RingCentral is increasing the number of its operator partners thanks to focused investment in this channel

20 September 2021 | Research

Article | PDF (3 pages) | SME Services| Enterprise Services

Listen to or download the associated podcast

RingCentral announced seven new partnerships with service providers between mid-2020 and mid-2021, including three with Tier 1 operators. RingCentral boasts several features that make it attractive to operators, but few are unique; its willingness to invest seems to be a crucial factor in the rapid growth in the number of its partnerships with operators. As the number of its partners increases, operators will need to carefully consider how they can develop their service wrap to provide distinctive UCaaS propositions.

RingCentral has made rapid advances since mid-2020 to sign up operators to its service provider programme

In November 2020, RingCentral had just three partnerships with Tier 1 operators – AT&T, BT and Telus – all already long-standing partners. Since then, RingCentral has announced partnerships with Deutsche Telekom, Verizon and Vodafone, and has signed up four smaller service providers (Eclipse Technology Solutions, ecotel, Horizon Telecom and Stack8) since mid-2020. RingCentral is investing substantial resources in its Global Service Provider business unit and expects to continue to expand its number of operator partners.

Other UCaaS providers are developing operator partnerships, but few are investing as much or growing this channel as rapidly as RingCentral. Microsoft Teams is supported by many operators, but partnerships are typically focused on provision of PSTN connectivity rather than a joint product offering. Cisco’s products are also offered by many operators but it has struggled to replicate the success of its Broadsoft platform with its cloud-based Webex product. Some of Zoom’s operator partnerships are beginning to extend to PSTN-integration or more integrated services but other major players in the UCaaS market typically partner with operators on essentially a reseller basis. For example, BT Global’s partnership with Zoom offers its products as part of a multi-vendor UC platform with enhanced security and service management.

Co-branding, go-to-market support and some level of network integration are common elements of RingCentral’s partnerships

RingCentral’s most recent partnerships offer co-branded products (for example RingCentral with Verizon), but the look and feel of the product and associated app is typically designed to reflect the operator brand. In the past, major operators have preferred white-label solutions, but RingCentral claims that operators are shifting towards using partner branding to emphasise the strength of those partners.

RingCentral provides significant go-to-market support, with dedicated sales teams assigned to each operator. Verizon told analysts that “At every stage of the go-to-market process, you’re going to see the RingCentral team and Verizon team shoulder to shoulder” and RingCentral marketing material appears on the websites of several of its partners. RingCentral has also created a set of API capabilities to allow operators to integrate their back-office systems with its cloud capabilities to support digital sales, account activation, billing, trouble ticketing and churn management.

RingCentral also offers operators an opportunity for network-level integration. Several of its partnerships include FMC services and it claims to be the only major UCaaS provider to extend all of its cloud functions over native dialling. It is working on IMS integrations for voice-over-5G services. RingCentral says that it is in advanced discussions with operators concerning deployment of UCaaS solutions at the network edge, and development of dedicated points of interconnect between the RingCentral cloud and operator infrastructure.

The operator channel is not the only one that RingCentral is investing in. It has also formed strategic partnerships with Atos, ALE and Avaya to become the exclusive solution marketed to their legacy on-premises customer base. Indeed, Deutsche Telekom’s own partnership includes access for its customers to Atos’ Unify Office by RingCentral. For at least two of these partnerships (Avaya and ALE), a substantial amount of cash was transferred up-front from RingCentral to the partner, indicating the strength of RingCentral’s appetite to gain access to customers.1 Its expansion plans are also supported by a rapidly growing number of reseller and independent software vendor (ISV) partners.

RingCentral is an attractive partner for operators, but other vendors may have much to offer too

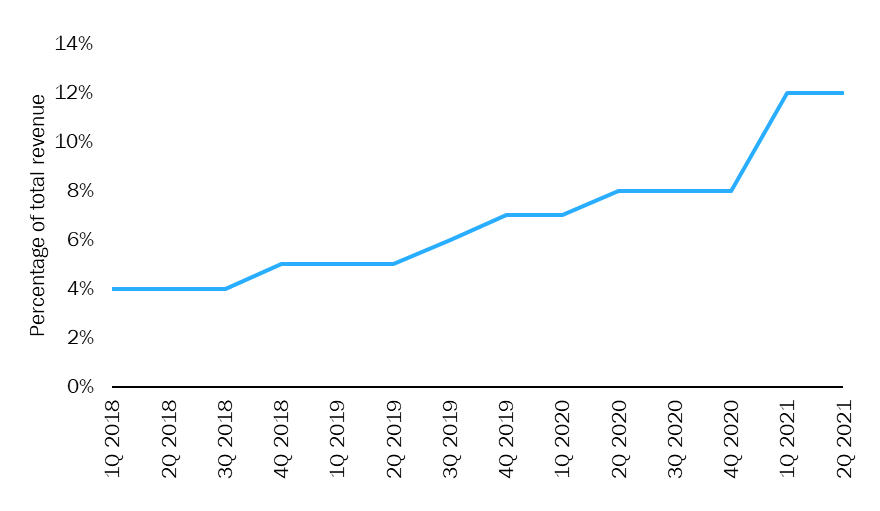

For RingCentral, its investments in operator partnerships seem likely to be an important contributor to securing ongoing revenue growth as it expands beyond its core small and medium-sized business markets in North America. The share of its revenue that is generated outside North America increased rapidly in the first half of 2021 (see Figure 1).

Figure 1: RingCentral’s revenue that is generated outside North America, 1Q 2018–2Q 2021

Source: Analysys Mason

For operators, RingCentral’s products provide a scale-able, cloud-based solution that can be rapidly provisioned and is suitable for a broad range of business types and sizes. RingCentral has also integrated contact centre solutions and API-integrations with a broad range of collaboration tools. Several other vendors offer similar products, but RingCentral’s go-to-market support, network integration opportunities, and above all its willingness to invest substantial resources in these partnerships, makes it an attractive choice for many operators. One of RingCentral’s existing partners told us that it values RingCentral’s collaborative approach, including the level of strategic integration and its flexibility to adapt to partner needs.

However, operators will need to carefully consider the potential value of alternative vendor partnerships. Although RingCentral does offer flexibility and opportunities for operators to differentiate, the retail products being advertised to businesses by its partners are strikingly similar in terms of price points and service bundling. Given RingCentral’s growth ambitions, it seems certain that the number of partners will increase, so the need for operators to ensure their service wrap is able to provide adequate levels of differentiation will only increase.

Individual operators have partnered with a growing number of vendors in the SD-WAN market in order to meet enterprise demand for specific technology solutions. We expect to see a similar trend in the UCaaS market. For smaller businesses, vendor choice is less important, but RingCentral’s products are unlikely to meet the needs of all small businesses. In particular, alternative providers may be better placed to support demand from the most price-sensitive businesses, and from some vertical segments and businesses with bespoke requirements.

1 For more information, see www.ringcentral.com/whyringcentral/company/pressreleases/ringcentral-to-become-exclusiveprovider-of-ucaas-solutions-to-avaya-in-strategic-partnership.html and www.ringcentral.com/whyringcentral/company/pressreleases/alcatel-lucent-enterprise-and-ringcentral-enter-into-a-strategicpartnership.html.

Article (PDF)

DownloadAuthor

Catherine Hammond

Research DirectorRelated items

Article

KDDI’s results demonstrate the challenges of entering new markets such as energy and finance

Strategy report

Strategies for telecoms operators to evolve their network-as-a-service (NaaS) propositions

Tracker

Cloud service providers' revenue tracker 2024