Operators have an opportunity to deliver SD-WAN to more than 3.5 million SME sites

Listen to or download the associated podcast

Millions of small and medium-sized enterprises (SMEs) could benefit from using SD-WAN, particularly to enhance the performance of cloud-based applications and services. However, few operators have yet to tailor their SD-WAN portfolios to the SME market; they have instead focused on large, distributed enterprises and mid-market opportunities. Operators that can adapt their solutions and marketing to meet the needs of the SME segment therefore have the potential to generate additional revenue and increase customer loyalty.

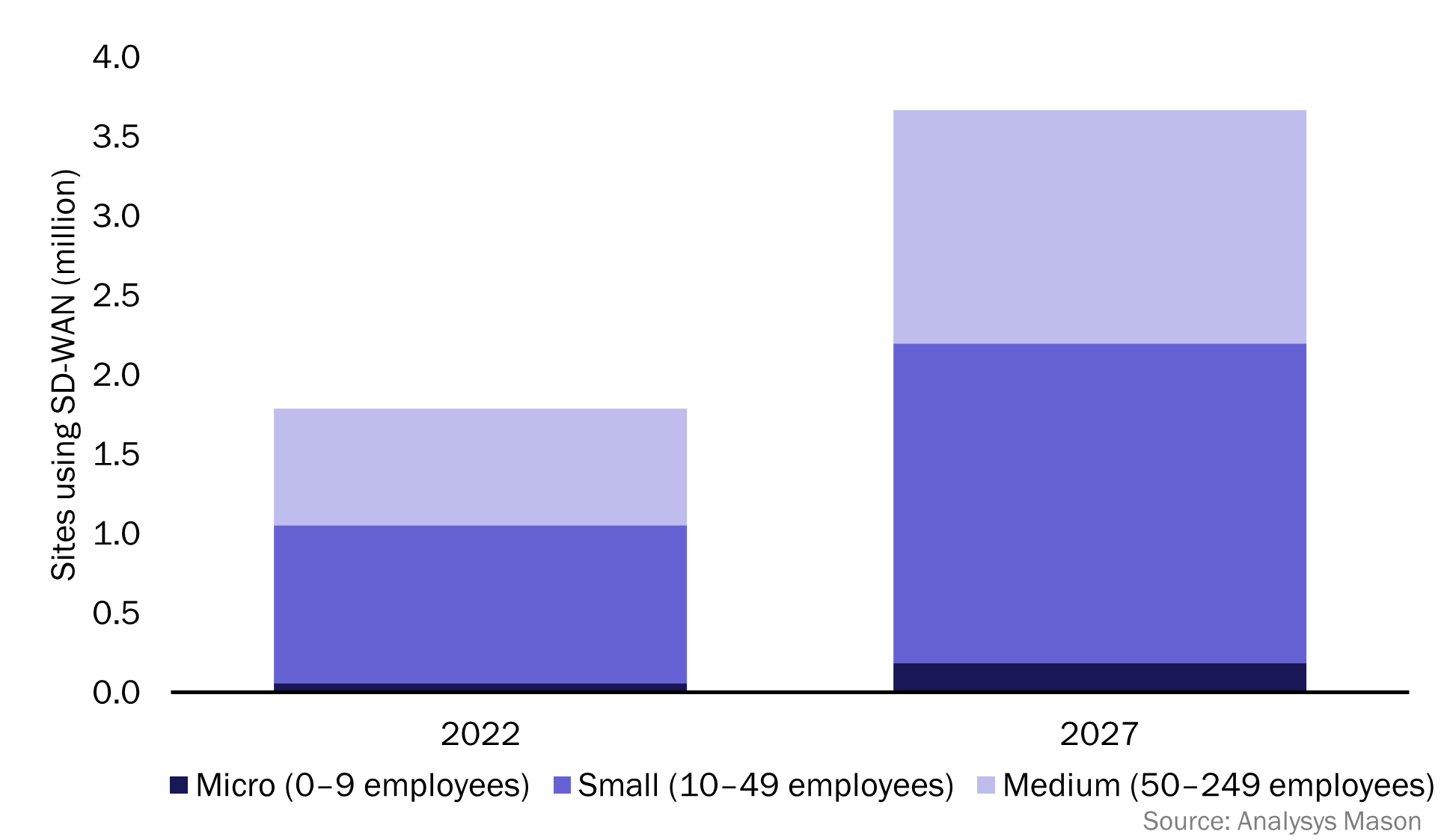

We estimate that SD-WAN will be used by SMEs at 3.7 million business sites worldwide by 2027, including more than 1 million sites in Western Europe. Operators can address this opportunity by offering simple, low-touch solutions that are competitively priced and deliver clearly articulated business benefits. These issues are discussed in more detail in Analysys Mason’s report, SD-WAN for SMEs: operator strategies and case studies.

