The worldwide SMB devices and peripherals market will begin to rebound in 2024

The devices and peripherals market has faced challenges in recent years. Worldwide sales have slowed after the initial surge triggered by the COVID-19 pandemic. The weak global economy has further impacted the market because businesses now weigh each purchase more carefully. Despite these challenges, Analysys Mason maintains a positive outlook for this market’s future. The worldwide devices and peripherals market will begin to recover gradually in 2024 and SMB spending will continue increasing at around 1.5% a year, supported primarily by spending in the PCs category. The surge in the number of businesses upgrading their older devices and transitioning to Windows 11 (as support for Windows 10 nears its end) and hybrid work patterns will drive this modest growth.

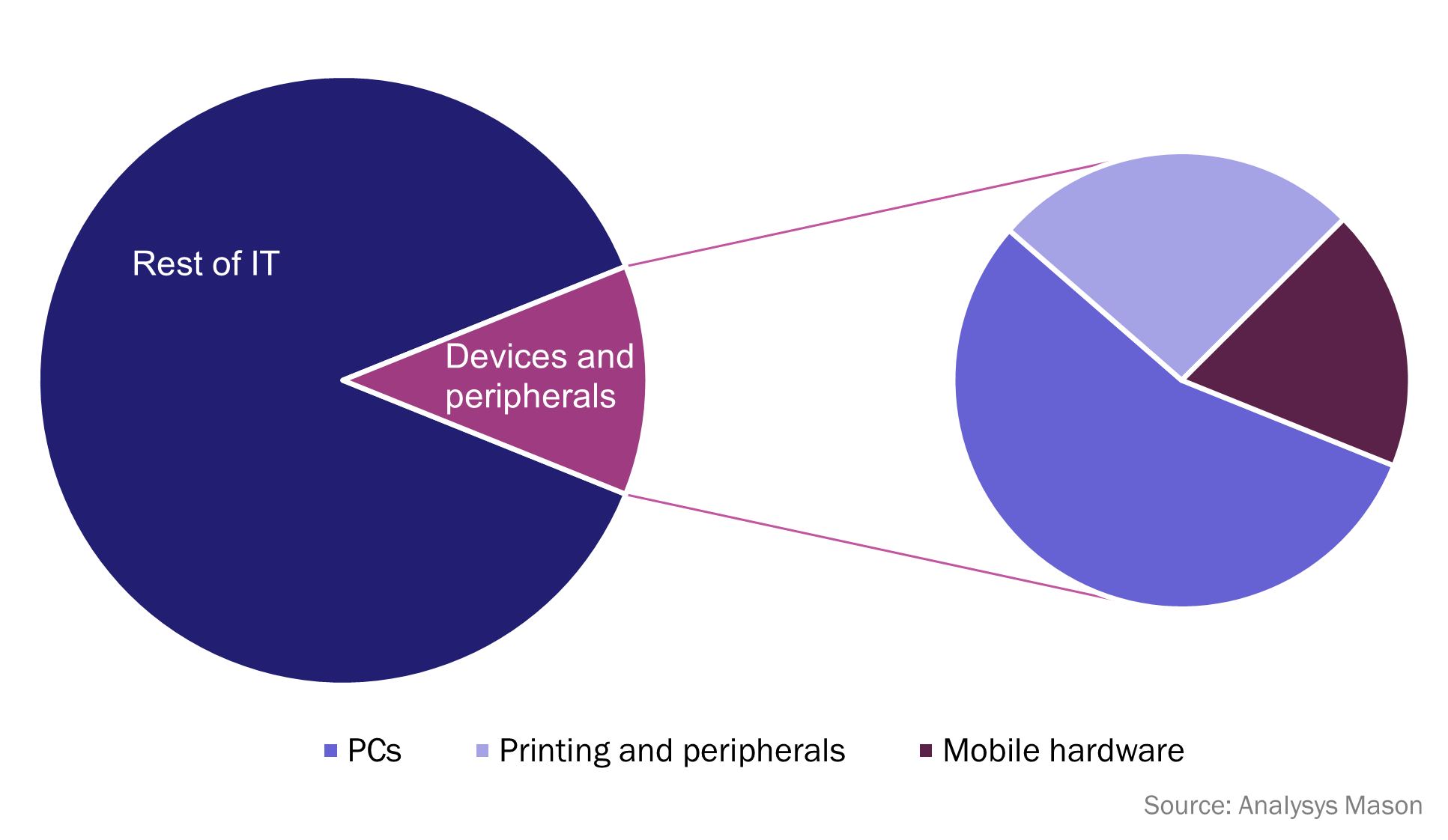

According to Analysys Mason's SMB Technology Forecaster, small (<100 employees) and medium-sized (100-999 employees) businesses (SMBs) worldwide will spend USD1.46 trillion on IT in 2023. 12% of that total IT budget will be spent on devices and peripherals. This can be further divided into three solution categories: 7% for PCs, 3% for printing and peripherals and 2% for mobile hardware (see Figure 1).

