Should actors incorporate 5G into the satellite industry to compete with Starlink's fast pace of innovation?

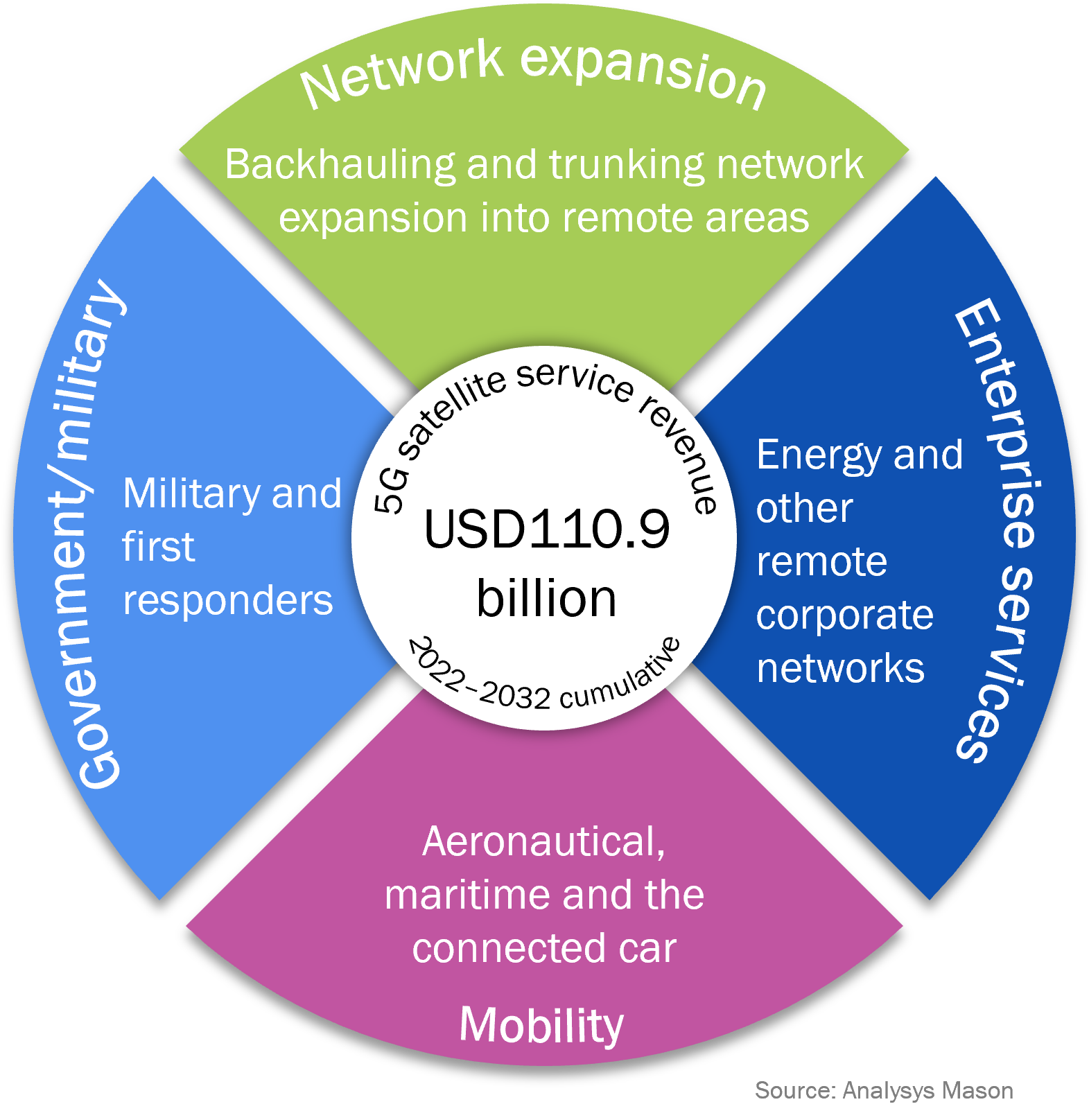

Starlink is the most disruptive force in the satellite market today. The fact that Starlink operates from the low-Earth orbit (LEO) differentiates it from legacy geostationary-Earth orbit (GEO) actors. However, attributing its success solely to its operation from the LEO overlooks how disruptive and difficult it is to imitate Starlink’s business model. No other actor in the value chain can match Starlink’s pace in terms of innovation, both from the technology and service standpoints. For the traditional satellite communications value chain, embracing 5G concepts and standards are vital to accelerate the pace of innovation and, at the same time, unlock the USD110.9 billion cumulative 5G satellite service revenue opportunity from 2022–2032.1

