Consumer survey: price erosion threatens fixed and mobile operators in the USA

07 February 2023 | Research

Article | PDF (4 pages) | Fixed Services| Mobile Services| Video, Gaming and Entertainment

The USA has some of the most expensive telecoms services in the world. This is partly due to the regional nature of the market competition in the country, particularly for fixed services. However, this comfortable situation for operators is potentially becoming less sustainable. Differentiation between mobile services is low, and cable operators are struggling with low customer satisfaction levels for fixed services.

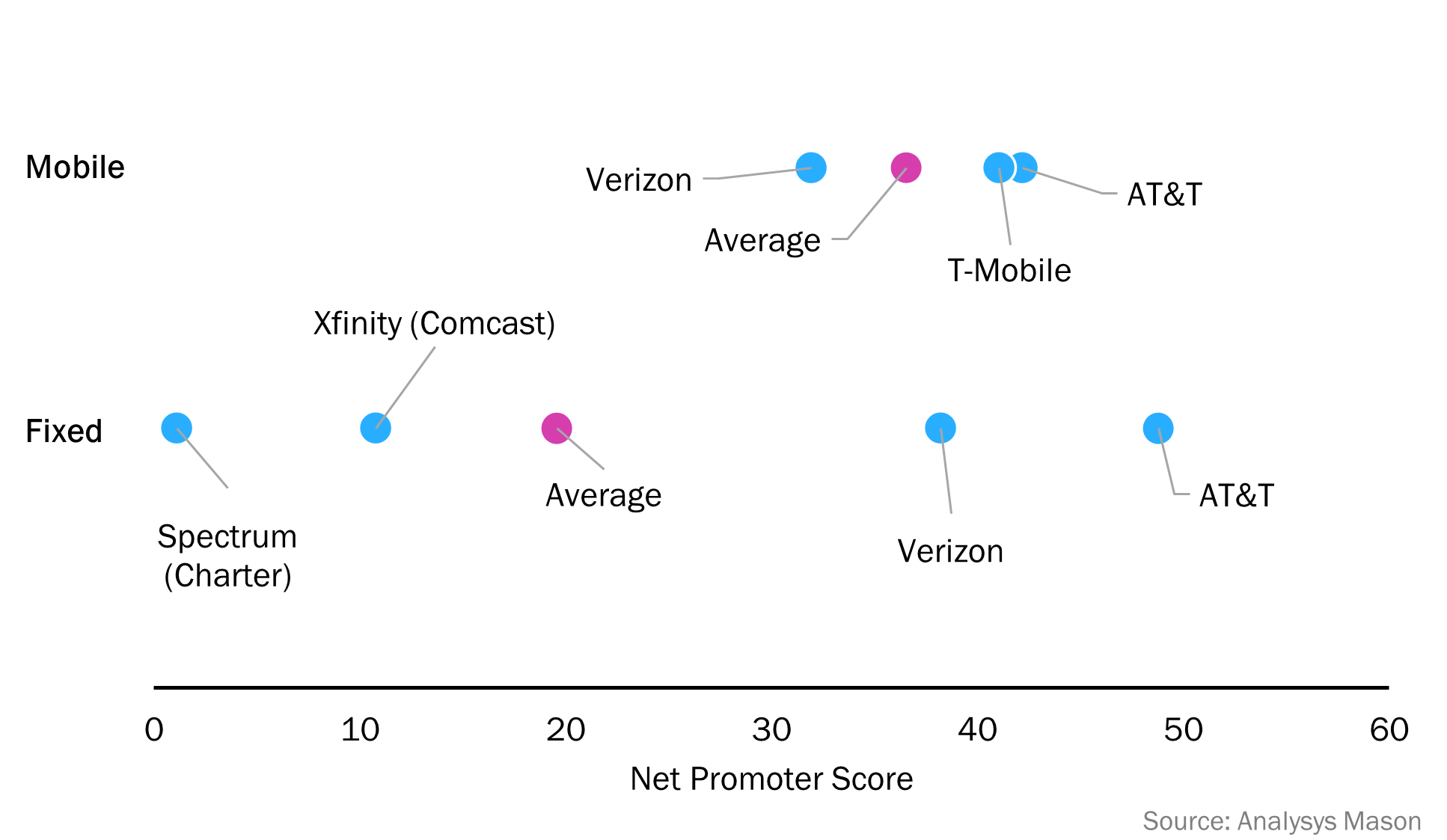

Net Promoter Scores (NPSs) for fixed providers range from +1 to +49 (Figure 1). Cable operators have the lowest scores and need to improve on almost all aspects of their service if they are to avoid remaining vulnerable to competition from other fixed suppliers (including those offering fixed-wireless access (FWA)). AT&T and Verizon score exceptionally well for fixed services; they need to build on their advantage and further cross-sell additional services, especially mobile.

