Operators that offer professionally monitored security services have an opportunity to increase their revenue

Telecoms operators are increasingly offering professionally monitored security (PMS) services because of their synergies with core telecoms services. Professionally monitored security services offer operators an opportunity to grow revenue and reduce churn by bundling services, although the success of this approach has, so far, been mixed. This article provides an overview of the five case studies discussed in detail in our recently published report Professionally monitored security services: case studies and analysis. We highlight the drivers behind the operators’ launches of these services and consider how successful each operator has been in this market space.

Operators have an opportunity to pivot into the growing professionally monitored security industry

Fixed broadband revenue is flattening in developed markets due to market saturation and increasingly competitive retail markets. In order to increase revenue growth, established operators are launching parallel services, including professionally monitored home security, which has strong synergies with fixed broadband because it is a home-based service and is billed monthly.

Professionally monitored home security packages as we define them typically consist of:

- a range of equipment such as sensors, control panels, and cameras

- professional installation of the equipment (although some operators offer less-expensive self-installation offers, and some other players such as Amazon are focused on the DIY market)

- the ability to monitor and calibrate the service from an app

- a 24/7 monitoring service

- police or private guard response in case of intrusion.

There are a range of different companies offering these services including alarm and security specialists (such as ADT), telecoms operators (for example, Comcast), insurance companies (such as Groupama) and tech start-ups and OTTs (including Amazon).

Professionally monitored security services can also help operators to improve churn

The inclusion of professionally monitored services alongside operators’ other offers is correlated with improved churn metrics for fixed broadband. This is because of the additional logistical difficulty in churning multiple services – and the potential loss of discounts, should the service be bundled. The average reported monthly churn of professionally monitored services is ~1%, which is slightly lower than the ~1.5% monthly churn rate typically reported by fixed broadband operators.

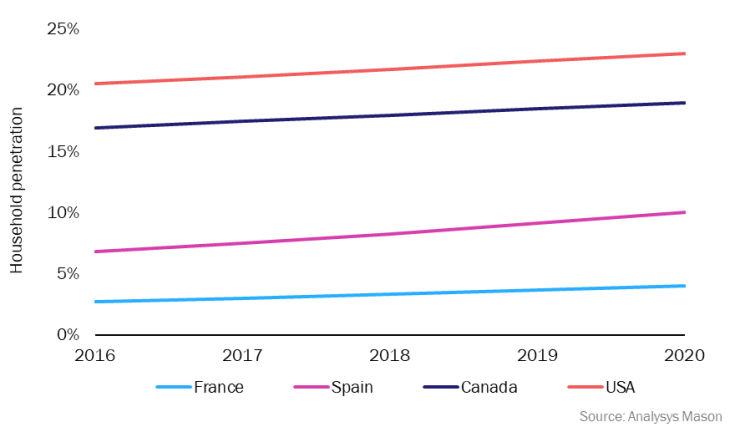

Globally, PMS service penetration does not exceed 25% of households in in any country (see Figure 1), but there is significant room for growth in most European countries, where penetration rarely exceeds 10%.. Average revenue per PMS subscription varies, but in the more developed North American markets represents 60–80% of broadband ASPU. These factors together point to the limits on the revenue potential of the service: Telus has been among the most-successful operators in this domain after acquiring ADT, the largest professionally monitored security company in the Canadian market. However, despite the relatively high market share that it now controls, professionally monitored security services make up around 3% of its total revenue (about 17% of broadband revenue).

Figure 1: Household penetration of professionally monitored security by country, 2016–2020

Operators have had differing levels of success with their professionally monitored security service propositions

Operators that want to launch PMS services have typically entered the sector in one of three ways:

- launching their own PMS service from scratch (typically including some small acquisitions)

- partnering with a security specialist in a joint venture (JV)

- acquiring a large PMS specialist.

Figure 2 summarises the case studies from Analysys Mason’s Professionally monitored security services: case studies and analysis. Operators have adopted different strategies when marketing their professionally monitored security solutions. Some offer discounts or bundle propositions to core telecoms customers, while others target the entire market.. Operators also offer different installation options, with some operators offering self-installation services while others insist on professional installation. Operators that are more flexible with their offers and have been able to integrate their offers with their core services have generally been more successful.

Figure 2: Assessment of selected operators’ professionally monitored services propositions

| Operator (location) | Total household penetration of PMS services | Method of entering PMS market | Bundling with core telecoms service | Success | ||||

|---|---|---|---|---|---|---|---|---|

|

At&T (USA) |

|

20–25% |

|

Developed its solution from scratch. Acquired smart-home management platform in 2011. |

|

No bundling options available. |

|

Evidence suggests that investment has been insufficient to establish AT&T as a viable security challenger. Its offer has been slimmed down significantly since launch, and it has struggled to establish significant market share. |

|

Comcast (USA) |

|

20–25% |

|

Developed its solution from scratch. Acquired the company that developed its smart-home IoT platform in 2017. |

|

Fixed broadband and PMS bundles are available but offer negligible savings for the consumer. |

|

Comcast has increased its PMS market share (which has peaked at around 5% of total broadband subscribers), although net additions slowed in 2020–2021 as the market in the USA matured and PMS specialists performed better. |

|

Telus (Canada) |

|

15–20% |

|

Three acquisitions of security specialists, the largest of which was Canada’s largest PMS provider (ADT). |

|

Broadband/mobile customers can take advantage of monthly discounts when taking the service. |

|

Quarterly net additions of Telus’s PMS services have continued to increase, and total subscribers to security services account for about 35% of Telus’s broadband subscribers. The acquisition of ADT has increased its addressable market and improved it sales and marketing functions, enabling continued revenue growth. |

|

Telefónica (Spain) |

|

9–12% |

|

Joint venture with security specialist Prosegur. |

|

No bundling offers available. |

|

Revenue from PMS services remains low in terms of Telefonica’s overall Spanish revenue (0.8% of total revenue), but Movistar Prosegur has seen subscriptions increase rapidly; 27% growth in the number of subscriptions between 1Q 2020 and 1Q 2021 outstripped the ~10% growth of the entire Spanish market. Movistar has reported that Movistar Prosegur gross additions have increased fourfold since the JV. Movistar’s large retail footprint is cited as a key reason for this. |

|

Orange (France) |

|

3–5% |

|

Entered into a JV with insurance company Groupama, which had already entered the PMS market. |

|

No bundling options available, but the service is only available to Orange broadband or mobile customers. |

|

Despite the relative success of Orange’s smart-home automation service, the demand for PMS has, so far, been lower in France than other comparable markets. However, the relatively high home consumer spend in France, and a current lack of investment in PMS, leaves room for growth. |

Source: Analysys Mason, 2021

Article (PDF)

Download