Point-of-sale vendors must look beyond e-commerce to drive revenue growth in the SMB segment

The point-of-sale (PoS) market is growing rapidly due to the increasing demand for e-commerce solutions from retailers as a result of the COVID-19 pandemic. This demand is especially strong for cloud-based solutions that are flexible and easy to deploy. However, vendors will need to provide solutions that go beyond domestic e-commerce if they are to sustain their current revenue growth levels.

Cloud-based retail solutions are the key revenue growth drivers for PoS vendors

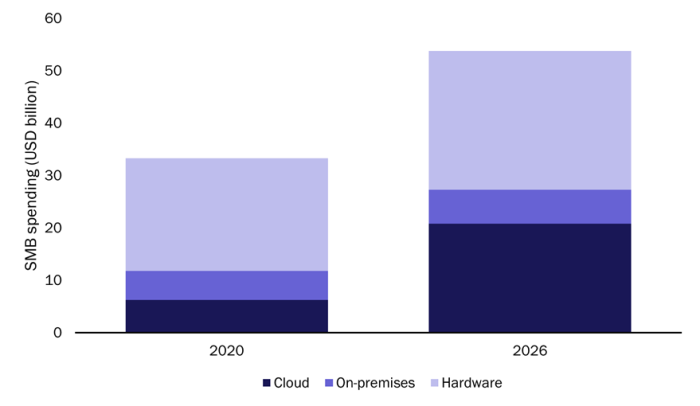

Small and medium-sized businesses (SMBs) in the retail and hospitality sectors have been updating their business operation systems to cater for the new way of running businesses since the outbreak of the pandemic. Analysys Mason’s SMB Technology Forecaster estimates that the spending on PoS solutions and products among SMBs was USD33.3 billion in 2020 and this is set to grow to USD54 billion by 2026 (at a CAGR of 7.4%). Spending on cloud-based PoS solutions will grow the most (at a CAGR of 22.2%) due to the rapid adoption of e-commerce systems (Figure 1).

Figure 1: SMB spending on PoS solutions and products, by category, worldwide, 2020 and 2026

Source: Analysys Mason, 2021

The results of our latest SMB survey show that over a third of SMBs in the retail sector are investing more on digital transformation now than compared to before the pandemic. SMBs want flexible and easy-to-deploy cloud-based solutions that allow them to quickly develop online sales capabilities. PoS vendors have therefore been developing new features and services to enable e-commerce in response to this rising demand. However, they will need to provide solutions that go beyond e-commerce to achieve long-term growth.

Vendors have been urgently adding online retail capabilities to meet the market demands

PoS vendors have been rushing to enable new features and capabilities for their solutions in order to support the growing demand created by the COVID-19 pandemic. Acquisitions and partnerships are an important part of this activity. For example, Lightspeed announced the acquisitions of Ecwid, an e-commerce platform provider, and NuOrder, a B2B ordering platform, in 2Q 2021. Square, a payments and retail solution company, formed a partnership with DoorDash in 4Q 2020 to offer its customers an on-demand delivery service.

The capabilities and services that major PoS vendors have been adding include:

- tools that enable retailers to build websites with e-commerce capabilities, e-stores and online ordering systems

- omnichannel sales and customer engagement platforms that can integrate mobile commerce, social media commerce and physical stores

- on-demand delivery and fulfilment platforms

- secure online checkout and touchless payment systems

- digital marketing support (for example, email marketing, chat, discount coupons and promotion management)

- inventory management solutions to cater for online fulfilment across all store and distribution centre locations

- financial services to support merchants (for example, by promoting the Paycheck Protection Program/COVID-19 Relief Programs1 and offering cash advances and loans).

Supplier networks and marketplaces are the key to strengthening vendors’ customer engagement

Retailers that adopt an omnichannel sales model need to have a complete view of their inventory so as to fulfil sales from both physical and online stores. Legacy standalone solutions that manage the inventory on a store level are therefore becoming obsolete. As such, many vendors are offering solutions that integrate with PoS terminals and online ordering system to automate inventory management.

However, disruptions to the supply chain caused by the pandemic mean that updating inventory management systems alone is not enough. Retailers must also develop new supply chain networks. Vendors that can help to build a new supply chain via supplier marketplaces will therefore have a competitive advantage. Shopify and Lightspeed have already launched supplier marketplaces and have integrated them with their PoS solutions to enable one-click replenishment. Other players should follow this strategy to sustain high revenue growth in the coming years.

Cross-border e-commerce platforms will be the next major revenue generator for PoS vendors

The growth in online sales worldwide has given retailers and brands the opportunity to expand into international markets. This may be another area in which PoS vendors can generate revenue growth, particularly via international transaction fees and an increase in gross merchandise volume (GMV) if they can improve consumers’ confidence in purchasing from international sellers.

Vendors in Europe have the potential to capitalise on Brexit, which has increased the complexity of B2C and B2B e-commerce operations between EU countries and the UK. Retailers, brands and suppliers in both the UK and the EU have inevitably had to upgrade their existing management systems to offer a seamless shopping experience to their customers. Vendors should therefore offer and promote cross-border e-commerce solutions to capture the growing opportunities in the retail industry.

SMB retailers and brands value PoS vendors’ abilities to solve their problems and to provide them with guidance for business growth. Offering supply chain solutions and cross-border e-commerce solutions will help vendors to build strong relationships with their SMB customers.

1 US Small Business Administration, Paycheck Protection Program. Available at: https://www.sba.gov/funding-programs/loans/covid-19-relief-options/paycheck-protection-program.

Article (PDF)

Download