Satellite manufacturers and launch service providers need a more focused strategy to address the market

13 August 2024 | Research and Insights

Article | PDF (3 pages) | Space Infrastructure

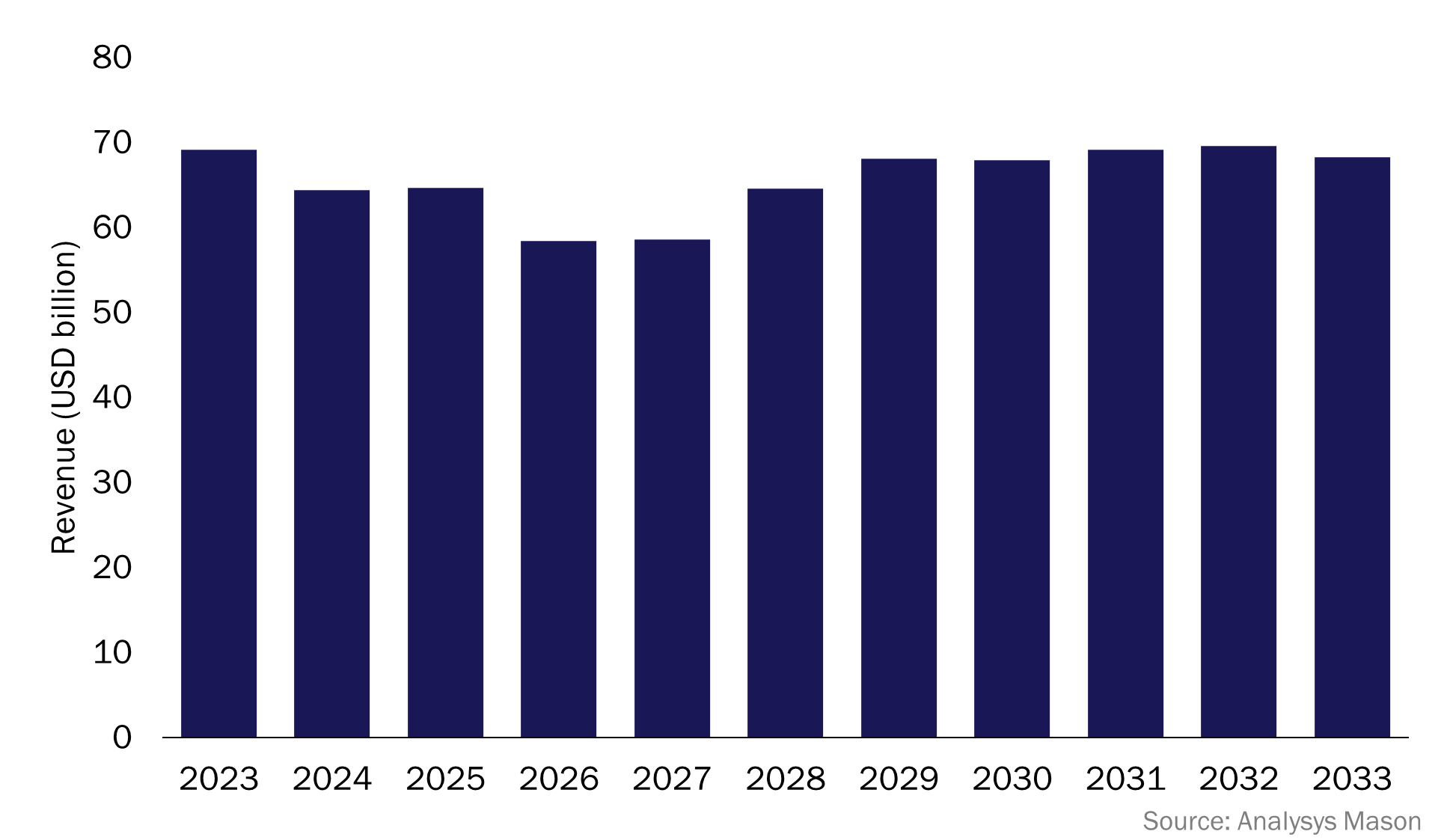

The satellite manufacturing and launch market presents a rapidly growing, diversifying opportunity. Indeed, Analysys Mason’s latest forecast predicts that over 37 000 satellites will be launched between 2023 and 2033, thereby resulting in USD723 billion of cumulative manufacturing and launch revenue (Figure 1). However, much of this opportunity will remain inaccessible to commercial satellite manufacturers and vendors because it will either be locked behind non-addressable regions or internalised by operators (that is, market players will perform internal manufacturing and launch activities, thereby reducing the commercial opportunity).