Figure 1: Net Promoter Scores for fixed and mobile services, USA, 2022

The situation for mobile operators is, if anything, more complicated. AT&T, T-Mobile and Verizon all have high NPSs for mobile services (Figure 1). They need to differentiate or risk being forced to compete on price.

This article is based on data from Analysys Mason’s USA: consumer survey report.

Mobile network operators are at risk of being forced to compete on price

Mobile network operators (MNOs) are struggling to differentiate. The NPSs for the three main MNOs fall within ten points of each other (Figure 1). Customers of all three players are also very satisfied with various aspects of their mobile service, such as coverage, price and customer service. For example, all MNOs have average customer satisfaction scores of either 4.1 or 4.2 out of 5.0 for network coverage, data spend and data allowance.

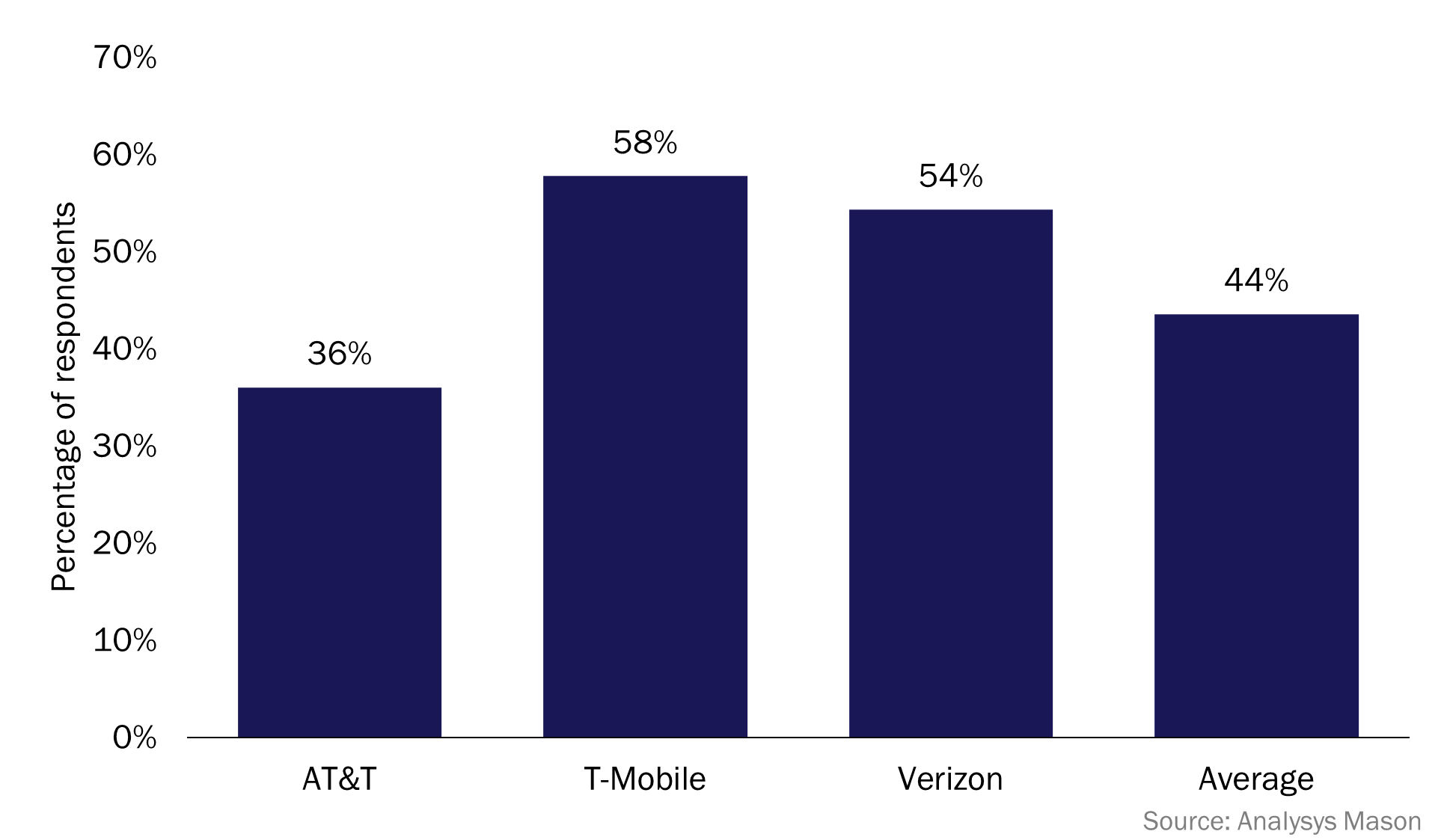

These results are encouraging but point to a potential problem. All three of the major MNOs provide a good-quality product to satisfied customers, but there is little to choose between them. Many MNOs use unlimited plans to attract new customers and retain existing subscribers. This practice is particularly commonplace in the USA (Figure 2). One might see this as a success but it also limits future opportunities; once a customer has a plan that includes unlimited voice, messaging and data, what else can an operator offer?

Figure 2: Share of mobile customers on unlimited data plans, USA, 20221

It should be noted that the move to unlimited plans is driven by local competition rather than customer demand; there is no relationship between data usage and the share of customers on an unlimited plan.

