Public edge forecast: the industrial edge represents a growing opportunity for operators in the next 5 years

01 May 2024 | Research

Article | PDF (3 pages) | Edge and Media Platforms

The public edge is a new market but parts of it are already showing their age. Our recently published public edge forecast breaks down the spend by edge node builders such as operators, public cloud providers, content delivery network (CDN) providers and data centre providers on physical edge locations, edge hardware, edge cloud software and professional services to 2028. It gives a picture of a dynamic environment. The segments that received investment early are starting to mature, whereas the smallest, newest part of the market is set to grow so quickly that by the end of our forecast range in 2028, it will have caught up with the most mature segment. A pleasant surprise is that it is operators that are driving this ambitious, adventurous and transformational change. Considering this, and the evolution of the overall public edge market, will give vendors and other suppliers looking to target the public edge some valuable guidance on where and how to focus their efforts.

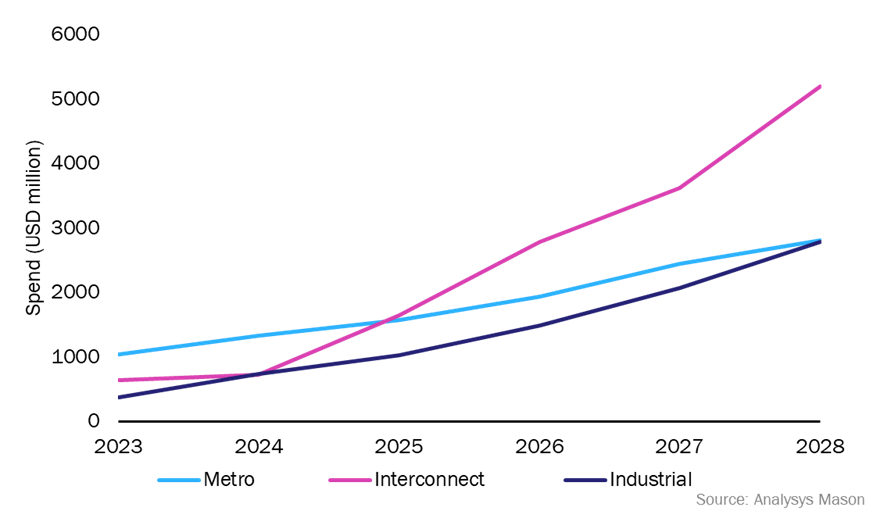

The interconnect segment will account for the largest proportion of public edge infrastructure spend from 2025

The metro edge, comprising regional buildouts of infrastructure by operators, data centre providers and public cloud providers in Tier-2 cities, will continue to be the largest segment of the edge market in terms of spend until 2025. The objective of these edge node builders is to fill gaps in coverage by extending their infrastructure. For example, Amazon Web Services’ (AWS’) main Availability Zone in Spain is in Zaragoza, in the north-east corner of the country, which has necessitated a Wavelength node to be located in a Telefónica data centre in Madrid at the centre of the peninsular.

Figure 1: Edge node builder spend on infrastructure and services by public edge segment type, 2022–2028

Spend in the metro edge segment will continue to grow for the next 5 years but the overall picture will change. Public cloud providers will still build out public edges, but data centre companies will bring in more and more networks (and eventually public cloud and SaaS providers) providing a rich ecosystem of services for their customers. Increasingly, their metro edges will become interconnect edges.

Simultaneously, CDN players will increase their spend significantly. CDN providers were the original occupiers of the edge and, for the past decade, have been centralising their operations at internet exchanges and peeering points, using a super POP model that can use as few as a hundred nodes for global delivery. Akamai’s purchase of Linode 2 years ago marked the start of the return to the edge and Akamai has recently announced plans to embed compute in all of its 4000+ caching nodes worldwide. Others will follow Akamai’s example, raising the CDN market share of public edge spend from 6% in 2022 to 22% in 2028. The CDN providers will use third-party interconnect edge data centres to host their new edge compute platforms and this will drive further growth at the interconnect edge. Interconnect edge spend will account for almost half of public edge spend by 2028.

Spend on the public industrial edge will increase to USD2.8 billion in 2028, up from USD370 million in 2022. A critical moment will occur in 2026 when enterprise demand for local – but cost-effective – processing for AI/ML means that enterprises will start using public rather than private industrial edges. Two groups are investing heavily in the public industrial edge.

- Operators have plans to to build out tens of thousands of public MEC nodes. Operators in Eastern Asia and particularly China are leading this trend, as they leverage the large investments they have made in 5G infrastructure over the past 5 years. Some operators in Europe and North America also have plans to build dense industrial public edge infrastructure.

- New entrants to the infrastructure markets are coming to the industrial edge. They include hosting company 1&1, which has plans for 500 industrial edge nodes in Germany, and industrial edge data-centre and networking specialist, Vapor.io. Companies from outside the internet infrastructure market are also taking an interest in this market. UK Power Networks is trialling private industrial clouds in its sub-stations, a first step to building public edge nodes that could sell services third parties such as consumers and enterprises.

Suppliers in the public edge market need to broaden their focus to the industrial and interconnect edge segments

Public edge suppliers will need to accommodate the rising and declining importance of the different edge market segments in different ways.

- Data-centre owners are in the unique position of being providers and consumers of edge services. As providers, revenue will be driven by CDN providers at the interconnect edge and by public cloud providers at the metro edge. To capture this growth, data-centre providers will need to evolve their sites to interconnect edges by adding more networks as well as connections to public clouds and SaaS providers.

- Hardware vendors will see the greatest growth coming from the industrial edge. Public cloud providers and, to a lesser extent, CDN players have a preference for insourcing, and they are the two largest spenders at the metro and interconnect edge. Operators are building metro edges but this is a slow-growing market, and hardware vendors should instead target the public industrial edge. This is particularly the case for more-adventurous hardware vendors that support open-source standards, ecosystems and architecture. We expect next-generation distributed edge applications to be deployed using such architecture.

- Edge cloud software and professional services software vendors should also target the industrial edge, again because public cloud providers and CDN providers prefer in-sourcing and are the two largest spenders at the metro and interconnect edge. To target the industrial edge segment successfully, software vendors will need to re-tool their software to be edge-native.

Article (PDF)

DownloadAuthor

Gorkem Yigit

Research Director