Figure 1: Satellite manufacturing and launch market revenue, worldwide

Satellite manufacturing and launch market players must look beyond the headlines and understand where the true opportunities lie in order to be successful. Major customers include government and military players with large and reliable budgets and programmes, large enterprises that are shifting to higher-performing satellite architecture and platforms, and satellite constellation operators that are outsourcing platforms and components for multiple satellites.

The demand for satellite manufacturing and launch services continues to grow and diversify

Analysys Mason’s Satellite manufacturing and launch services: trends and forecasts 2023–2033 explains that most of the satellites that will be ordered and launched between 2023 and 2033 will be for communications satellite constellations (that is, fleets of satellites operating collectively). Examples include so called ‘mega-constellations’ from Starlink and Kuiper (each of which will contain thousands of satellites) and the Space Development Agency’s (SDA’s) Transport Layer (part of a government programme to procure hundreds of satellites from commercial vendors). Earth observation, navigation and situational awareness are also growing areas of opportunity. Indeed, Analysys Mason has tracked 140 constellation projects in these areas that are currently in development or actively operating.

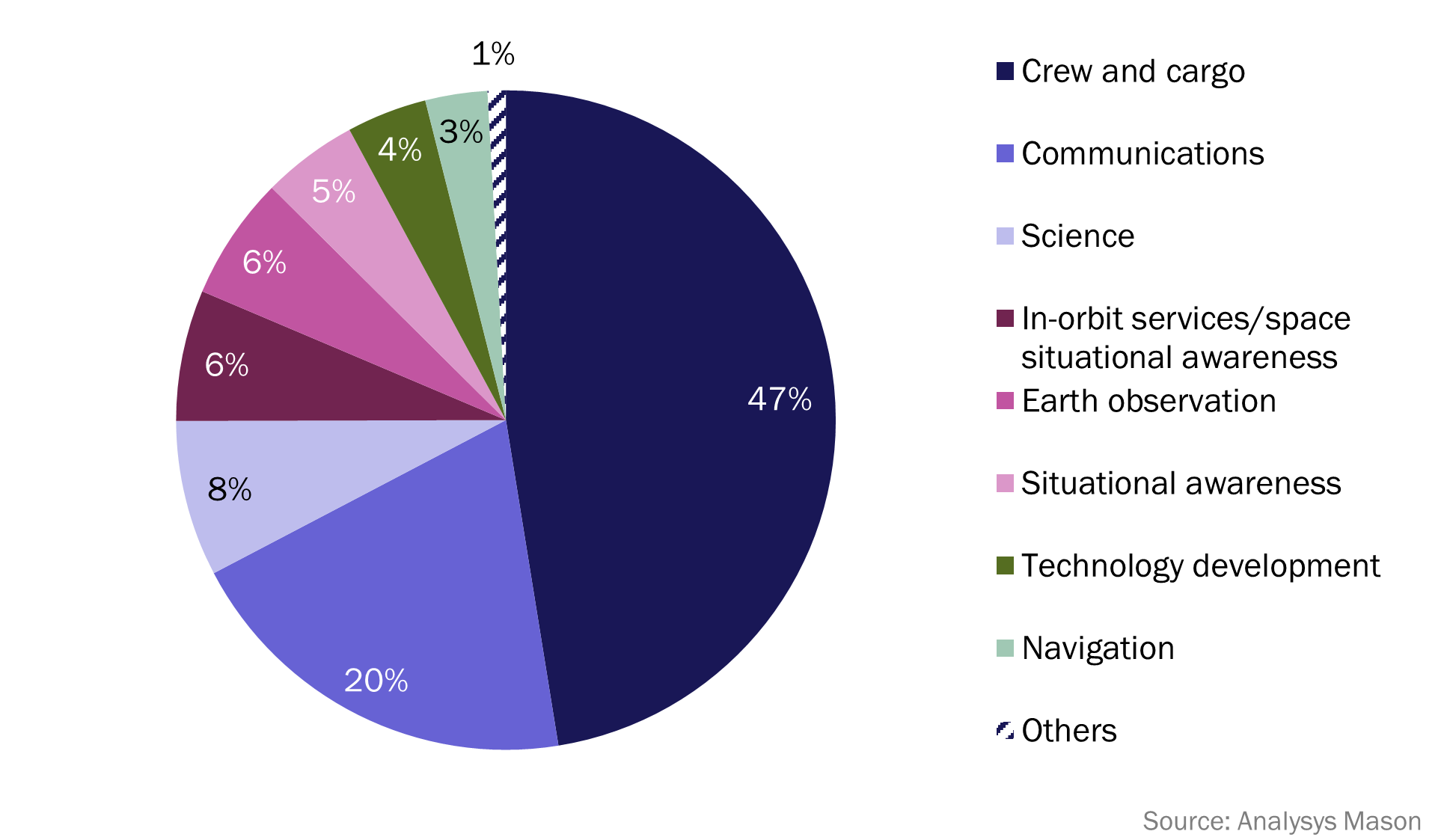

Revenue in the satellite manufacturing and launch market will be driven by very expensive, high-mass missions. Indeed, crew and cargo missions to the International Space Station (ISS) and, later, to the Moon (such as those from NASA’s Artemis programme), as well as eventual commercial space station activity, will account for 47% of all satellite manufacturing and launch revenue between 2023 and 2033 (Figure 2). The ongoing astronaut and supply missions to the ISS alone, each weighing over 6000kg, will require the most funding for research, development and contracting, and thus will outpace the rest of the market in terms of revenue generation.

Figure 2: Breakdown of the cumulative satellite manufacturing and launch market revenue by application, worldwide, 2023–2033

Much of the demand remains closed off to most players due to several non-addressable customers