The clear risk is that the three US MNOs will have little choice but to compete on price. ARPU in the USA is higher than that in almost any other high-income country, so there may well be scope for operators to be more aggressive on price.

Fixed operators receive a wide range of satisfaction scores

The fixed sector has a very different set of dynamics to the mobile market. Indeed, Figure 1 shows that there are considerable differences in NPS between the best-performing (AT&T (+49)) and worst-performing (Spectrum (+1)) operators. Spectrum (Charter) has the lowest satisfaction scores for four out of the five individual service elements included in our survey (speed, usage restrictions, reliability and price) and is only slightly ahead of the other major cable operator, Xfinity (Comcast), for the fifth attribute (customer service). Spectrum does not score above 3.8 (out of 5.0) for any attribute, and its lowest score, for price, is just 3.3. This is the lowest in result in our survey. Conversely, AT&T’s scores are all between 4.0 and 4.2 (out of 5.0).

Cable operators have benefitted from the low level of competition within their footprints. However, they need to improve almost all aspects of their services if they are to avoid being vulnerable to churn. Verizon and T-Mobile have launched low-priced FWA offers that specifically target cable customers; such plans may have extra appeal while the economy is relatively weak.

AT&T and Verizon have also done a better job of cross-selling other services to their fixed customer base than their cable rivals have. For example, AT&Ts’ customers are more than twice as likely to buy an additional Wi-Fi unit from their operator than customers of Xfinity (Comcast) or Spectrum (Charter).

