SK Telecom's AIVERSE illustrates a potential role for operators as metaverse aggregators

Most telecoms operators are exploring their future role in the metaverse, motivated by its high revenue growth potential and the significant investment of players such as Meta and Microsoft. On first appraisal, telecoms operators may struggle to identify the role(s) that they can play in the metaverse ecosystem. However, SK Telecom (SKT) has a particularly developed metaverse strategy that may act as a guide for other operators.

SKT’s metaverse plans tie into its aspiration to aggregate experiences through T Universe

A variety of companies can offer services within the metaverse ecosystem because this ecosystem depends on the interoperability of functions, protocols, services and users in order to operate. Hyperscalers, particularly Meta, have articulated ambitious plans to redirect their business interests towards the metaverse.

Operators know that connectivity will be important to the metaverse and that this is an area in which they can excel, but there are other aspects of the metaverse ecosystem that they can enable or participate in. Both operator and hyperscaler strategies are explored in the Analysys Mason report Metaverse strategies: case studies and analysis.

SKT is positioning itself to do exactly this (that is, enable and participate in other aspects of the metaverse), and will play a number of roles in the ecosystem. It sees the metaverse as a key area for revenue growth and already has multiple metaverse-related activities in development. These activities form part of its wider AIVERSE strategy, which includes a commitment to M&A in metaverse-related areas, the development of international partnerships and the evolution of:

- subscription services through ‘T Universe’, a platform that gives subscribers access to products and services from SKT’s partners (including major brands such as Microsoft and Starbucks)

- its ifland metaverse platform, which allows users to meet in virtual spaces and use customisable avatars and virtual items

- a character-based AI agent, NUGU, which is designed to support and sell all services and experiences across SKT’s service portfolio, as well as those of partners in the metaverse and T Universe.

The market situation that allows SKT to pursue its metaverse strategy is unusual

SKT is able to take a first-mover approach to the metaverse because its domestic consumers are particularly receptive: they are more familiar with virtual worlds than consumers in most other countries (partly thanks to SKT’s previous initiatives).