Much of the opportunity in the satellite manufacturing and launch market remains closed off to most players. Communications constellations from China, such as the G60 and SatNet programmes, will largely remain non-addressable, at least for any player outside of China. Most crew and cargo missions require very high-risk, high-mass and high-performing services, so will remain outside the capabilities of many players. For example, both Boeing and SpaceX started to develop an orbital vehicle for crewed missions in 2010, but SpaceX only started to serve the market in 2020 and Boeing’s Starliner only launched this year after suffering several charges for ongoing delays.

The same scenario can be seen across all applications; established companies are serving high-mass, high-value missions, while a very large number of smaller players vie to disrupt the market.

Manufacturers and launchers must focus on areas with the highest likelihood of market access and penetration

The good news is that the satellite manufacturing and launch market is not entirely closed, it simply requires strategic navigation. Analysys Mason’s satellite infrastructure research and insights demonstrate that much of the funding and support in this area comes from government programmes.

For launch players, Europe’s Flight Ticket Initiative, the Space Force’s Tactically Responsive Space and JAXA’s Small Satellite Rush Program are examples of where governments have provided funding and support for the development of additional commercial technologies and services.

For manufacturers, the most direct opportunity lies in large procurements similar to SDA’s Transport Layer or missile-tracking layers, though there is also an opportunity in the development of new architecture and solutions to support governments and large enterprises. Platform providers and component suppliers that are seeking to target the continuing constellation boom should use standardised products and procurement methods. Commercial satellite manufacturers need to make buying a better option for operators than building. That is, manufacturers need to reduce costs, increase speed and scale and reduce procurement challenges to better address the market.

Players in the satellite manufacturing and launch space must continue to adjust their strategies to match and anticipate the flow of support as new processes decrease the barriers to access space and as terrestrial networks and customers use space technologies to expand their reach and business.

Article (PDF)

DownloadAuthor

Dallas Kasaboski

Principal Analyst, expert in space infrastructureRelated items

Article

D2D services must balance capabilities, expectations and willingness to pay

Predictions

Predictions for the space industry in 2026

Podcast

Military satcom and commercial capacity integration: why secure orchestration matters