IT service providers in the USA are experiencing high levels of customer churn: business survey 2022

21 March 2022 | SMB IT

Article | PDF (3 pages) | Business Applications| Cyber Security| Devices and Peripherals| IT and Managed Services| IT Infrastructure| UC and Digital Services

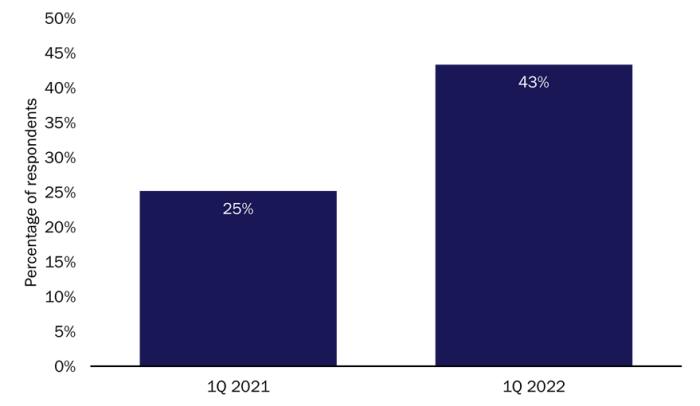

43% of the respondents to our survey of 413 small and medium-sized businesses (SMBs; 0–999 employees) in the USA in 1Q 2022 switched to a new IT service provider during 2021. This figure is 18 percentage points higher than the result from our previous survey in 1Q 2021. IT service providers, and the vendors that supply and support them, need to demonstrate to SMBs that they can address a rapidly changing environment in order to reduce this high level of churn.

The increase in the rate of SMB churn suggests that IT service providers need to improve their performance

The considerable year-on-year increase in the percentage of SMBs that have switched their IT services provider in the last 12 months (Figure 1) sends a strong message to vendors and service providers that SMBs are dissatisfied.

Figure 1: Percentage of SMB respondents that have changed their IT services channel partner churn in the last 12 months, USA, 1Q 2021 and 1Q 2022

Source: Analysys Mason, 2022

35% of small businesses (SBs; 0–99 employees) and 57% of medium-sized businesses (MBs; 100–999 employees) in our US panel reported switching their IT services supplier in 2021. Larger SMBs and those in the IT and communications, hospitality, healthcare and financial services, insurance and real estate (FIRE) sectors had the highest levels of churn. Indeed, 66% of businesses with 500–999 reported changing their IT service providers.

Such high levels of churn were probably caused by the pandemic. Businesses had to adapt to new conditions and required new or different products and expertise. Existing providers were not offering the services and solutions that businesses needed in order to operate under these new circumstances, so SMBs switched providers.

The worst of the pandemic looks to be over, but the requirements of businesses are still far from stable. SMBs are still adapting to new ways of working (such as hybrid working) and are increasing their number of both employees and sites. IT service providers need to show that they can support these changes to avoid further churn.

Vendors, operators and service providers need to offer value propositions that align with SMBs’ key strategic initiatives

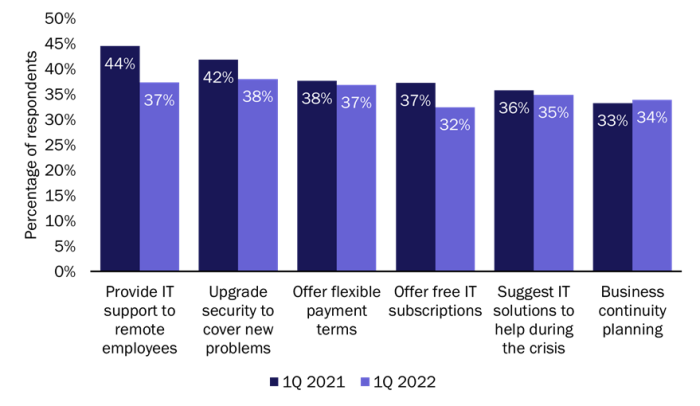

We asked SMBs which services from IT vendors and telecoms operators are the most helpful to them (Figure 2). The responses varied depending on business size, industry vertical and how successful the business was during the preceding 12-month period.

Figure 2: Services from technology suppliers cited as being the most helpful by SMBs, USA, 1Q 2021 and 1Q 2022

Source: Analysys Mason, 2022

More than a third of SMBs reported that IT support for remote workers is helpful, but the importance of this service has declined since last year. This is likely to be because SMBs’ remote working strategies have become more established and effective.

SMBs are focusing on modernising their business operations in order to expand their businesses and increase their revenue. MBs in particular would like their providers to suggest new technology solutions to help their businesses (for example, providers could set up order systems or websites/e-commerce solutions and help to migrate infrastructure to the cloud). Indeed, 44% of MBs reported that this service would be very helpful.

Most SMBs consider upgrading their security to be a key priority. They are looking to their service providers to recommend ways in which to address problems caused by the pandemic, as well as any new problems that come about as they expand their businesses. Security vendors, channel partners and telecoms operators can play a strong role here.

The interest in contingency and business continuity planning services from providers continues to be strong. Indeed, around a third of SMBs reported that this would be very helpful to them.

IT providers that offer SMBs strategic help beyond just IT support have an opportunity to become “trusted partners”

SMBs’ priorities include retaining and hiring employees and expanding their businesses (for example, by opening new locations and broadening their product and service offerings). Providers that can offer SMBs strategic advice will have an opportunity to become trusted partners and gain an advantage over those that only offer IT solutions.

The pandemic caused high (and possibly unprecedented) levels of churn for IT service providers. This churn was probably due to service providers not being able to meet the needs of their customers. These needs continue to change, and probably at a faster rate than before the pandemic. Vendors and service providers need to show customers that they can address these changes if churn levels are to fall.