Satellite operators must develop managed services to preserve revenue as wholesale capacity prices decline

Wholesale capacity pricing is decreasing across the satellite communications (satcom) industry, eroding profit margins for traditional wholesale leasing. Geostationary (GEO) operators are increasingly becoming vertically integrated service providers to preserve their bottom line. Operators faced with shrinking margins on wholesale capacity must develop end-to-end managed services that add value beyond just leased bandwidth. Customers in business-facing verticals want to adopt these ‘plug-and-play’ solutions, known as satcom-as-a-service (SaaS) because they provide technical expertise and support with reduced customer investment in network deployment.

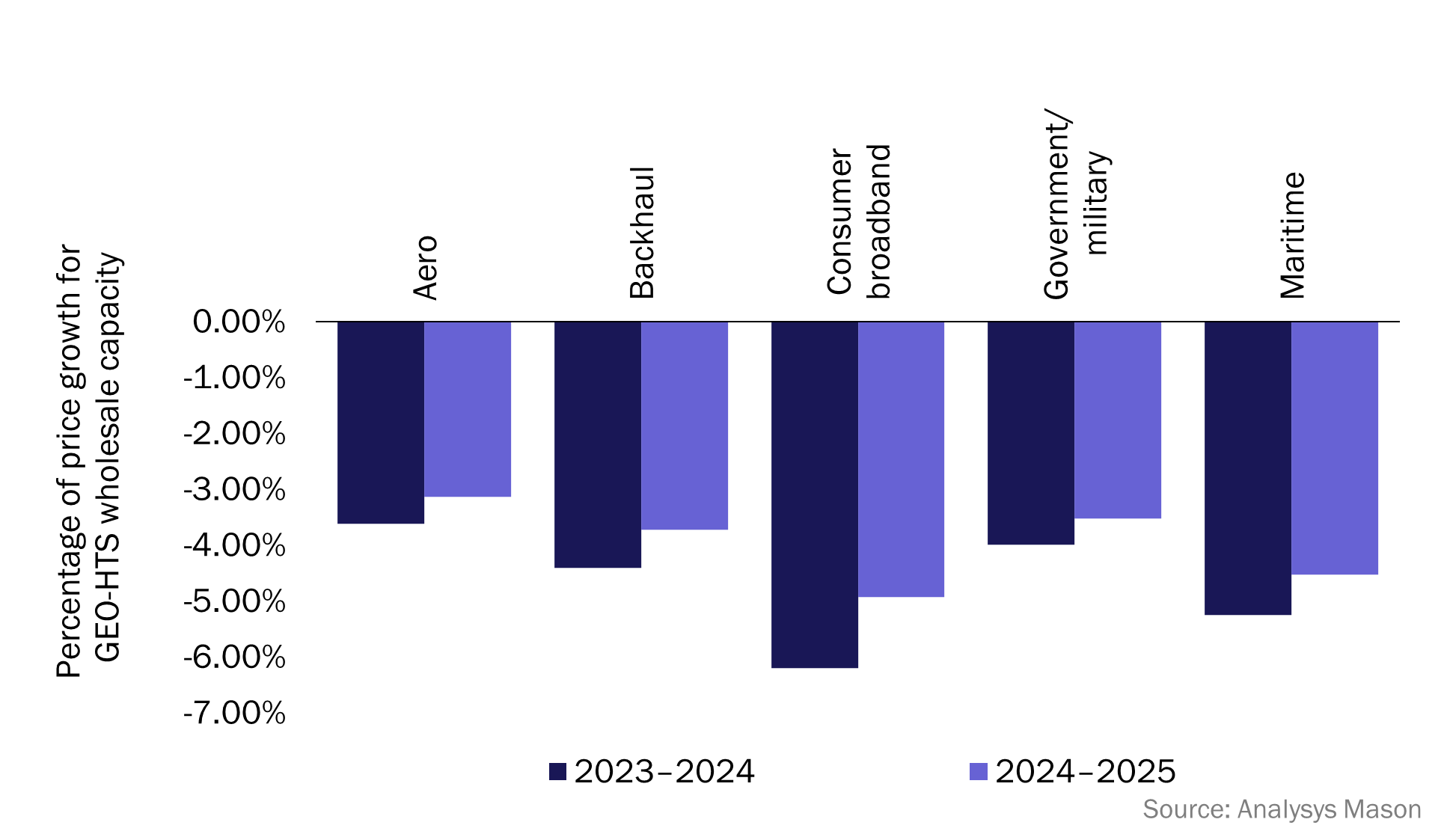

GEO high throughput satellite (HTS) capacity prices fell by an average of 4.6% worldwide in 2023, and Analysys Mason expects them to fall by a further 3.9% in 2024. Analysys Mason’s Satellite capacity pricing index, 10th edition, from our Satellite Capacity research programme, offers an analysis of 1Q 2024 wholesale capacity prices, as well as a forecast for 1Q 2025.