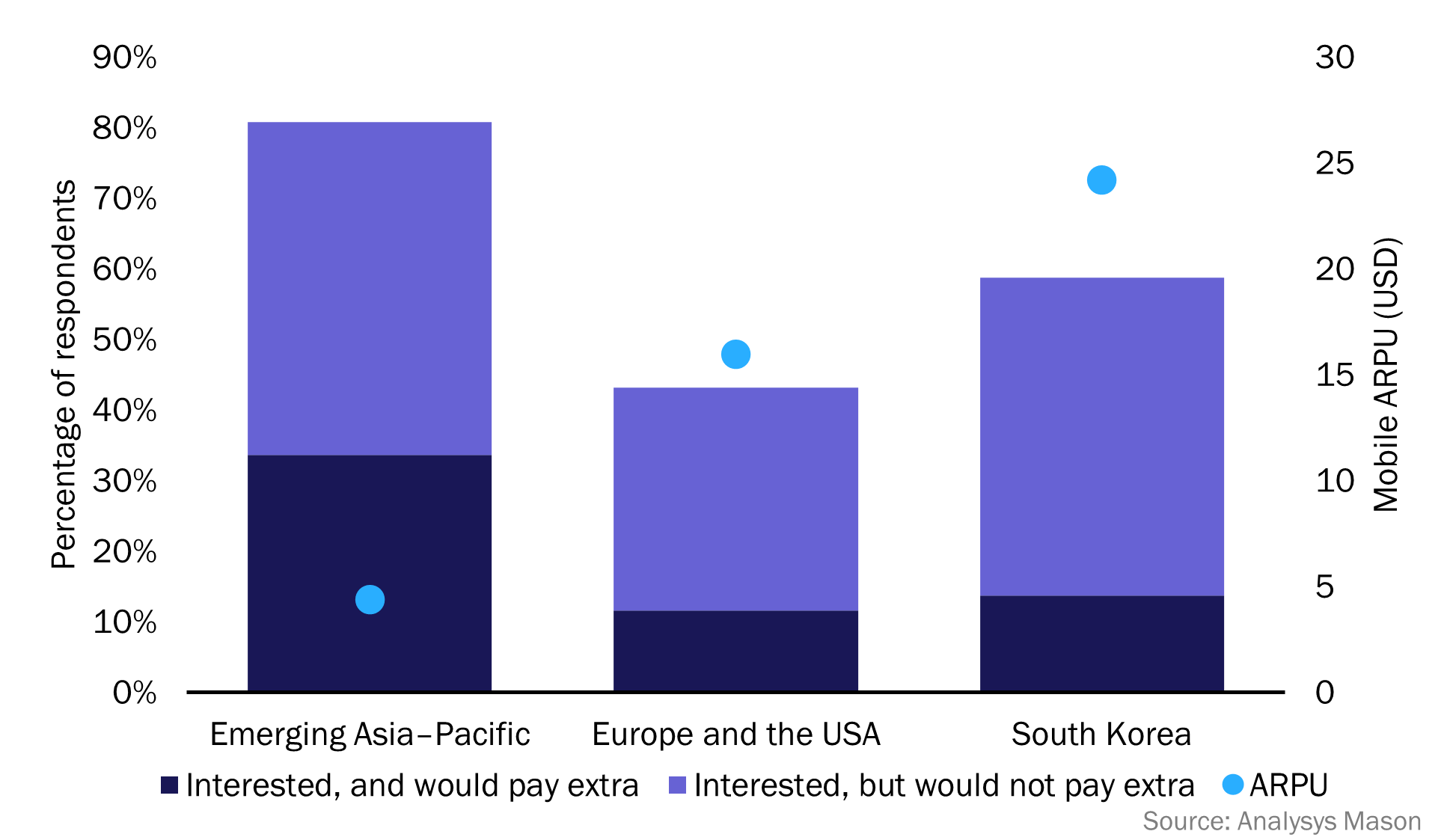

South Korean consumers also have a greater interest in the use of AR/VR services than those in other developed markets (see Figure 1 based on our 2021 survey of consumers). A receptive and affluent target audience means that monetising the metaverse is much more realistic in South Korea in the short-to-medium term than in many other countries.

Figure 1: Consumer interest in AR/VR services and mobile ARPU by region, 3Q 2021

SKT has a long-established presence in building virtual worlds; it launched Cyworld in the early 2000s. Other operators will be new to this aspect of the metaverse and have not yet made significant investments in this area. This means that there will be a barrier in terms of both cost and culture to those operators that aim to replicate SKT’s approach without having the same experience and prior investments. Accordingly, the best approach for other operators may be to partner.

SKT announced, in May 2022, an agreement with Deutsche Telekom (DTAG) to launch a version of ifland in Germany. Both SKT and DTAG are open to launching a joint venture to pursue metaverse opportunities across DTAG’s European footprint if the initial launch is successful. Other operators outside of this footprint may wish to consider partnering with SKT.

Telecoms operators do not need to be leading innovators in the metaverse, but they can be ‘fast followers’

The hype around the metaverse, combined with shareholder interest (as shown by the large number of corporate investor presentations that mention the metaverse), incentivises operators to consider their potential role in this space. Telecoms operators are usually ‘fast followers’ outside of their core business areas; they take established products, services and solutions that are adjacent to connectivity and bundle them with their core services.

Few consumers are as open to the metaverse as those in South Korea, and this may limit other operators’ ability to invest significant amounts in metaverse R&D. However, there are parallels between SKT’s T Universe model and other operators’ content aggregation approaches. Indeed, many operators are already positioning themselves as aggregators of video content and will be looking to extend this into other entertainment services (such as gaming) and beyond.

SKT has taken this approach further by becoming a curator of digital and real-world experiences and has extended this into the metaverse. This may signpost one potential future role for telecoms operators within the metaverse: as curators of metaverse experiences. This could, for example, include providing access to exclusive metaverse events, or offering discounts and exclusive access to content and other assets within the metaverse. This is a logical and incremental progression from the current T Universe experience.

SKT has built on its existing e-commerce capabilities, as well as the B2B knowledge from its longstanding SK Planet division, to make T Universe (and, by extension, its wider AIVERSE strategy) successful. SKT has extensive experience of working with business partners as an ICT enabler and provider of AI/data/marketing solutions. Other operators may also have some or all of this relevant experience.

Depending on their starting point and ambition, telecoms operators could take one of three approaches inspired by SKT’s strategy.

- Observe. Operators could track the evolution and success of SKT’s AIVERSE division and the expansion of ifland into Europe and other parts of the world.

- Partner. Partnerships will enable operators to be fast followers, thereby putting them in a position to capitalise on developments in the metaverse as and when they arise. For example, Meta and Microsoft are forming partnerships with telecoms operators, and SKT is collaborating with other operators to expand ifland.

- Replicate. Some operators have well-established loyalty programmes and are aiming to enrich and diversify their approaches to service aggregation (for example, Verizon’s +Play in the USA or Spanish operators’ diversification into energy). Scaling these ambitions to the metaverse is potentially risky, but expanding the horizons of one’s aggregation strategy is a logical progression.

Article (PDF)

DownloadAuthors

Martin Scott

Research DirectorRelated items

Article

Netflix–Warner Bros.: what a unified content delivery strategy could mean for ISPs

Survey report

Mobile data plans and data usage: consumer survey

Survey report

Norway: consumer survey