SASE represents a USD16 billion opportunity for operators

Listen to or download the associated podcast

SASE solutions bring together SD-WAN with cloud security to form an integrated service. Revenue for each of the component markets (that is, SD-WAN and cloud security) is expected to grow strongly between 2022 and 2027, and SASE services will account for a growing share of the combined revenue. There are also significant bundling and cross-selling opportunities for players in each of the individual markets, and we expect that these will contribute to the anticipated rapid increase in the adoption of SASE solutions.

This article highlights key findings from Analysys Mason’s SD-WAN and SASE: worldwide trends and forecasts.

SASE offerings will account for a growing share of the spending on SD-WAN and cloud security services

SASE is commonly understood to be the integration of SD-WAN, security service edge (SSE) and firewall-as-a-service (FWaaS) solutions into a single offering.1 Many SD-WAN vendors are extending their offerings to include security elements, and security vendors are adding SD-WAN to their products. Some operators and other service providers already offer single-vendor SASE solutions or are developing integrated multi-vendor solutions. The markets for both SD-WAN and SSE are growing rapidly, but spending on these solutions may increase even more rapidly due to the integration enabled by SASE.

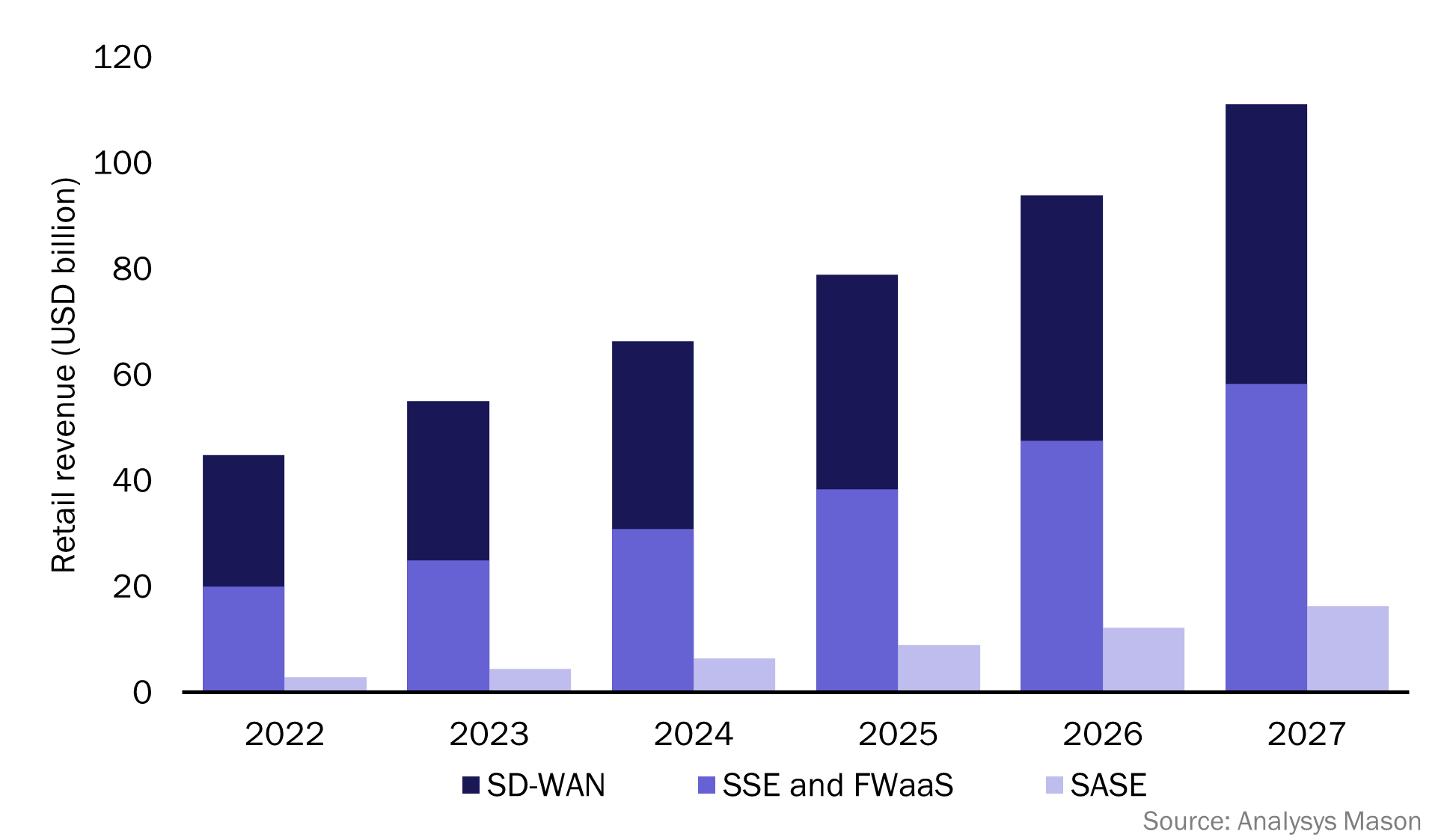

The combined SD-WAN, SSE and FWaaS markets worldwide will generate over USD110 billion in revenue by 2027; this will be split almost equally between SD-WAN and security (Figure 1). This combined market size represents the total addressable market for SASE services. SASE solutions are not a new revenue stream in themselves, but delivering SD-WAN and security as an integrated product offers significant cross-selling opportunities for providers.

