Refuelling providers need strategies to match changing demand for in-orbit satellite services

In early March 2024, NASA cancelled On-orbit Servicing, Assembly, and Manufacturing 1 (OSAM-1), a mission that was designed to demonstrate in-orbit satellite refuelling and assembly, and had been in development for a decade. Cancelling a key demonstration of a service, at a critical stage in the development of the in-orbit services (IOS) market, raises questions as to the viability of some services, particularly satellite refuelling.

At the same time, several announcements suggest that commercial demand is shifting away from satellite operators towards other IOS providers, such as ClearSpace and Astroscale, and demand from government and military customers is expected to increase. In addition, alternative technologies and approaches will challenge the value proposition, but satellite refuelling IOS providers will be able to compete in this evolving market via strategic partnerships, compatible design approaches and an eye to expanding capabilities.

Satellite refuelling will continue to generate revenue, but demand from commercial customers is declining

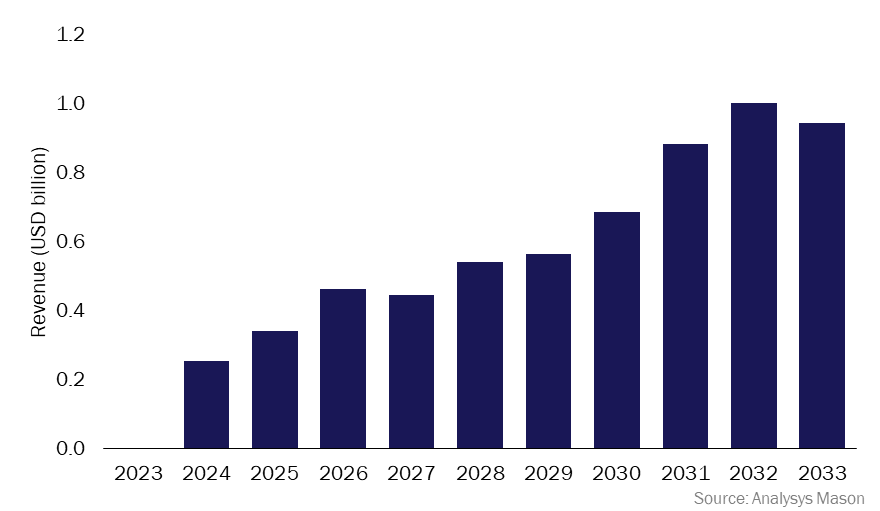

Analysys Mason’s recently published In-orbit satellite services, 7th edition report forecasts over USD6 billion in cumulative revenue from satellite refuelling, as a subset of life extension (LE) services, between 2023 and 2033 (Figure 1). In fact, while IOS are diversifying into other applications such as last-mile delivery, de-orbiting, and debris removal, LE services will generate the most revenue overall. Despite advances in manufacturing and launch, satellites remain expensive, and the ability to extend their mission more cheaply than replacing them, remains enticing.

Figure 1: In-orbit satellite life extension service revenue, worldwide, 2023–2033

OSAM-1 began development nearly 10 years ago. At that time, its sole mission was to refuel the Landsat-7 satellite. However, in 2020, NASA changed the mission design, requiring OSAM-1 to also demonstrate in-orbit robotic assembly. After a recent report from NASA determined that OSAM-1 was several years delayed and had exceeded its USD2 billion budget, OSAM-1 was cancelled.

The cancellation is a shame, but not a surprise. The programme was ambitious, not only involving the refuelling of a satellite, but an unprepared one, as well as on-orbit assembly. Refuelling an unprepared satellite, as in a satellite that was not originally designed to be refuelled, is on the far horizon of what is achievable. To add an assembly component to the mission more than doubled the originally projected cost. In space, complications are magnified. If one requires an extra part or wishes to extend a mission in the slightest, the consequences may be far more costly, and difficult than here on Earth.

The demand for satellite refuelling services is mainly coming from government and military customers

Despite these challenges, demand for satellite refuelling has continued. The US government and military officials have expressed interest, specifically citing the ability to “maneuver without regret” as a driving factor. As satellites continue to increase in capability, and as other nations continue to demonstrate the ability to change orbits and inspect other sovereign satellites, US officials cite a satellite’s limited fuel as a restriction in this context. NASA itself has cited a “broader community evolution away from refuelling unprepared spacecraft”, but the emphasis here is on “unprepared”. Customers and manufacturers have already begun to incorporate refuelling capability into future spacecraft design. While replacing satellites remains an option, extending the life of satellites via refuelling is often more enticing as it ensures continued operation and service, preserves limited orbital launch locations, and shifts risk away from the prospect of building and launching entirely new spacecraft.

Interest in satellite refuelling for commercial customers has shifted in the meantime. The prime driver for refuelling services has always been the limited on-board chemical propellant. However, electrical propulsion has developed significantly, to the point that the majority of commercial geostationary satellites are expected to adopt it. In addition, alternatives, such as smaller satellites and new technology continues to grow. The result is a decrease in satellite refuelling from commercial customers, reflected as a 9% reduction in the CAGR of revenue, decreasing the commercial revenue forecast by USD700 million, compared to the previous edition of our forecast report. However, the expanding market is leading to the rise of refuelling demand from other in-orbit service providers, which is expected to grow as the sector develops.

Satellite refuelling service providers will need to integrate and expand

Integration is at the heart of all in-orbit services. After all, the value proposition of IOS is to support the satellite manufacturing and launch industries. As such, satellite refuelling technology, value and supply chains must fit with established processes. Deviation from this can lead to delays, cost increases, and confusion in procurement. Partnerships are essential for ensuring this collaborative approach, benefiting from economies of scale, and access to funding.

Expansion is the future of the IOS market. While the first step is to replace traditional satellite practices, the future should be focused on expanding capabilities. Satellite operators continue to want increased flexibility in terms of both satellite design and operation, and IOS providers must be prepared to adapt and offer value that evolves with their customers. Satellite refuelling service providers must turn their attention to government and military customers and other IOS providers, and their typical practices and priorities. Additionally, satellite refuelling is a niche service in an under-developed area of the market. Combined with the growing presence of electric propulsion, satellite refuelling may have a potential end-of-life, when such services will not be in demand. While adding a new capability to OSAM-1 may have led to its cancellation, IOS providers must recognise that refuelling is a means to an end, and only one part of the life extension market.

Article (PDF)

DownloadAuthor