SD-WAN offers potential benefits to many SMEs

SD-WAN is often considered to be a service for multi-site organisations, but it is increasingly relevant for all businesses that want improved performance for SaaS applications. Many operators targeted their initial SD-WAN deployments at large, distributed enterprises and then extended their portfolios to include ‘branch solutions’ that are suitable for sites with straightforward connectivity needs. However, few operators have yet to really target the SME market with solutions that are tailored to their specific needs and can be delivered at scale. Instead, this segment is typically addressed by managed service providers (MSPs) and local IT providers.

Not all SMEs will need full-blown SD-WAN, but features such as application visibility and prioritisation would be useful to many. We expect that the take-up of SD-WAN solutions among SMEs will be significant over the next 5 years, as shown in Figure 1.

Figure 1: Number of micro, small and medium-sized business sites using SD-WAN, worldwide, 2022 and 2027

Many SMEs have historically relied on a single connectivity link for each of their sites, but the availability of wireless back-up means that businesses can potentially benefit from the dynamic use of multiple links, or at least seamless failover, both of which are supported by SD-WAN. Many SMEs are placing an increasing value on this type of business continuity service. SMEs with multiple business sites that deploy SD-WAN will also benefit from WAN management and from solutions that support remote workers.

Operators should offer simple, low-touch solutions with clear benefits for SMEs

Most SMEs are unaware of SD-WAN and their interest in the technology is low, but they do want the benefits that such solutions deliver. They expect to be able to procure services quickly and easily, but also need support from their providers in setting up and using the service. They are cash-constrained and need low-cost solutions.

The following list details some important characteristics of SD-WAN offers that are likely to succeed in the SME segment.

- Marketing focuses on solutions, not technology. Operators should present their offers as solutions to SMEs’ needs instead of attempting to sell the technology. Indeed, many providers are moving away from branding that highlights the technology, for example, Adaptiv Networks’s SD-Internet is now known as Business Connect and O2 Germany launched Smart Network in 2021 with no obvious reference to SD-WAN.

- Business benefits are clearly articulated. The results of our end-user surveys show that cloud-based solutions and support for remote workers are becoming increasingly important for SMEs. Providers should address these concerns by demonstrating how their solutions can increase the reliability and performance of cloud applications and services.

- Bundled solutions for common business needs are available. Bundled solutions are easy for SMEs to consume, and many operators offer SD-WAN together with connectivity, unified communications and security services. Some, such as Telefónica Spain, are leading with security while others, such as Windstream, are bundling SD-WAN closely with unified communications services. Almost all operators bundle their SD-WAN solutions with underlay connectivity and, increasingly, with wireless failover solutions. Business continuity is important for many small businesses and seamless failover solutions facilitated by SD-WAN services are a valuable contribution to this.

- Propositions are price-competitive. SD-WAN propositions that address small and single-site businesses should be priced competitively compared to SD-WAN services for larger deployments. Service upgrades to include SD-WAN capabilities can start from as little as EUR10 per month per site, though EUR50–100 is more typical. Many SMEs expect as-a-service pricing with no upfront cost for CPE (or at least an option to amortise the CPE cost over the lifetime of the contract).

- Technical support is available when needed. SME customers often need support to install and manage their services, even when provisioning is designed to be low-touch. This can be costly to manage but is an essential part of serving SMEs. Many operators offer web and telephone support; indeed, Virgin Media O2 has launched a co-managed service that addresses this need by enabling businesses to use prepaid credits to request changes and access other support services.

SD-WAN and associated services are already contributing to the growth of SME service revenue for some operators

SD-WAN revenue per customer is much lower for SMEs than for larger businesses, so operators addressing this market will need to drive scale and standardisation. Nonetheless, strong revenue growth can be achieved. Operators that are doing well in the SME space include Vodafone Italy, which reports selling services to more than 750 small business sites within a 3-month period. Other operators have reported significant take-up for bundled services that include SD-WAN as an option: Virgin Media O2 Business has reported “good traction” for its Smart Internet Access product and Telefónica Spain has reported that almost 5500 customers take its Secure Company bundle as of May 2022.

SD-WAN on its own is unlikely to be a game-changer for SMEs, but it has an important role to play as part of a bundled or value-added solution. Operators already have established partnerships with SD-WAN vendors and should extend and adapt their solutions to serve the SME market more effectively.

Article (PDF)

DownloadAuthor