CSPs’ spending in the service design and orchestration market is expected to increase in the next 5 years

The latest forecast from Analysys Mason on service design and orchestration (SDO) systems and services for the telecoms industry suggests that communication service providers’ (CSPs’) spending will increase steadily between 2023 and 2028. This growth will mainly be attributed to the rapid roll-out of 5G standalone (SA) networks and the digital transformation initiatives undertaken by telecoms providers.

Of all SDO sub-segments, spending is expected to increase most quickly in the end-to-end orchestration and inventory management systems sub-segments, at a CAGR of 2.7% and 3.0% respectively.

The telecoms industry is currently at a point where investments in new SDO technology are difficult to monetise without updating backbone systems such as inventory systems. Concurrently, CSPs are increasingly deploying end-to-end orchestration systems to reduce costs and improve automation levels.

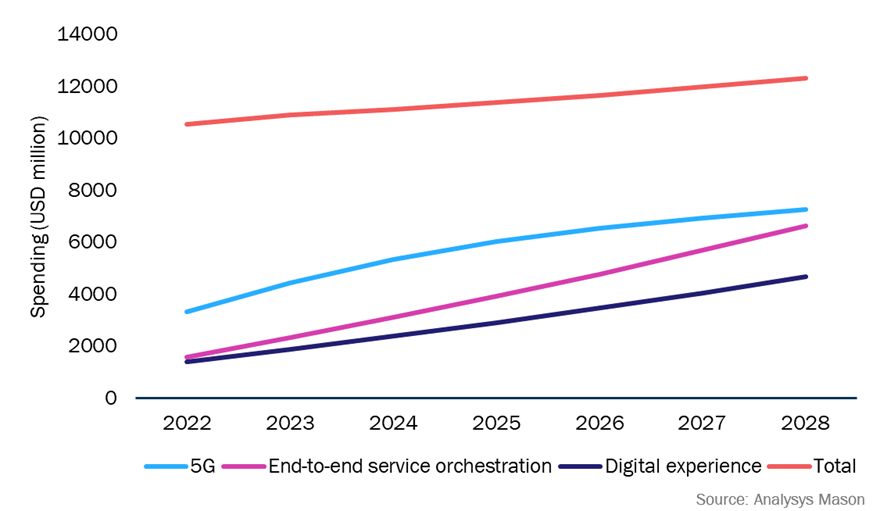

Figure 1: Forecast for CSP spending in the service design and orchestration market, by driver, worldwide, 2022–2028

5G-related investments will reach USD7.3 billion by 2028 and will account for 59% of all CSPs’ SDO spending

5G is one of the leading drivers of CSPs’ SDO software and services spending, and we expect it to grow at a CAGR of 13.9% during 2023–2028, to reach USD7.3 billion. This growth will be driven by increasing numbers of CSPs deploying 5G SA in developed regions and initiating 5G roll-outs in emerging regions.

However, 5G-related spending is expected to slow down from 2026 onwards as the technology matures. CSPs will initially invest to overlay their legacy stacks with standardised overhaul systems, driving costs up significantly, but as systems are consolidated and retired, investment in products will slow down, although CSPs will continue to invest in 5G-related professional services to optimise existing capabilities and further reconstitute their OSS stacks. As part of their 5G network deployments, CSPs will require planning and optimisation tools that leverage the flexible architecture of 5G SA and vRAN, and will continue to invest in inventory management solutions and end-to-end orchestrators to enable dynamic assurance and service delivery.

Spending on end-to-end service orchestration solutions will reach USD6.7 billion worldwide in 2028

End-to-end orchestration is expected to be a substantial driver for the SDO market; Analysys Mason expects CSPs to spend USD6.7 billion on these solutions in 2028, which represents a CAGR of 27% during the forecast period. CSPs are leveraging closed-loop automation to mitigate errors during service fulfilment processes, especially for service modifications that traditionally require human intervention. This trend is evident not only in the deployment of new products by CSPs but also in recent M&A activities, where vendors procure automated assurance capabilities to complete their OSS stack in preparation for supporting CSPs on their digital transformation journeys by providing full closed-loop solutions. Despite the high costs and disappointing monetisation opportunities associated with 5G, the automation, configuration and optimisation of network resources and service lifecycles are expected to bolster network operations efficiency, reduce operating costs and facilitate the delivery of new services such as network slicing.

Public cloud providers are also strategically positioned to offer value-added functions for end-to-end orchestration. They can serve as a platform mediation layer between vendors and have a significant opportunity to develop cloud-principled software down the stack, helping CSPs to expand their operational and business footprint. While many vendors remain sceptical of competition from cloud providers, viewing them as purely IT companies with limited network knowledge, it is imperative for vendors to reassess this competition and form strategic partnerships with cloud providers to avoid direct competition. Cloud providers have been steadily acquiring telecoms expertise and have gathered knowledge through numerous partnerships over the years, while also learning from their own experiences in the SD-WAN, data-centre, campus and subsea cable domains.

CSPs have focused on autonomous operations but are realising that they need to go back to basics

According to our forecast, CSPs will invest in supporting systems such as inventory and engineering solutions because data quality will become increasingly important in delivering agile 5G-enabled services and dynamic infrastructure sharing. After several years of focusing on new services and OSS solutions to support these services, including service management and orchestration (SMO) platforms and network slicing, the industry is taking a reflective pause. There is a growing recognition that before new services can be deployed, the foundational systems must be updated. Inventory and engineering systems, which have been somewhat neglected, will need to be updated to support these new services. CSPs cannot move on until their foundational systems are ready. Updating systems that provide one of the most valuable assets – data, is essential and we will see more investments in this area, as well as planning and automation on engineering levels.

Digital transformation is a slow process; CSPs are taking a phased approach to deploying overhaul systems, leveraging existing investments and slowly retiring legacy OSS. Overall, this shift from smaller investments and futuristic conversations about 5G monetisation and new technologies towards actual interest in preparing for autonomous operations and a structured approach is a positive sign, indicating potential steady growth for the SDO market.

Analysys Mason is at the forefront of analysing service design and orchestration systems and services for the telecoms industry

Our recent report, Service design and orchestration: worldwide forecast 2023–2028, provides forecast data for the service design and orchestration market and includes: detailed evaluations of product and professional services delivery types and specific regional developments; an assessment of the key drivers that influence the market; and recommendations for vendors and operators.

Article (PDF)

DownloadAuthor

Alex Bilyi

AnalystRelated items

Strategy report

Network and service APIs: implications for CSPs’ operational systems

Strategy report

Autonomous networks: strategies for reaching Level 4

Article

Spending on telecoms service design and orchestration systems and services will increase at a CAGR of 2.3%