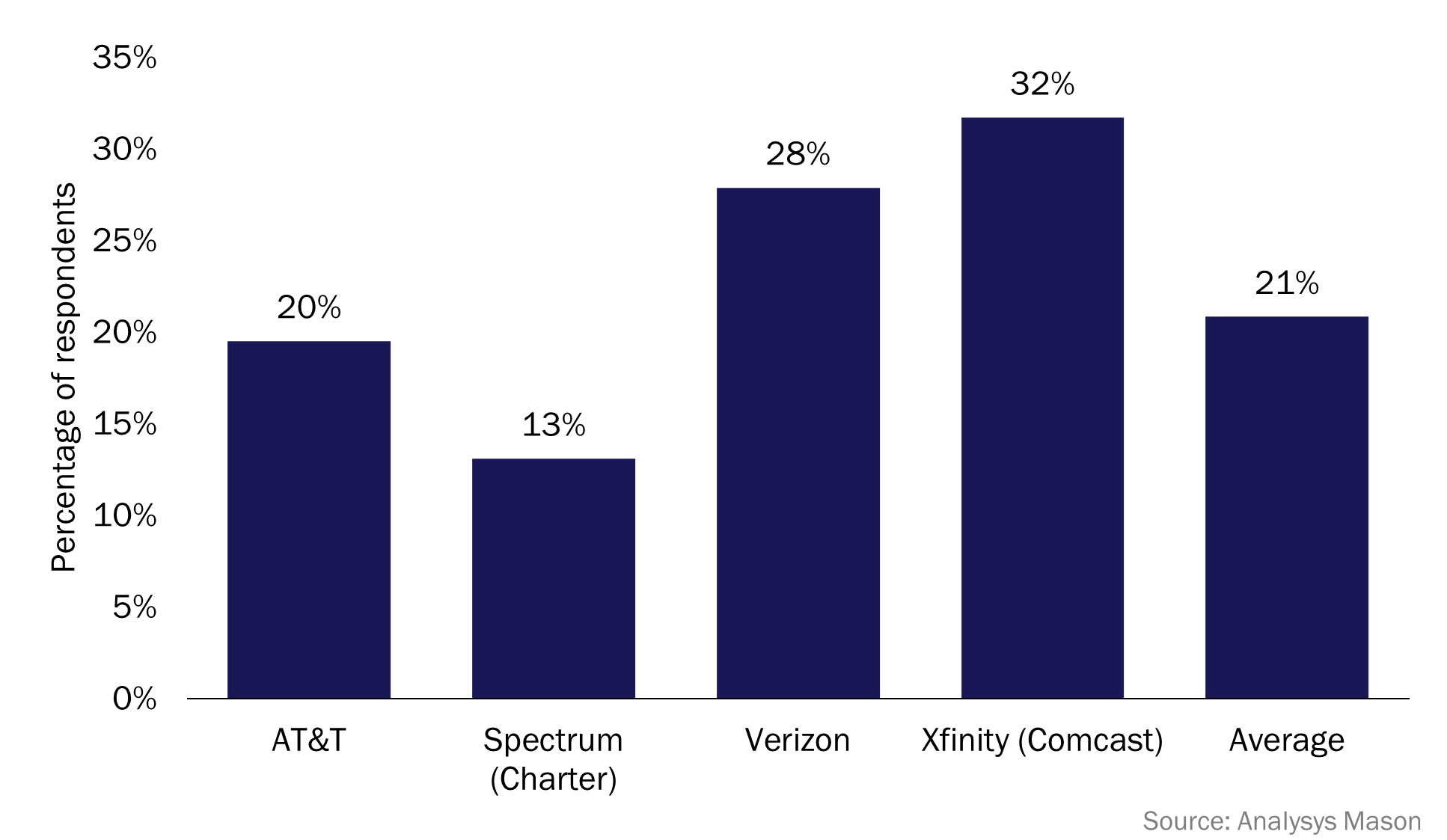

All fixed operators in the US have the potential to migrate their customers onto faster plans. Indeed, Figure 3 shows that just over 20% of customers are on connections that provide speeds of over 500Mbit/s (typically 1Gbit/s). This result is in line with that in other high-income countries, but is around 10 percentage points lower than in the best-performing countries such as Spain. We estimate that more than half of customers in high-income countries will take these fast connections in 2–3 years. Migrating customers to faster speeds will be an essential part of fixed infrastructure providers’ defence against FWA competition, which cannot offer such fast speeds; this is especially true for cable operators.

Figure 3: Share of fixed customers on connections with speeds of over 500Mbit/s, USA, 2022

The threat of revenue erosion is real in both the fixed and mobile markets

Operators in the USA have been focused on increasing their revenue from connectivity services, possibly to a greater extent than their peers in other high-income countries. They have managed to grow their revenue in recent years by maintaining ARPU and finding new customers. However, this model may come under pressure, especially in the mobile market, where operators must find differentiators to avoid price competition.

In the fixed market, cable operators are poorly rated by customers and there is the real threat of substitution by lower-price (and possibly lower-performance) FWA services. Fixed operators may need to lower prices to compete, even if only a relatively small share of the market moves to FWA, thereby eroding market value.

1 Information about the customers on unlimited plans is self-reported and may differ slightly to the operators’ own reporting.

Article (PDF)

DownloadAuthor