To maximise the 5G RedCap opportunity, vendors and operators must focus on use cases and ecosystem support

08 January 2024 | Research

Article | PDF (4 pages) | IoT Services| Wireless Technologies

5G reduced capability (RedCap) is a connectivity standard that enables IoT devices to operate more efficiently and to use less bandwidth than traditional 5G devices (for example, smartphones), which reduces the cost of the associated applications because they do not require full 5G capacity. RedCap technology has the potential to increase the addressable market for 5G while providing additional capabilities over existing low-performance IoT solutions. Both vendors and operators should view 5G RedCap as an opportunity to diversify network use cases and drive network monetisation. However, operators and vendors must also ensure that they consider the strengths and limitations of the technology as part of proving its use cases and driving maturity within the ecosystem.

RedCap technology can offer a functional ‘middle ground’ between high performance 5G and NB-IoT

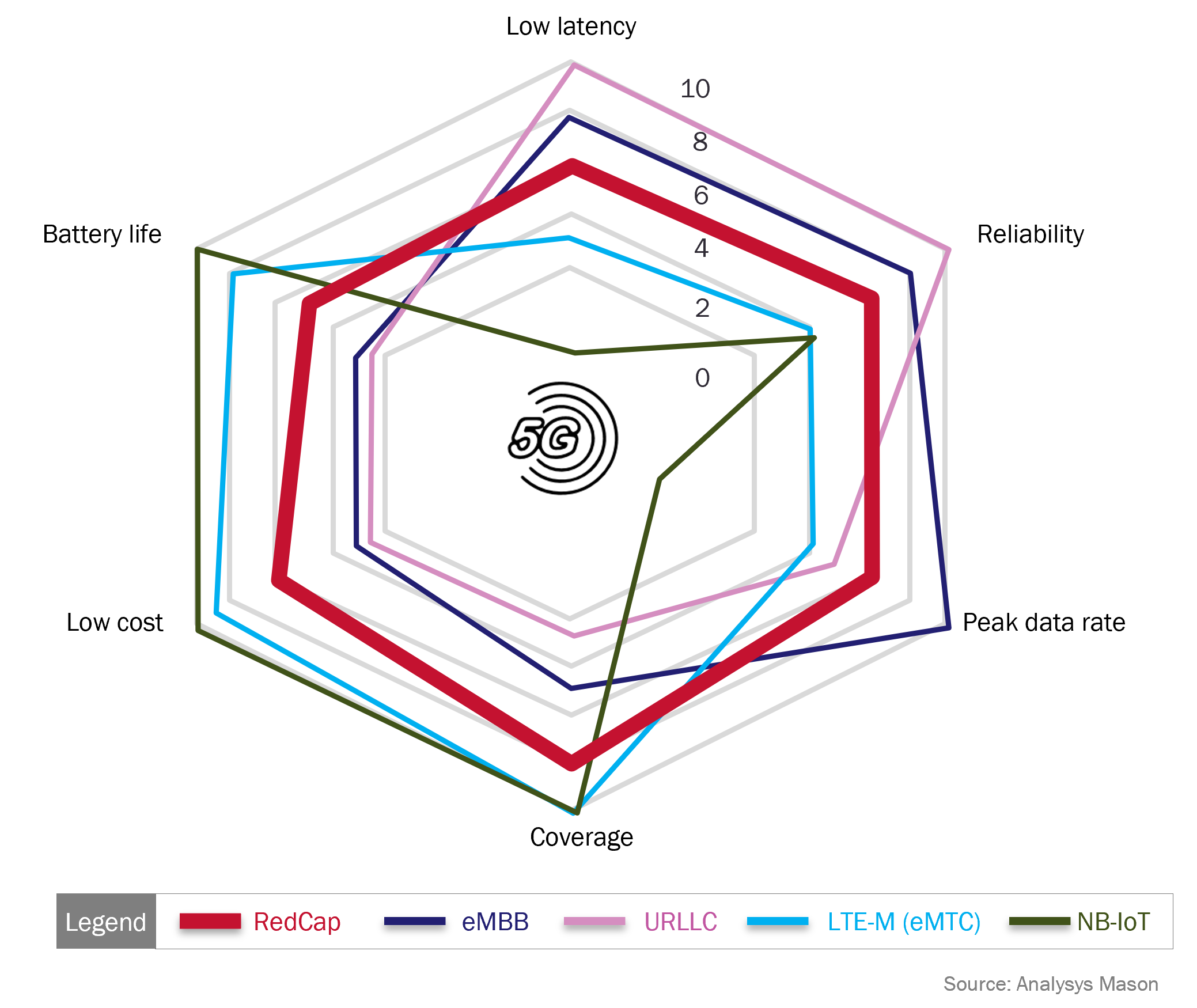

RedCap technology was first standardised in 3GPP’s Release-17 in 2022. It allows IoT devices to leverage a subset of the capabilities of the 5G network to support applications that fall between the performance requirements of 5G and narrow band IoT (NB-IoT). In this way, 5G RedCap provides a middle ground of connectivity; leveraging some of 5G’s advanced capabilities (such as low latency, high reliability and a higher peak data rates), as well as outperforming 5G enhanced mobile broadband (eMBB) in terms of component costs and battery life (see Figure 1).