Figure 1: Share of SMB IT spending by solution category, worldwide, 2023

SMBs will spend USD179 billion on devices and peripherals in 2023

Analysys Mason predicts that SMBs will spend a combined total of USD179 billion on devices and peripherals in 2023: small businesses (SBs) will spend USD131 billion, and medium-sized businesses (MBs) will spend USD48 billion. Furthermore, SMBs’ spending on this category will grow at a CAGR of 1.5% during 2022–2026 to reach USD189 billion in 2026.

- PCs (including desktop PCs, notebook PCs, 2-in-1 PCs and tablets). SMBs’ spending on PCs accounts for over 50% of their total spending on devices and peripherals. Our forecast predicts that SMB spending on PCs will increase at a CAGR of 2% between 2022 and 2026, resulting in a total expenditure of USD106 billion in 2026. The 2-in-1 PCs have the most potential for growth among all form factors. One of the main drivers of long-term growth in the PC category is the need for hardware refreshes as businesses transition from Windows 10 to Windows 11 (before Microsoft support for the former ends). Hybrid work is yet another factor: new working patterns mean that employees need a reliable PC to work efficiently in and out of the office. SMBs understand the importance of ensuring business continuity by providing their staff with stable and secure PCs.

- Printing and peripherals (including printers, 3D printers, printing supplies and other peripherals). We expect SMBs’ spending on printing and peripherals to decline at a CAGR of –0.4% between 2022 and 2026. While the 3D printers market is growing and the peripherals market is about flat, the drop in the number of sales of printers and printing supplies accounts for most of the decline in this category. The pandemic and the emergence of hybrid work arrangements have also contributed significantly to a decline in the volume of office printing as more individuals are working from home. In addition, the trend towards digitalisation, propelled by the behaviour of younger digital-native individuals, is accelerating, and businesses will print less. More specifically, employees have grown increasingly comfortable with incorporating digital tools into their work processes and many things that used to be printed for convenience can now be shared electronically. In addition, the widespread use of cloud solutions has created a less paper-centric environment.

- Mobile hardware (including handsets). According to Analysys Mason’s projections, SMBs’ spending on mobile hardware will increase from approximately USD33 billion in 2022 to USD36 billion by 2026 at a CAGR of 2%. The growth is attributable to the increased adoption of business mobile handsets during the pandemic, and we anticipate this trend to continue.

Asia–Pacific will overtake the Americas as the world’s fastest-growing devices and peripherals market

