The Rogers–Shaw–Videotron deals could unlock the growth of fixed–mobile convergence in Canada

03 May 2023 | Research

Article | PDF (4 pages) | Fixed–Mobile Convergence| North America Metrics and Forecasts

The adoption of fixed–mobile convergence (FMC) services in Canada has historically been low because of the limited overlap of operators’ mobile and fixed networks and market fragmentation. The market structure changed in April 2023, when the government approved the merger between Rogers and Shaw, forcing Shaw to divest its mobile division to preserve competition in the mobile market.

Rogers became the first operator with nationwide mobile and fixed network coverage. Videotron bought Shaw’s mobile division and can finally launch services outside Quebec, its home province. These transactions represent a milestone in the development of the FMC market in Canada.

This article draws on the Analysys Mason’s Fixed–mobile convergence in Canada: trends and forecasts 2023–2028 report (forthcoming). The report provides detailed 5-year forecasts for the adoption of FMC and multi-play services and an analysis of operators’ strategies.

FMC service adoption is limited in Canada because the fixed broadband market is fragmented

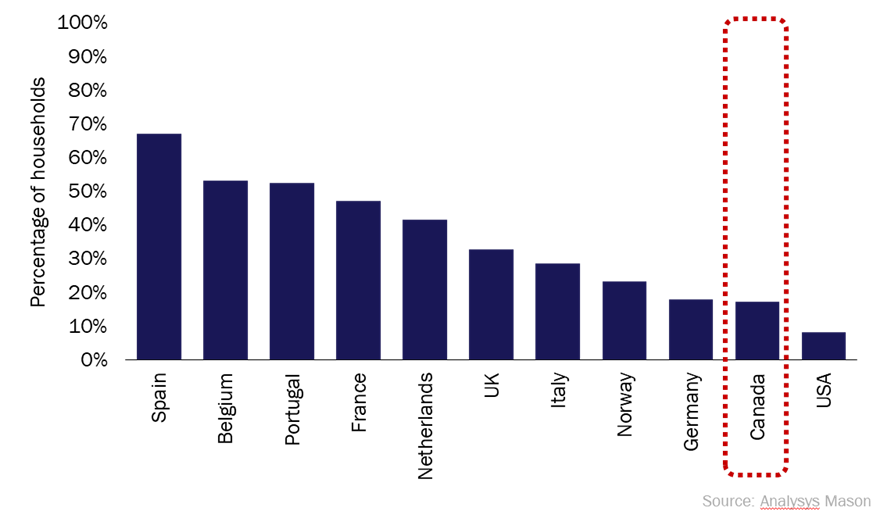

FMC household penetration was 17% in Canada in 4Q 2022, which is low by comparison with other countries (Figure 1).

Canada’s integrated operators have historically not had strong incentives to promote FMC options due to the lack of national challenger operators and limited competition from standalone players. To protect their market share, they promoted fixed broadband plans with 24-month subscriptions and offered multi-SIM plans, rather than FMC bundles.

Figure 1: Penetration of FMC accounts, Canada and selected countries, 4Q 2022

The Rogers–Shaw–Videotron deals established a new national integrated operator and a new regional challenger operator

The government approved the merger between Rogers and Shaw’s fixed division in April 2023, after 2 years of political discussions and negotiations.

Canada has one of the highest mobile and fixed broadband retail tariffs in the world, and there were worries that the consolidation of the two large players would result in prices increasing even further. To allow the deal to go ahead and increase retail price competition in the mobile market, the government forced Shaw to divest its main mobile division (Freedom Mobile).

The transactions mark notable changes to the market (Figure 2).

- Rogers became the first operator to entirely cover Canada with both its mobile and fixed networks.

- Videotron can expand its operations outside Quebec. It has looked for years for opportunities to develop its business in new regions of Canada because it had limited room to increase its share of connections in Quebec.1

Figure 2: Overview of changes following the Rogers–Shaw–Videotron transactions, Canada, April 2023

| Topic | Rogers | Videotron |

| Transaction | It bought Shaw’s fixed division for USD15 billion | It bought Freedom Mobile, Shaw’s main mobile brand, for USD2.1 billion |

| Fixed network coverage | Coverage expanded from eastern Canada to western Canada | Coverage remains limited to Quebec |

| Mobile network coverage |

|

|

| Market share of connections |

|

|

Source: Analysys Mason

These two transactions could unlock the growth of FMC

Videotron will use a competitive pricing strategy to gain mobile market share in the new areas. It has agreed with the government that it will soon increase by 10% the data allowance included in the mobile plans of existing Freedom Mobile customers and that it will introduce mobile tariffs that are at least 20% cheaper than the tariffs offered by the major operators.

Videotron can also introduce FMC bundles, even though it does not have a fixed network outside Quebec.2 In early April 2023 it stated that it will launch “attractive multi-service bundles including not only wireless, but also Internet and television services, within the next few months”.

Videotron will probably launch fixed broadband and FMC services by buying wholesale services. Many standalone or predominantly mobile operators worldwide have built a large FMC customer base in recent years, reselling FTTP services over third-party networks. Videotron can pursue a similar strategy, benefiting from improved regulation on wholesale services. In March 2023, the government reduced by 10% some fixed wholesale fees. It also plans to open up the FTTP network of the major operators in all regions of Canada.3

Rogers has scope to quickly consolidate its and Shaw’s customer bases using FMC, before Videotron launches the new tariffs outside Quebec. Rogers has historically been cautious about promoting FMC bundles; it offered such services for a limited time in 2022. In 4Q 2022, it stated that “we will continue to capitalize on that [bundling] […] at the right time”. Now that it has nationwide mobile and fixed broadband network coverage, it can build bundles with well-integrated mobile and fixed services (rather than offering simple cross-selling options as the other operators do).

Videotron’s expansion outside Quebec represents a threat on a regional basis to Bell, Rogers and Telus. These operators need to monitor Videotron’s strategy and changes to FTTP wholesale regulation, to be ready to adapt their operating strategies. They can make greater use of FMC bundles to consolidate their customer bases, ahead of Videotron’s expansion in new areas. If they wait for too long, they might have to pursue a similar FMC strategy later, but will have to offer significantly larger discounts.

1 Its share of fixed broadband connections was at 11.5% from 2019 to 2022 and its share of mobile connections increased by only 0.5 percentage points to 4.4% in the same period. For more information, see Analysys Mason’s Americas programme and Analysys Mason’s DataHub.

2 It bought VMedia in 2022, a small internet service provider with around 50 000 customers. VMedia provides fixed services in Alberta, British Columbia, Ontario and Quebec, mainly thanks to wholesale agreements. It has also a small proprietary fixed network.

3 The government plans to force all fixed operators to provide their competitors with wholesale access to their FTTN and FTTP networks in all regions of Canada. As of 1Q 2023, Ontario and Quebec were the only regions where there was open-access regulation on FTTP services.

Article (PDF)

DownloadAuthor

Stefano Porto Bonacci

Principal AnalystRelated items

Tracker

Fixed–mobile convergence quarterly metrics 4Q 2024

Forecast report

Ireland: fixed–mobile convergence forecast 2024–2029

Article

Fixed–mobile bundles: benefits such as higher fixed speeds can be as powerful as monetary discounts