Wholesale capacity is becoming a low-margin commodity because of an abundant supply of satellite capacity

Global satellite capacity is increasingly commoditised, and with wholesale capacity prices falling each year, this is reducing satellite operators’ profit margins. Until Starlink’s entrance to the market in 2020, operators benefited from scarcity economics, maintaining high margins on capacity pricing because supply was limited. The price of wholesale capacity has declined sharply since 2020, a trend that continued in 2024 and is forecast to persist through 2025 (see Figure 1). HTS capacity supply is still growing exponentially, with a large contribution from Starlink’s continual constellation expansion. This supply growth will accelerate further in 2026–2027, once the existing Starlink and OneWeb constellations are joined in low-Earth orbit (LEO) by Amazon Kuiper and Telesat Lightspeed.

Figure 1: Year-on-year change in GEO HTS average capacity prices by vertical, 2023–2024 actuals and 2024–2025 forecast

Satellite operators will need to continue improving payload efficiency and reducing capex. However, relying on profitable capacity leasing alone could spell disaster for many players. In an environment of abundant supply, the players with the lowest capex will undercut the market and seize the bulk of available capacity demand.

Traditional GEO operators must move down the value chain to capture high-margin revenue from their services

Many GEO players have expanded their business models to offer end-to-end services to their customers. Traditional GEO operators’ connectivity revenue is roughly split 70:30 between capacity and value-added services. This varies significantly across different operators and verticals. In backhaul, these services take the form of end-to-end infrastructure-as-a-service (IaaS) models. The satellite provider handles everything from site deployments to gateway construction to network management. This removes the need for their telecoms customers to have satellite-specific knowledge and can lower the capex requirements for new networks because gateways are shared. For the satellite operator, 50% or less of the total revenue is from low-margin capacity, and the profits are largely earned from the rest of the service.

The pressure for satellite operators to provide quality services in satcom has led to a shift towards vertical integration. For example, Intelsat bought-out in-flight-connectivity (IFC) service provider Gogo at the end of 2022, and now offers a full end-to-end service to airlines and business jet customers. Intelsat’s value proposition in IFC comes from its equipment installation and repair, on-site training for third parties and diagnostic support from its ‘Aircraft Maintenance Control Center’. These operations require segment-specific knowledge and expertise that newcomers such as Starlink must develop in order to compete. Intelsat recently contracted a large amount of capacity from OneWeb, in large part to bolster its IFC offering. This capacity allows the operator to scale its IFC business to more customers, while the vertical integration with Gogo makes each customer more profitable because Intelsat captures the full value from the service. Multi-orbit services are on the rise, combining the resiliency of GEO communications with the added capacity of LEO. More generally, leasing supplementary capacity can unlock new regions and mobility routes, or allow operators to serve outlier customers with particularly high bandwidth demands.

Operators should embrace co-operation with other stakeholders as networks become more standardised and interchangeable

In 2023, non-terrestrial networks (NTNs) were included in 5G standards for the first time with 3GPP Release 17. As these standards are developed further in future releases, the unification of satellite and terrestrial networks will improve, reducing the time and cost of integrating and deploying new satellite networks. Moreover, the emergence of software-defined payloads is increasing the in-orbit processing capabilities of satellites, allowing for smarter network management and cheaper, more-simplistic ground segment architecture. Overall, the industry is moving towards a “plug-and-play” environment where telecoms operators and other customers can readily incorporate satellite technology into existing their networks.

It will become easier to combine different satellite networks because. the industry is shifting towards standardisation and software-defined computing, which will facilitate a more co-operative ecosystem. Equipment manufacturers have already developed a new wave of ground segment architecture and user terminals that can capably handle multiple beams from different operators. Any satellite operators that remain siloed risk being left behind by an industry evolving towards integration. As capacity becomes abundant, as well as homogenised by interoperability, the most successful players will be those that build on that capacity with exceptional service.

Article (PDF)

DownloadAuthor

Luke Wyles

Analyst, expert in space and satelliteRelated items

Report

Analysys Mason research and insights topics for 2026

Article

Discussions at Space Tech Expo Europe underscored the need for a European satellite market strategy

Article

Satellite connectivity’s performance and cost mean it is now a core part of the digital infrastructure ecosystem