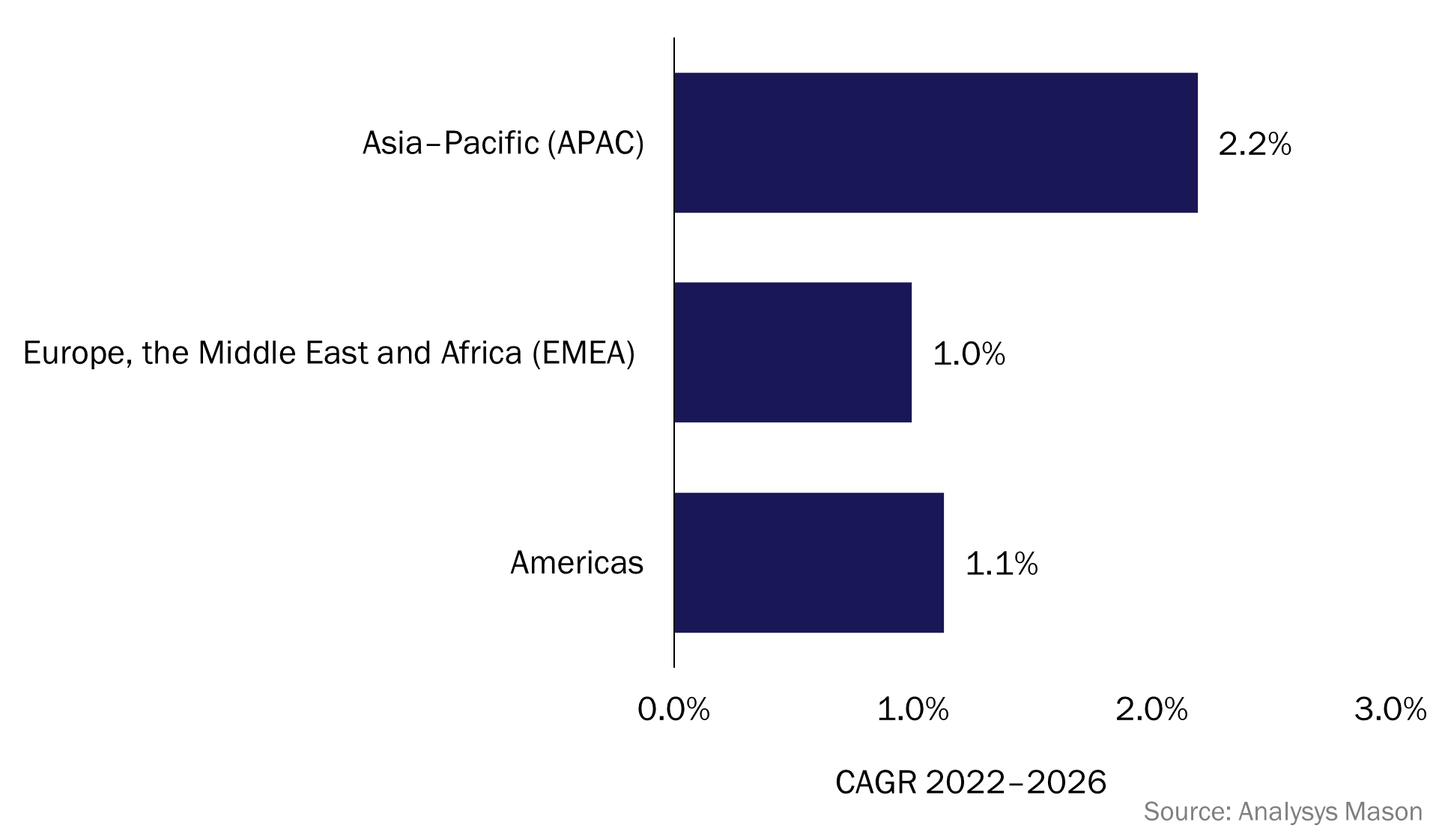

By 2023, Asia–Pacific (APAC) is expected to account for 36% of the total SMB spending on devices and peripherals, growing at a CAGR of 2.2% between 2022 and 2026 (see Figure 2).

Figure 2: Compounded growth in SMB spending on devices and peripherals by region, 2022–2026

In APAC, the rising number of SMBs, as well as rapid technological developments and competitive prices, will together support market growth. The devices and peripherals market in APAC continues to grow because the region has one of the fastest-growing mobile hardware markets globally (in particular, adoption of business mobile handsets in APAC is higher than in the Americas or EMEA).

According to our forecast, SMBs in the Americas will increase their spending on devices and peripherals from USD59 billion in 2022 to USD62 billion in 2026. At the same time, spending on devices and peripherals by SMBs in Europe, the Middle East and Africa (EMEA) will grow from USD56 billion to USD58 billion during the same period. Although these numbers indicate a slower growth rate than the APAC region, we anticipate that these modest growth trends will persist in both regions.

IT vendors must strike a balance between the requirements of IT teams and end users

SMBs worldwide have come to realise the significance of investing in IT to gain a competitive advantage. In today's digital age and hybrid work environment, the devices used by employees play a vital role in driving productivity and job satisfaction and safeguarding sensitive company data. As a result, PC and device vendors must strike a balance between catering to IT departments’ and end users’ needs. While the IT team requires secure, stable, durable, easy-to-manage and scalable devices, end users seek sleek, lightweight devices with high processing power and extended battery life.

In addition, the refresh cycle is critical in the SMB PCs and devices market. The introduction of Windows 11 is expected to drive the next wave of device upgrades. Furthermore, vendors should provide customised offerings that cater to the specific needs of different businesses, including flexible payment options and on-site support. Vendors should also promote the benefits of more-frequent upgrades, such as increased productivity, reduced downtime and enhanced security.

The downward trend in spending on printing and peripherals will continue because businesses are moving towards digital platforms and, as a result, their printing volume is lower. As a result, vendors need to consider an as-a-service model to sustain their revenue.

Article (PDF)

DownloadOur SMB Technology Forecaster provides key fact-based insights and answers to help shape your SMB strategy

Find out moreAuthor