Figure 1: SD-WAN, SSE and FWaaS and SASE revenue, worldwide, 2022–2027

The adoption of SASE solutions is being driven by businesses’ need to improve both the performance and reliability of cloud services (addressed by SD-WAN) and the security associated with accessing applications and data in the cloud. The integration of SD-WAN and security is appealing to businesses of all sizes because a combined solution is often simpler to control and implement than two separate products; it also allows businesses to reduce their number of suppliers. As such, we expect that SASE will account for 15% of the combined SD-WAN and cloud security market in 2027, up from 6% in 2022. The total SASE retail revenue will reach USD16 billion by 2027.

SD-WAN retail revenue has grown significantly in recent years. The number of enterprises served is also growing strongly, and the number of locations per enterprise is trending upwards for several vendors. We expect that this growth will continue into the future, as shown in Figure 1; SD-WAN retail revenue worldwide will double between 2022 and 2027 to reach USD54 billion. The number of sites using SD-WAN services will also roughly double during this time period across all regions and business sizes.

Spending on SSE and FWaaS has also increased rapidly recently. For example, Zscaler reported a 56% year-on-year increase in revenue in FY2021. We expect that revenue for these services will grow at a CAGR of 24% between 2022 and 2027 to reach USD58 billion worldwide by 2027. Large and very large enterprises currently account for the vast majority of cloud security spending, but we expect that the adoption of cloud security services among small and medium-sized enterprises (SMEs) will rapidly increase as standardised, low-cost services become more readily available.

