Providers of satellite connectivity for defence-based unmanned aerial vehicles must diversify their solutions

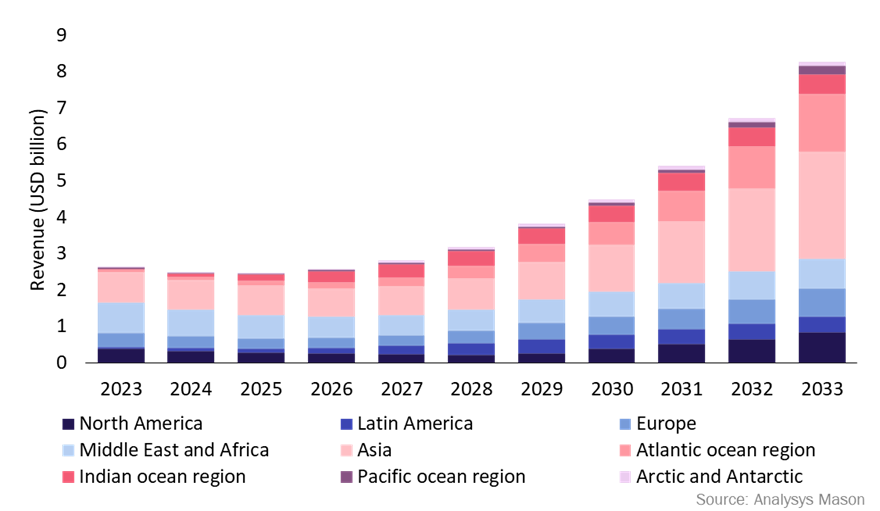

Satellite communication (satcom) players have an opportunity to enhance their revenue potential by addressing governments’ need for diverse connectivity options in the defence-related unmanned aerial vehicle (UAV) market. The UAV market is positioned to experience substantial growth in the next 10 years (Figure 1). Analysys Mason’s recent report, Government and military satellite communications: trends and forecasts 2023–2033, expects UAV retail revenue to increase at a CAGR of 12% worldwide in the next 10 years. Government end users are assessing how to enhance their use of UAVs and are interested in creating a portfolio of unmanned aerial systems (UAS) abilities that can address all mission types. Satcom providers can enhance their competitiveness by offering services that address these diverse needs.

Figure 1: UAV satcom retail revenue, worldwide

The UAV satcom market is positioned for growth but successful revenue capture will require rapid adaptation by satcom providers

The growth of geopolitical instability has demonstrated the need and demand for rapid changes in the approach to connectivity. The war in Ukraine demonstrated the value of UAVs in a conflict zone. Innovation on the part of Ukraine’s small defence force has led some commentators to describe the conflict as the “first drone war”. The Ukraine army used UAVs successfully at the start of the war and is also now using first person view (FPV) drones, which are cheaper to procure and generally quicker to manufacture. In 2025, Ukraine procured a broad spectrum of UAV types to allow targeted used of the technology according to the needs of each mission.

Interest in UAV capabilities will widen in all regions in the next 10 years as governments seek to take advantage of the low latency and other benefits associated with non-geostationary orbit (NGSO) services.

Governments will be keen to take advantage of UAVs with optimised performance. UAVs such as the General Atomics MQ-9 Reaper have been capable of satellite-controlled landings since 2024. Insitu has reported that its group 3 UAVs (systems with gross take-off weight below 1320lb and above 55lb) have satcom capabilities, dramatically broadening the range of missions that this category of UAV could address. Satcom providers must be prepared to answer new UAV-related demand queries quickly as more governments seek to procure and deploy this technology.

Commercial satellite players should consider their ability to address the diverse connectivity needs of UAV missions

The growth in UAV usage and innovations means connectivity demands are expanding from short-range line-of-sight (LOS) missions through to long-range beyond-line-of-sight (BLOS) connectivity. Lessons can be learned from Ukraine about potential UAV use cases. Companies bringing new UAVs to market are increasingly focused on optimising the technology and enabling connectivity in smaller systems. The recently launched, Maritime Jump 20-X VTOL system with “multiple satcom options”, is a clear example of this. The UAS is a new version of AeroVironment’s existing UAV and can now fly off naval ships. This drive for innovation and optimisation of UAV satcom terminals and abilities will increase as governments broaden the types of missions that such systems will have to address.

Service providers should examine their ability to provide a range of connectivity capabilities to respond to this market development. Providing a range of throughput, frequencies and orbit options can allow governments to match connectivity abilities to needs. This may also open the potential for “line-fit” contracts to develop, ensuring rapid access to required connectivity types. Interoperability, adaptability and flexibility will be core priorities in future government procurements. Such diversified connectivity options also provide a competitive service case for industry players and can enable governments to expand or move connectivity needs to various geographical locations as required. This is an increasingly important asset, particularly for governments that are active around the world.

Activity now will benefit long-term growth as potential disruptors appear on the horizon. NGSO capacity will increase significantly by the end of the decade and bring with it more favourable link budgets, lower latency and global coverage abilities. The market is also beginning to take an interest in multi-orbit connectivity. Satellite providers can aid in protecting their long-term competitiveness by progressing connectivity options now. Multi-orbit, multi-band flexibility coupled with logistical flexibility of satcom contracts will be a strong market differentiator going forward.

Article (PDF)

DownloadAuthor

Shagun Sachdeva

Senior Analyst, expert in space mobilityRelated items

Article

Geopolitics and sovereignty are (once again) a driving force for the space industry

Strategy report

The pulse of the satellite industry: questions and answers for senior executives 2025

Article

Players in the satellite-based Earth observation market must target government analytics procurement