Figure 1: Comparison of RedCap’s capabilities with those of enhanced mobile broadband (eMBB), ultra-reliable low latency communications (URLLC), LTE-M enhanced machine type communication (eMTC) and NB-IoT

In some scenarios, RedCap could offer a viable alternative to the two existing 4G-based IoT standards: LTE Category (Cat) 1–4 and NB-IoT. The technology will offer the following benefits over existing IoT standards.

- Reduced latency compared with existing LTE-M (eMTC) and NB-IoT technologies. This enables RedCap to support applications that require near real-time data communication.

- Higher peak data rates than LTE Cat 1 and NB-IoT to support new IoT applications that require greater bandwidth.

- Capacity to leverage new 5G capabilities including the benefits of the 5G core, such as network slicing and advanced positioning.

The reduced capabilities of RedCap devices will also offer the following benefits, which are not offered by 5G URLLC or eMBB for IoT devices and applications.

- Improved power efficiency. Compared with eMBB and URLLC, RedCap’s improved power efficiencies create a middle ground in terms of functionality and battery life.

- Reduced costs. As well as potentially lower costs than traditional devices, RedCap devices can use half-duplex frequency division duplex (FDD) transmission mode to leverage less costly switches rather than expensive duplexers.

There are also other new 5G IoT technologies that must be considered by stakeholders, such as mMTC, advanced 5G sensing and passive IoT. However, 5G RedCap offers an alternative to these technologies that is optimal for certain use cases and could create different opportunities in new and existing applications.

RedCap technology will enhance existing applications and enable new use cases, but the ecosystem is not yet mature

The following key applications for RedCap are anticipated.

- Industrial wireless sensors. This includes connected sensors for remote monitoring, predictive maintenance, energy management and asset tracking. While RedCap’s higher cost and power consumption currently limit its suitability in narrowband applications, its benefits in terms of latency and reliability make it suitable for more-critical applications. Its ability to leverage 5G improved positioning and network slicing also expands its addressable market beyond that of 4G IoT.

- Wearables. Small, connected devices (including smart watches, health monitoring devices, fitness trackers and AR/VR headsets) can be worn on the body and equipped with sensors and processors to collect and transmit data. RedCap technology enables wearables to access 5G’s lower latency, higher data rates and advanced positioning, but with a smaller device size, improved power efficiency and reduced costs.

- Surveillance devices. This includes cameras or recording devices, such as security cameras, body cams and facial recognition systems. RedCap technology could offer a lower cost alternative to 5G eMBB connectivity for these applications, potentially improving the business case for 5G connected cameras.

- Smart grids. Smart electrical grids are connected to the network to improve efficiency, reliability and sustainability. The numerous applications of smart grids are dependent on connectivity, such as smart metres, and grid sensors and for real-time monitoring. RedCap is able to bring improved latency, peak data rates and reliability to these applications compared with traditional IoT connections such as NB-IoT and LTE-M.

- Fixed–wireless access (FWA). RedCap technology can lower cost, lower performance and more compact customer premises equipment (CPE) for 5G FWA. This could help FWA to better address some emerging market opportunities where CPE prices are the main barrier to adoption.

Although 5G RedCap will offer a new balance of cellular connectivity for IoT that will be applicable across a range of applications, it remains an emerging technology that needs to prove that it can add value to end users. At the moment, RedCap has still not reached substantial commercialisation and its ecosystem remains immature, which could slow adoption of the technology.

Operators and vendors should see 5G RedCap as a key opportunity, but one that still needs proof and ecosystem support

Although RedCap will not serve all IoT applications, its potential to augment operators’ IoT offerings and to support new market segments makes it a valuable opportunity. Over the past year, trials of RedCap chipsets and products have continued to break ground and its performance enhancements in 5G Advanced are expected to further increase its utility.1 Consequently, both vendors and operators should see 5G RedCap as an opportunity to diversify network use cases and drive network monetisation. However, investment to support RedCap’s capabilities will only be justified if the industry can prove its advantages and use cases for customers.

Operators and vendors should consider themselves as key enablers of RedCap, not only in terms of connectivity, but also in driving ecosystem maturity. In applications such as surveillance, smart grids, sensors and wearables, both operators and vendors should build specialised partnerships, support new device manufacturers and demonstrate the benefits that RedCap can offer both existing markets and new applications. By doing so, operators and vendors can accelerate the pace of ecosystem maturity to increase RedCap adoption and new revenue opportunities.

1 For further information, see Analysys Mason’s 5G Advanced R&D tracker.

Article (PDF)

DownloadAuthor

Stephen Burton

AnalystRelated items

Article

Stakeholders must collaborate to prove the security benefits of Open RAN and de-risk early deployments

Forecast report

Mobile packet core: worldwide forecast 2024–2030

Strategy report

Considerations and strategies for Open RAN cyber security