Rich Business Messaging has limited appeal for businesses, but A2P vendors could drive demand

Infobip held its Rich Messaging Live event in London in March 2023, with particular focus on Rich Business Messaging (RBM).1 RBM offers increased functionality compared to application-to-person (A2P) SMS messaging, and although penetration is on the rise, factors such as Apple’s refusal to adopt the technology are limiting adoption. Infobip outlined what it is doing to overcome these issues at the event.

There are 12 countries worldwide where all the network operators are RCS-enabled. RCS penetration remains low and businesses have limited interest in adopting a richer operator-based messaging experience instead of using a combination of A2P SMS and third-party apps (for example, WhatsApp). Infobip’s RCS Pilot Programme is offering Infobip’s customers the chance to move from A2P SMS services to RBM, with minimal effort, at no additional cost per message.2 This will demonstrate the capabilities of RBM, increase exposure and generate return on investment for RCS-enabled operators by reducing the barriers to entry.

RBM offers significant customer service capabilities, but its reach is limited despite the efforts of Google and operators

RBM should provide a more flexible and trusted form of messaging than SMS. Businesses using RBM must be verified by Google and then approved by the operator before engaging with end-users. The end-user can see that the business has been verified (a feature that WhatsApp is currently testing). Additionally, RBM offers increased functionality (compared to SMS) such as read-receipts, link tracking, e-commerce or moving an A2P message to a customer service conversation seamlessly.

A2P vendors such as Infobip offer RBM for the same price as A2P SMS messaging (with SMS as a back-up channel). If the operator does not have an RCS-enabled network, the message can be delivered as an over-the-top (OTT) message by Google such as is the case with Virgin Mobile in the UK. For example, if a Virgin Mobile customer has an Android device with RCS integrated into the native messaging app, the messaging will appear there – otherwise the recipient will have to download an app to receive the message as a RBM rather than an SMS.

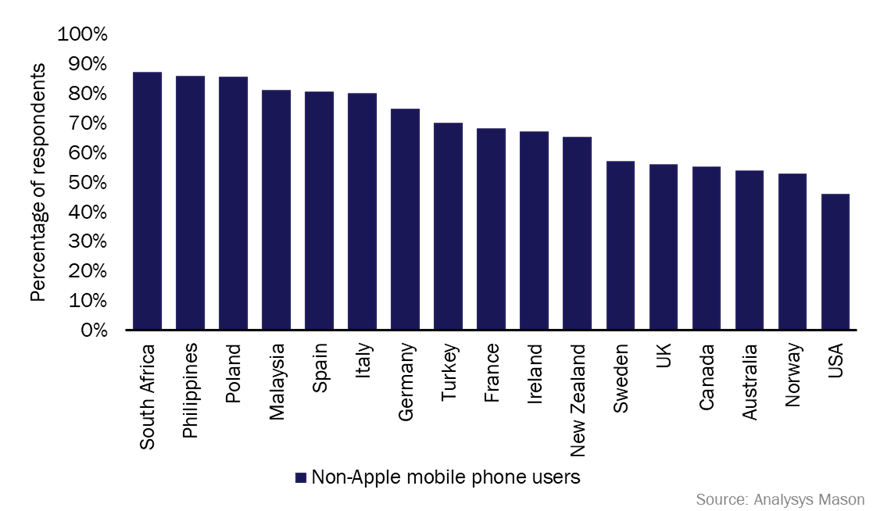

A major challenge for RBM is adoption. RCS penetration is limited to Android devices because Apple is not supporting the technology. Figure 1 is the number of users who could have RCS capabilities according to the Analysys Mason consumer survey. RCS penetration estimates vary significantly. In aggregate, it is likely to be used by around 20–30% of the UK’s population.

Figure 1: Penetration of non-Apple device users, by country, 2022

Google is continuing to engage with Apple to encourage adoption. Additionally, the EU passed the Digital Markets Act 2022, which states technology companies such as Apple must “ensure the interoperability of their instant messaging services’ basic functionalities” requiring compliance by 2024. One solution for Apple to comply would be to adopt RCS. If Apple fails to comply it could face a fine of up to 20% of its total revenue.

Infobip is pursuing solutions to drive businesses to move from A2P SMS to RBM, enabled by the RBM pricing strategy

RBM abide by the same data and privacy laws as SMS A2P messaging so businesses can easily move from SMS A2P messaging to RBM. A2P vendors can encourage businesses to do this by making a zero-effort transition that can be achieved at no additional cost. This is Infobip’s strategy to RBM.

Infobip manages the account set-up and creates ‘agents’ (that is, conversational entities that can respond to two-way RBM conversations). This allows businesses to use RBM to reach RCS-enabled end-users at no additional cost, bypassing any ubiquity concerns (because SMS is a back-up channel), while increasing customer engagement and awareness of RBM. Infobip’s approach demonstrates the utility of RBM and reduces the resources required to benefit from RBM.

Additionally, Infobip’s approach allows operators to see a return on their RCS investment and familiarises end-users with the benefits of RCS – however, it requires vendors to invest. Many vendors may be reluctant given RCS’s low penetration and the uncertainty arising from global financial concerns.

Figure 2: RBM pricing strategy

| RBM message type | Functions | Price |

| Basic |

|

Charged per message.

|

| Premium |

|

Charged per message. ‘Slightly’ higher than a basic message.

|

| Conversational |

|

Charged per 24-hour period.

|

Source: Analysys Mason

Figure 2 shows the standard pricing model as suggested by Google, but individual operators or aggregators may offer variations. Additionally, if an RBM end-user is visiting another country (away from their home network) the cost of receiving the rich message is not standardised and will vary by operator.

All stakeholders need to invest in RCS if adoption is to be maximised

The availability of RCS is on the rise and some big brands (for example, Asda and FedEx) are experimenting with RBM. With continued heavy investment from Google, operators and A2P vendors RBM will continue to grow. RBM offers the necessary functionality for operators to compete directly with third-party apps (for example, WhatsApp) for business messaging. It is uncertain whether RBM will supersede third-party apps and SMS to become the default business messaging platform or whether it will only fragment the market further. Its reach is limited, but growing. However, that growth will continue to be limited until Apple adopts RCS.

RBM accounted for 1% of the total number of business messages in 2022 and this is expected to rise to 9% by 2027 according to Analysys Mason’s Application-to-person messaging: worldwide trends and forecasts 2022–2027.

1 RBM refers to messaging, including A2P messaging, over the Rich Communication Services (RCS) platform.

2 Assuming an equivalent message, a ‘basic’ RBM consisting of text which is less than 160 characters.

Article (PDF)

DownloadRelated items

Tracker report

Fixed broadband speed tracker 2Q 2025: trends and analysis

Article

Hyperscaler submarine investments will continue in Asia–Pacific, and other regions are primed for growth

Article

D2D services must balance capabilities, expectations and willingness to pay