We expect that businesses of all sizes will adopt SASE solutions

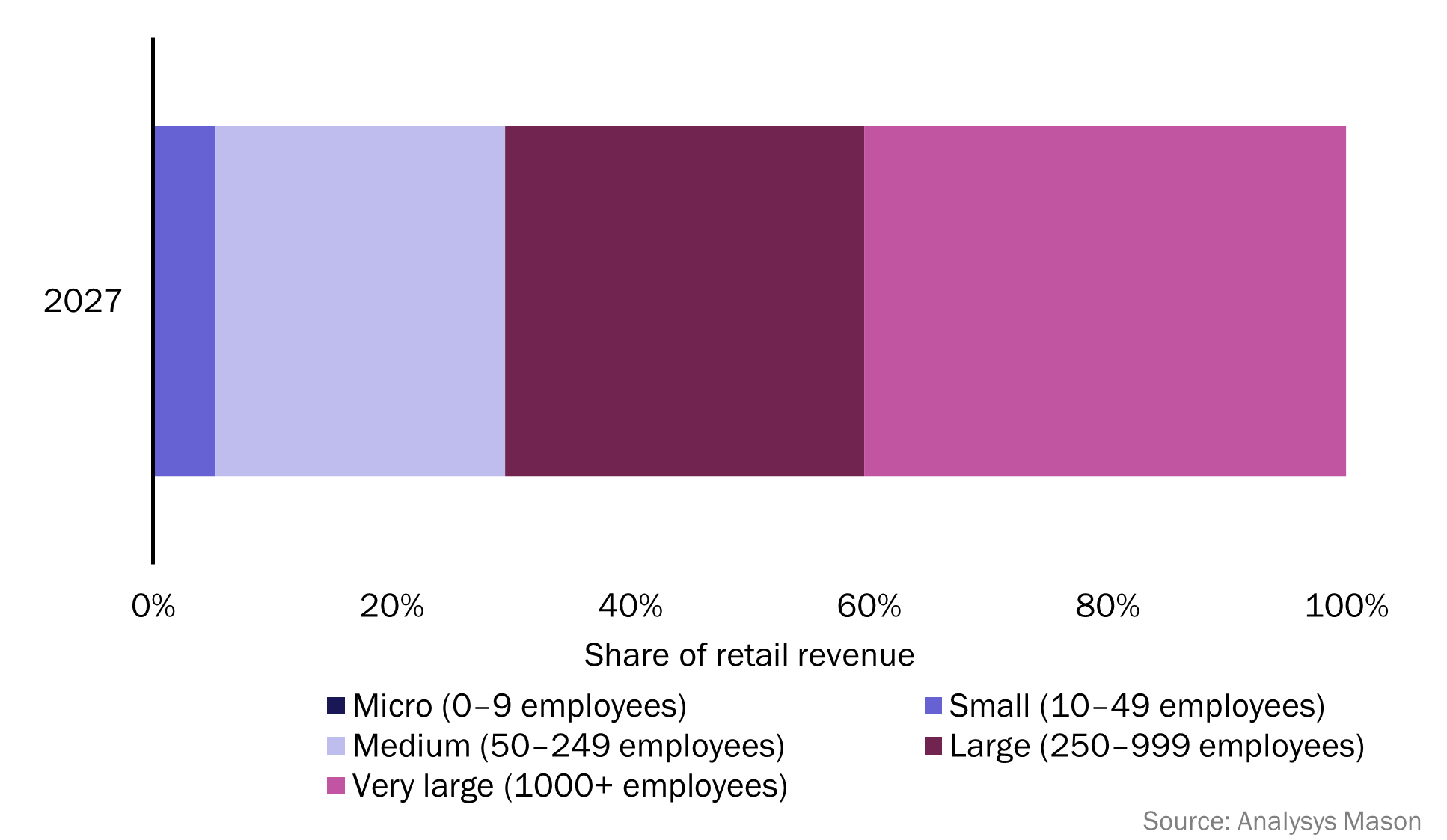

Large and very large businesses account for most of the spending on SSE and FWaaS worldwide. Indeed, 72% of large and very large businesses will buy at least one SSE or FWaaS solution by 2027. They also account for a significant portion of the SD-WAN market. This means that many large and very large businesses are already in a position to adopt SASE services, and indeed, many of the first SASE deployments have been made by these firms. However, we expect that the take-up of SASE solutions will be quite gradual for this segment because it will be limited by contract lifecycles and multiple regional approaches within a single business.

Large and very large enterprises will generate the most SASE retail revenue in 2027. However, revenue growth rates among SMEs will be more rapid, albeit from a much smaller base. We expect that SMEs will generate almost 30% of all SASE revenue by 2027 (Figure 2). SASE may be particularly appealing to SMEs because they have few legacy security services to replace, thereby allowing them to be flexible enough to adopt SASE solutions. Standard, integrated solutions may also be more affordable for the SME segment than for their larger counterparts.

Figure 2: Share of SASE retail revenue by business size, worldwide, 2027

SASE has the potential to deliver strong revenue growth; operators should not miss out on this opportunity

Many operators have already taken steps to launch SASE solutions; others should follow quickly to avoid missing out on the fast-growing market. Operators hold a strong position in the connectivity market and many are also well-positioned in the security market. Many operators already upsell SD-WAN to connectivity customers by highlighting the benefits of an integrated underlay and overlay service, so SASE provides them with an opportunity for further upselling.

The SASE market is highly competitive, and includes specialist providers of each of the component parts as well as integrated providers. SASE vendors often sell directly to large enterprises and many systems integrators (SIs) and managed service providers (MSPs) are very active in the market. Operators that wish to gain a share of this market will need to clearly differentiate their services; emphasising the benefit of providing integrated connectivity is one possible way to do this. However, operators will also need to match or exceed the capabilities of their competitors in terms of other aspects including the quality of managed and professional services for large enterprises and the scalability of simple solutions for smaller businesses.

1 SSE products include secure web gateways (SWGs), zero-trust network access (ZTNA) and cloud access security brokers (CASBs).

Article (PDF)

DownloadAuthor

Matt Small

AnalystRelated items

Article

KDDI’s results demonstrate the challenges of entering new markets such as energy and finance

Strategy report

Strategies for telecoms operators to evolve their network-as-a-service (NaaS) propositions

Tracker

Cloud service providers' revenue tracker 2024