Open RAN, 5G SA and intelligent mMIMO will be the main sources of long-term stability in the RAN market

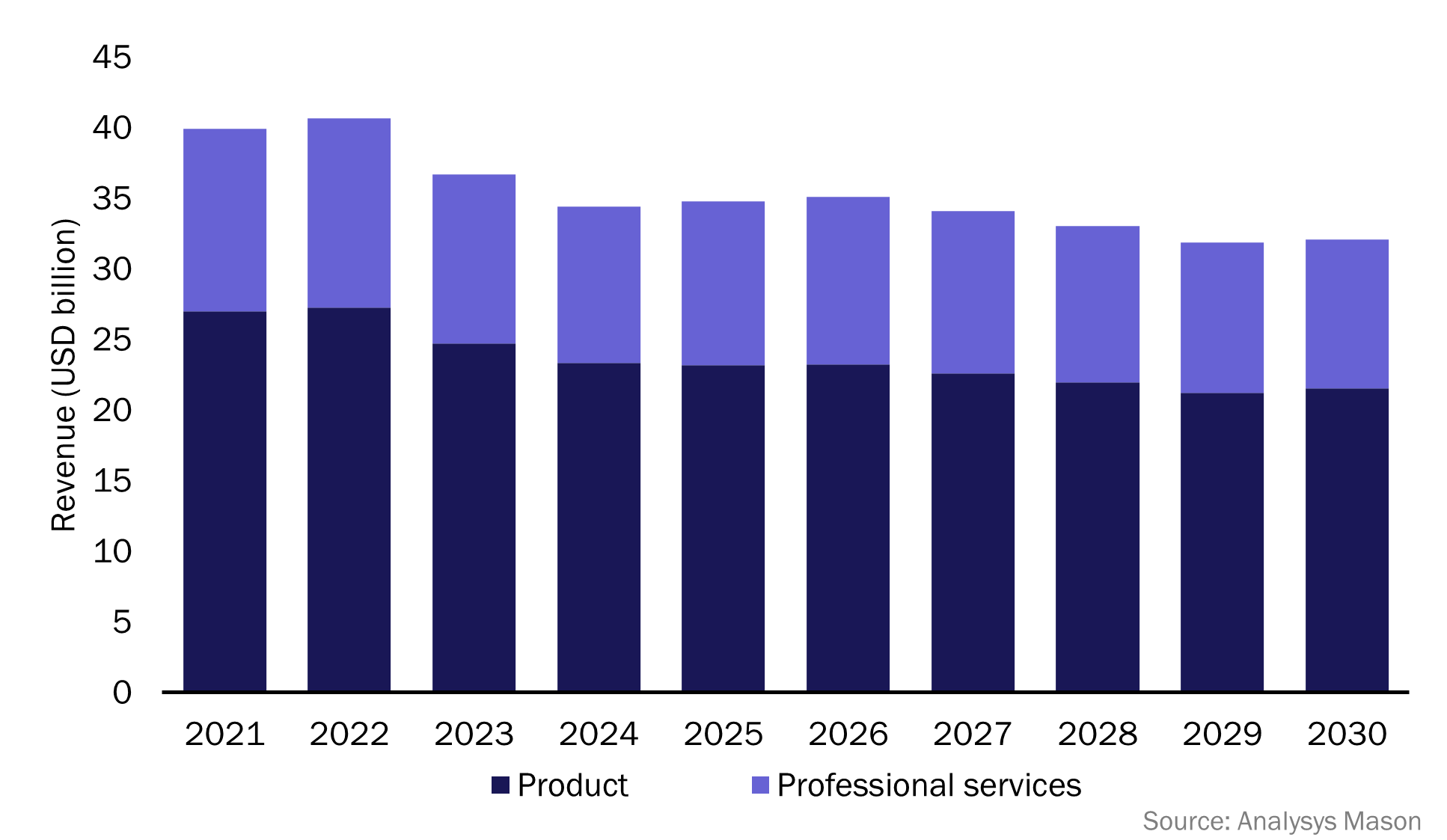

The amount of revenue generated in the RAN market has fallen significantly since the start of 2023, thereby shaking industry confidence (Figure 1). This decline is expected to continue throughout 2024, but market conditions are beginning to show signs of improvement. The RAN market is expected to become more stable, though operator capex fatigue means that significant long-term revenue growth is not anticipated.

Figure 1: RAN total revenue by delivery type, worldwide

Analysys Mason’s Radio access networks: worldwide forecast 2021–2030 explains that RAN revenue growth in emerging markets and the adoption of new architecture such as virtualised RAN (vRAN)/Open RAN and 5G standalone (SA) will be the main sources of RAN market stability during the forecast period. However, the impact of these new architectures will only be fully realised when a substantial proportion of operators are sufficiently convinced of their value. It is therefore critical that vendors demonstrate the real-world capabilities of these new architectures, and they should use the experience of early movers to prove the business case for migration to the wider market. The business case for both 5G SA and Open RAN will be maximised when these architectures are combined with the latest capabilities of 5G Advanced and network AI.

