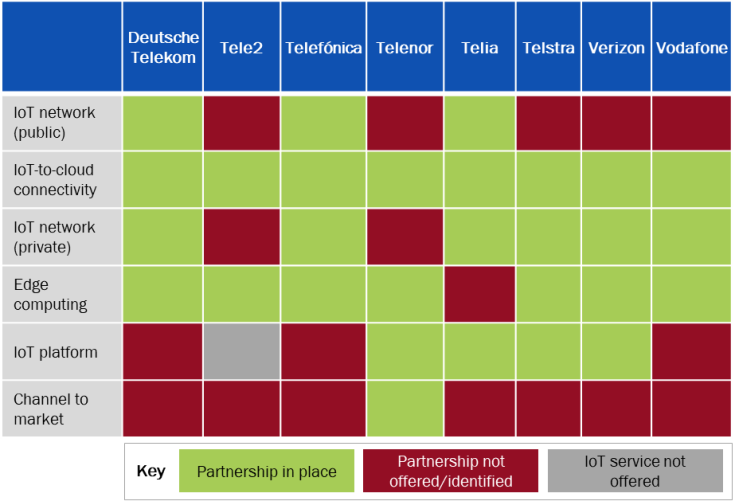

Figure 2: Selected operators’ partnerships with PCPs by IoT service area

Source: Analysys Mason, 2022

All operators with IoT business units must work with PCPs, if only to meet enterprise requirements for IoT-to-cloud connectivity. Similarly, all operators should analyse the advantages of moving from capex-intensive assets to cloud-based assets for IoT. Capex efficiencies, time to market and scalability are important considerations, especially as new entrants are adopting a cloud-first approach.

Operators should also consider how working with cloud providers can facilitate participation in more-lucrative areas of the value chain such as building and delivering applications. Operators have no choice but to work more closely with PCPs for IoT, but their level of engagement will depend on how far they can leverage PCPs’ assets to build a differentiated IoT service.

Article (PDF)

Download