Private 5G networks are gradually emerging in sectors beyond manufacturing and transport

The number of private LTE/5G networks announced in the public domain reached 448 in 1Q 2023, up from 338 in 1Q 2022, according to Analysys Mason’s Private LTE/5G networks tracker.1 The share of private networks that use 5G continues to rise. We estimate that around 25% of all private LTE/5G networks use 5G. According to our tracker (which includes a subset of all networks), over 50% of networks use 5G as of 1Q 2023.

The rising share of announced private networks that use 5G indicates that momentum is starting to build behind private 5G, and there are initial signs that private 5G deployments are moving beyond the industrial sectors that have driven the bulk of activity so far.

Industrial sectors account for most private 5G deployments, but the industrial share is falling

The data in our private LTE/5G networks tracker is not comprehensive. 5G networks are more likely to be announced publicly than LTE networks, because 5G is a newer technology and subject to far more attention; the number of networks announced is not equal to the number of networks deployed.

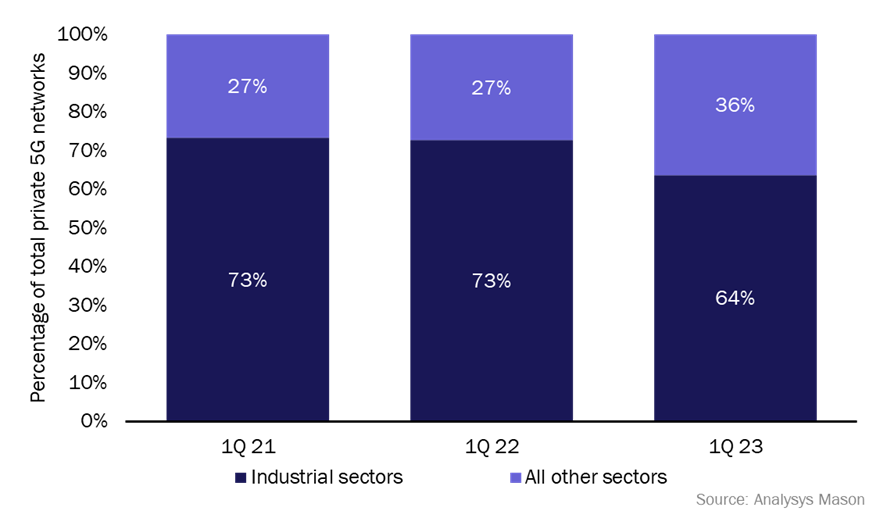

Nevertheless, the evolution of the data in the tracker provides a guide to how the private LTE/5G networks market is developing over time. Early private 5G activity was concentrated in industrial verticals, led by the manufacturing sector (49% of all 5G networks in 1Q 2021), followed by transport and logistics (17% in 1Q 2021), and mining, oil and gas (7% in 1Q 2021). The industrial sectors are beginning to account for a smaller proportion of private 5G deployments as the number in other sectors is starting to accelerate (Figure 1).

Figure 1: Share of private 5G networks, industrial and non-industrial sectors, 1Q 2022–1Q 20232

A few sectors in particular are driving this growth.

- Entertainment venues. Verizon is particularly active in this segment and is working with multiple US sports organisations. In February 2023, Verizon announced a deal with the NFL to deploy private networks at the stadia of all 30 NFL teams, to enable real-time coach-to-coach communications. It also trialled a private network at Hard Rock Stadium to support the venue hosting the Formula 1 Miami Grand Prix, including solutions such as digital signage and point-of-sale terminals.

- Broadcast networks. Specialists such as Neutral Wireless are deploying ‘pop-up’ standalone private 5G networks to support video streaming of live events. Neutral Wireless has trialled these temporary networks for broadcasters such as BBC and QTV (UK), TV2 (Denmark) and RTE One (Ireland), which are attracted to the flexibility of using wireless connectivity.

- Healthcare. Private 5G is being trialled in several hospitals around the world. Recent announcements include Cleveland Clinic Hospital (Verizon, USA), Apollo Hospitals (Airtel, India) and Ewha Womans University Mokdong Hospital (Samsung, South Korea). Healthcare facilities are subject to strict regulation, making it difficult to use public cellular networks, and fixed networks come with much less flexibility in terms of what can be connected. Private 5G in hospitals is being tested for a host of applications including computer vision, robotic-assisted surgery and remote examinations.

Many private 5G deployments are at the pre-commercial stage, but the activity in new sectors should be encouraging

The private 5G market is nascent and many firms are still at the exploration stage. Indeed, of the 231 private networks using 5G in our tracker, less than half are currently commercial and almost 40% are trials/proof-of-concepts or testbeds. In contrast, over 80% of private LTE networks are operational and less than 10% are trials/testbeds.

This difference reflects the varied stages of maturity that private LTE and private 5G are at. Private LTE has existed for a decade, giving time for suppliers and enterprises to test, build and learn from early deployments.

Private 5G has only been around for a few years and it will take time for the market to progress from trials to commercial deployments. In addition, the LTE device ecosystem is mature while the 5G device ecosystem is limited, and the price of 5G equipment and devices is significantly higher than that for LTE equivalents, and will remain so until the market scales.

However, private network suppliers should be encouraged by the rise in 5G activity in new sectors, even if many deployments will continue to be trials in the short term and it will be some time before such deployments will translate into real revenue opportunities. There are only so many mines, airports and ports in the world to target; the addressable market for sites such as entertainment venues and hospitals is considerably larger. Trials and testbeds will help to understand the commercial and technical requirements of enterprises in these sectors and lay the groundwork for commercial private 5G deployments.

1 The tracker captures details of private LTE/5G networks announced in the public domain only, including trials, testbeds and temporary networks. The total private networks market including undisclosed networks is considerably larger.

2 ‘Industrial’ sectors include: manufacturing, transport, logistics, and mining, oil and gas. Non-industrial sectors include agriculture, education, entertainment, healthcare public sector, real estate, retail and utilities.

Article (PDF)

DownloadAuthor

Ibraheem Kasujee

Senior AnalystRelated items

Forecast report

USA: private LTE/5G networks forecast 2024–2029

Article

MWC25: telecoms players pushed new B2B products, but any boosts to revenue are years away

Article

The private networks market continues to face barriers to wider adoption, but there are signs of steady progress