A return to stability in North America and revenue growth in emerging regions will halt the RAN market decline

Vendor revenue for RAN products and services worldwide declined by almost 10% year-on-year in 2023, driven predominantly by a slow-down in market activity in North America (NA) and developed Asia–Pacific (DVAP). Indeed, revenue in NA plummeted by over 30% year-on-year in 2023 as major operators in the region built up excess inventories and reduced their spending following large-scale deployments using mid-band spectrum. This was countered somewhat by a peak in demand in India, driven by high-intensity roll-outs by Bharti Airtel and Reliance Jio. However, this did not compensate entirely for the decline in NA and the negative performance in other key regions.

The worldwide RAN market was affected by the poor economic situation in major nations, as well as decreased demand caused by operators’ hesitancy to adopt new network architecture. Indeed, spending on Open RAN and vRAN architecture declined in 2023, despite having grown substantially between 2020 and 2022. Major Open RAN projects from early movers reached natural milestones, and delays to new adopters’ timelines created a gap in demand. 5G SA adoption at the RAN level was also disappointing; 5G SA-related RAN revenue grew in 2023, but the architecture has not yet seen the success that many vendors were hoping for.

Market conditions are expected to improve worldwide in the long term, but the end of major projects in India and a slow-down in spending in China will push the market into further decline during 2024. Nonetheless, the market in NA is already showing signs of stabilisation, and revenue growth in regions such as emerging Asia–Pacific (EMAP), Latin America and Sub-Saharan Africa (SSA) will contribute to overall stability in the future.

Open RAN, 5G SA and intelligent massive MIMO will be the main sources of RAN revenue growth

The RAN market will return to stability between 2025 and 2028, predominantly thanks to operators’ delayed migrations to new architecture and investment in massive MIMO (mMIMO). vRAN and Open RAN will be the fastest growing sub-segments of the market in terms of revenue, and we predict that these architectures will together account for over 70% of vendor revenue by 2030. The 2023 results have shaken industry confidence in the Open RAN market, but we still see a strong commitment by operators to roll out vRAN over the next 4 years. Indeed, the results of Analysys Mason’s latest survey of Tier 1 and Tier 2 mobile operators showed that, on average, operators expect to expand their vRAN investment to 29% of their radio footprint by 2028.

The next few years will also be a critical time for the adoption of 5G SA. The business case for the cloud-based 5G core is mounting. The first of three releases of the 3GPP 5G Advanced standards is now frozen, and developments in network AI and automation are improving the business case for cloud-native networks. 2023 was a poor year for new 5G SA service introduction (Analysys Mason’s 5G deployment tracker shows that only 11 5G SA networks went live in 2023, versus 15 in 2022), but existing 5G SA networks continued to be expanded, thereby driving RAN deployments and upgrades. There will be further proof points of the benefits of 5G SA (such as new services creation, agility and full automation) as the footprint of 5G SA-capable networks and devices continues to grow.

Continued innovation in mMIMO and more-intelligent antenna solutions will also provide incentives for operators to invest in their networks. mMIMO solutions from vendors are becoming increasingly advanced in terms of chipset performance, beamforming and energy efficiency, and vendor revenue for mMIMO is expected to increase at a CAGR of 14% between 2021 to 2030.

Vendors must focus on proving a combined business case for Open RAN, 5G Advanced and network AI

Open RAN and 5G SA will be the main sources of RAN market growth for the next 6 years, but neither will reach its full potential while operators continue to remain hesitant about the business case for new architecture. Many operators still need additional proof points for both domains in terms of total cost of ownership savings and how these new architectures can support new services and monetisation opportunities.

Vendors should use their experiences with early-mover operators to provide these proof points and should develop frameworks and initiate trials for advanced use cases that combine the latest capabilities from both the RAN and core networks. The latest developments in network AI and 5G Advanced should be incorporated deep within these efforts to maximise the combined business case for 5G SA and Open RAN. So far, there have been many efforts by vendors to develop and advertise AI functionality, but more must be done to link these efforts to the architectural business cases of 5G SA and Open RAN.

Article (PDF)

DownloadAuthor

James Kirby

Senior AnalystRelated items

Survey report

Operators’ requirements for their next-generation RANs: survey results and analysis

Article

Stakeholders must collaborate to prove the security benefits of Open RAN and de-risk early deployments

Forecast report

Mobile packet core: worldwide forecast 2024–2030