Figure 1: Key drivers for 5G satellite service revenue, 2022–2032

Starlink’s key advantage is in its business model, not the orbit

When analysing Starlink, it is easy to attribute Starlink’s success to its use of LEO. But when further examining Starlink’s core revenue streams, the attributes of LEO make up a small part of SpaceX’s success.2 For example, lower latency is always referenced as an advantage of LEO, but the vast majority of use cases work perfectly fine over GEO. In fact, lower latency is disappearing from the sales pitch of LEO players, and they have been unable to monetise or differentiate based on latency. Similarly, LEOs have very low satellite usability (20–30%) as the physics of the orbits make the satellite spend most of its time over areas with no demand. This puts LEOs’ cost-effectiveness under question in comparison to GEO. So what factors are contributing to Starlink’s success?

No other player in the satellite value chain can match Starlink’s pace in terms of innovation. Every batch of Starlink satellites is different. The distributed architecture of LEO allows for much lower risk of failure for individual batches of satellites or launches, compared for example with the recent ViaSat-3 very high throughput GEO satellite failure. In addition, new iterations of the user terminal are released every few months. Finally, from a service perspective, Starlink has radically changed the paradigm, stopping service-level agreements (SLAs) (but still delivering on customers’ valuable metrics) and redefining the way to interact with customers by developing direct channels. It has implemented this strategy with very aggressive pricing.

The legacy satellite value chain needs to radically accelerate the pace of innovation to keep up with Starlink

The industry’s response to Starlink’s strategy has been to take defensive positions to preserve the value of existing assets and businesses, but the way the value chain is structured has not really changed yet. Software-defined satellites are great innovations – Airbus’ OneSat and TAS’ Space Inspire are successful – but GEO platform designs only get upgraded around once every 5 years. One could say the same for very small aperture terminal (VSAT) platforms like Gilat, ST Engineering iDirect or Comtech, that launch new platforms only about every 5 years. Other LEOs, such as OneWeb and Lightspeed, are no different. The entire constellations are built based on the same satellite design. This means that innovation cycles will happen only when the constellations are upgraded 5–10 years from now. With these structures and incentives in place, the traditional satellite value chain will not be able to match Starlink’s speed of innovation.

Incorporating 5G concepts and standards into the satellite industry will make the value chain more dynamic, unlock new services and facilitate adoption

Starlink is very unique in many aspects, for example, being vertically integrated and having favourable access to funding, which puts its competitors in a difficult position to match its fast technology evolution. But one of the key elements for accelerating innovation in the traditional satellite value chain is the adoption of 5G concepts and standards. The development of virtualisation and an Open RAN-like ecosystem would accelerate the pace of innovation on the ground segment, breaking vendor lock-in effects and allowing the selection of best-of-breed solutions, including non-satellite players, for each network element. On the space segment side, 5G can transform technologies incorporating innovations, such as generative payloads, and trigger new business models including neutral hosts, or infrastructure-as-a-service.

From a service perspective, 5G will also make service provisioning easier, faster and more flexible. It will also enhance many network features, specifically security, slicing and traffic optimisation. The concept of 5G ‘network of networks’ is fundamental to develop multi-orbit services and satellite-terrestrial integrated offerings. Ultimately, 5G will facilitate satellite adoption by mainstream telecoms operators unlocking new revenue streams.

1 For more information, please see NSR’s 5G via satellite, 4th edition report.

2 SpaceX is the parent company that develops multiple space-related projects such as launchers, crew space travel or government services. Starlink is a project (communications constellation) under SpaceX.

Article (PDF)

DownloadAuthor

Lluc Palerm

Research Director, space and satellite, expert in satellite strategies for telcosRelated items

Case studies report

Chinese satellite constellations: case studies and analysis

Article

Geopolitics and sovereignty are (once again) a driving force for the space industry

Podcast

How can mobile operators capture the value of satellite direct-to-device services?